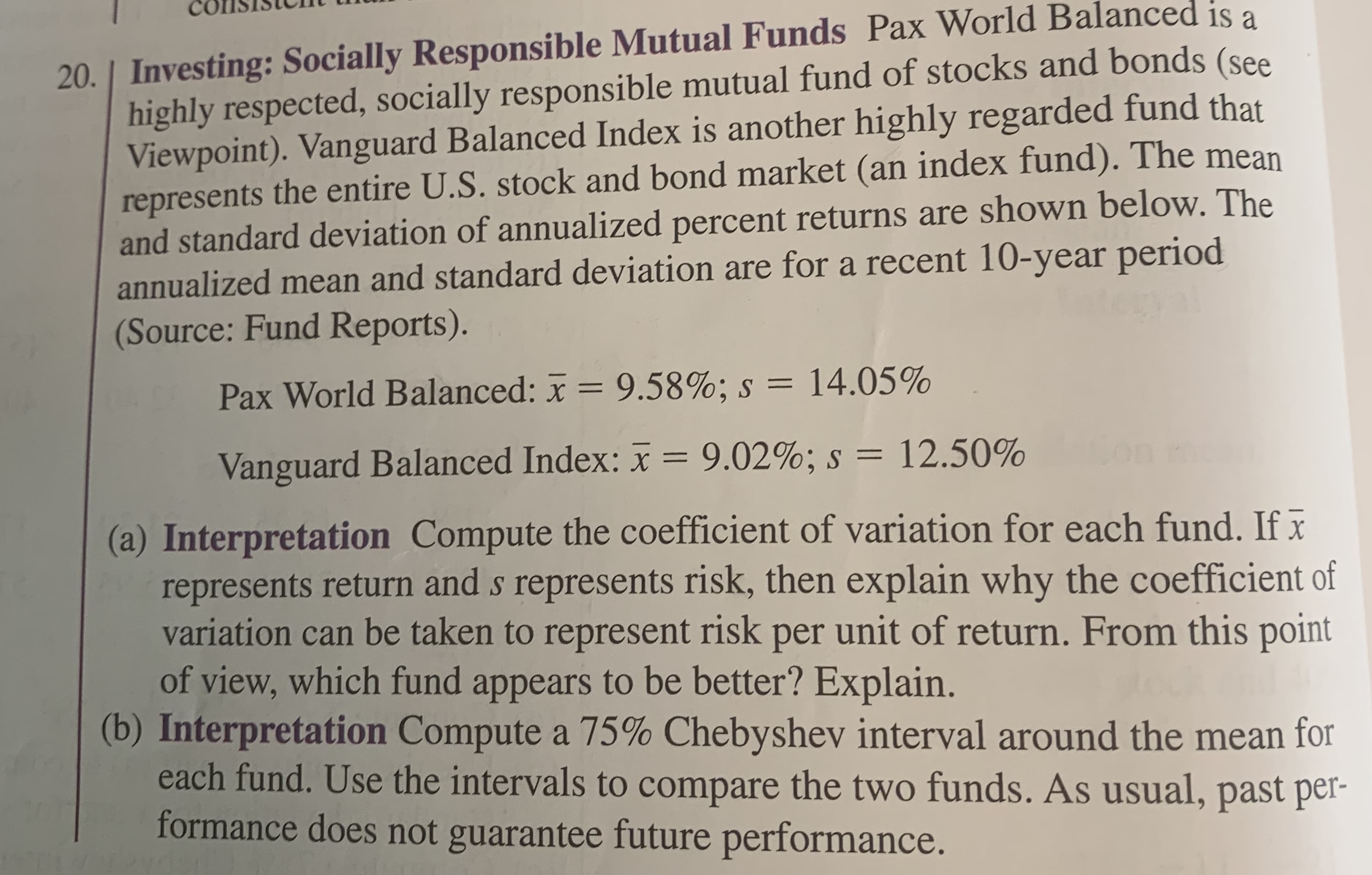

20. Investing: Socially Responsible Mutual Funds Pax World Balanced is a highly respected, socially responsible mutual fund of stocks and bonds (see Viewpoint). Vanguard Balanced Index is another highly regarded fund that represents the entire U.S. stock and bond market (an index fund). The mean and standard deviation of annualized percent returns are shown below. The annualized mean and standard deviation are for a recent 10-year period (Source: Fund Reports). Pax World Balanced: x 9.58%; s = 14.05% Vanguard Balanced Index: x 9.02%; s = 12.50% (a) Interpretation Compute the coefficient of variation for each fund. Ifx represents return and s represents risk, then explain why the coefficient of variation can be taken to represent risk per unit of return. From this point of view, which fund appears to be better? Explain. (b) Interpretation Compute a 75% Chebyshev interval around the mean for each fund. Use the intervals to compare the two funds. As usual, past per- formance does not guarantee future performance.

20. Investing: Socially Responsible Mutual Funds Pax World Balanced is a highly respected, socially responsible mutual fund of stocks and bonds (see Viewpoint). Vanguard Balanced Index is another highly regarded fund that represents the entire U.S. stock and bond market (an index fund). The mean and standard deviation of annualized percent returns are shown below. The annualized mean and standard deviation are for a recent 10-year period (Source: Fund Reports). Pax World Balanced: x 9.58%; s = 14.05% Vanguard Balanced Index: x 9.02%; s = 12.50% (a) Interpretation Compute the coefficient of variation for each fund. Ifx represents return and s represents risk, then explain why the coefficient of variation can be taken to represent risk per unit of return. From this point of view, which fund appears to be better? Explain. (b) Interpretation Compute a 75% Chebyshev interval around the mean for each fund. Use the intervals to compare the two funds. As usual, past per- formance does not guarantee future performance.

Glencoe Algebra 1, Student Edition, 9780079039897, 0079039898, 2018

18th Edition

ISBN:9780079039897

Author:Carter

Publisher:Carter

Chapter10: Statistics

Section10.4: Distributions Of Data

Problem 19PFA

Related questions

Question

Transcribed Image Text:20. Investing: Socially Responsible Mutual Funds Pax World Balanced is a

highly respected, socially responsible mutual fund of stocks and bonds (see

Viewpoint). Vanguard Balanced Index is another highly regarded fund that

represents the entire U.S. stock and bond market (an index fund). The mean

and standard deviation of annualized percent returns are shown below. The

annualized mean and standard deviation are for a recent 10-year period

(Source: Fund Reports).

Pax World Balanced: x 9.58%; s = 14.05%

Vanguard Balanced Index: x

9.02%; s = 12.50%

(a) Interpretation Compute the coefficient of variation for each fund. Ifx

represents return and s represents risk, then explain why the coefficient of

variation can be taken to represent risk per unit of return. From this point

of view, which fund appears to be better? Explain.

(b) Interpretation Compute a 75% Chebyshev interval around the mean for

each fund. Use the intervals to compare the two funds. As usual, past per-

formance does not guarantee future performance.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 7 steps with 5 images

Recommended textbooks for you

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill