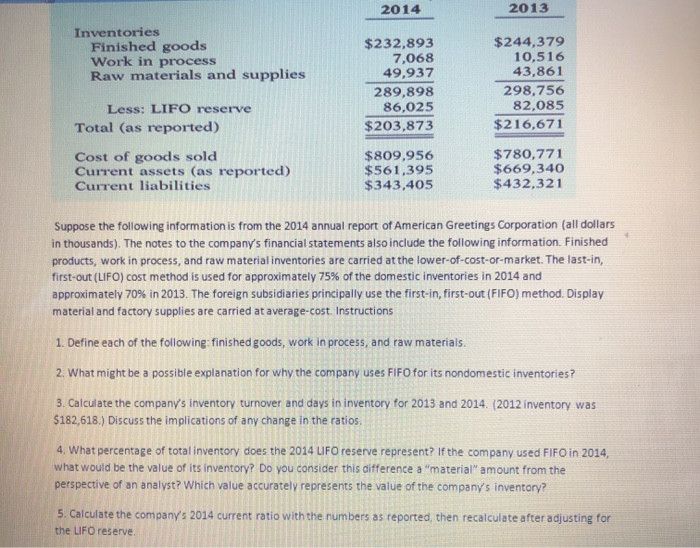

2014 2013 Inventories Finished goods Work in process Raw materials and supplies $232,893 7,068 49,937 $244,379 10,516 43,861 289,898 298,756 82,085 Less: LIFO reserve ৪6,025 Total (as reported) $203,873 $216,671 Cost of goods sold Current assets (as reported) Current liabilities $809,956 $561,395 $343,405 $780,771 $669,340 $432,321 Suppose the following information is from the 2014 annual report of American Greetings Corporation (all dollars in thousands). The notes to the company's financial statements also include the following information. Finished products, work in process, and raw material inventories are carried at the lower-of-cost-or-market. The last-in, first-out (LIFO) cost method is used for approximately 75% of the domestic inventories in 2014 and approximately 70% in 2013. The foreign subsidiaries principally use the first-in, first-out (FIFO) method. Display material and factory supplies are carried at average-cost. Instructions 1. Define each of the following: finished goods, work in process, and raw materials. 2. What might be a possible explanation for why the company uses FIFO for its nondomestic inventories? 3. Calculate the company's inventory turnover and days in inventory for 2013 and 2014. (2012 inventory was $182,618.) Discuss the implications of any change in the ratios. 4. What percentage of total inventory does the 2014 LIFO reserve represent? If the company used FIFO in 2014, what would be the value of its inventory? Do you consider this difference a "material" amount from the perspective of an analyst? Which value accurately represents the value of the company's inventory? 5. Calculate the company's 2014 current ratio with the numbers as reported, then recalculate after adjusting for the LIFO reserve.

2014 2013 Inventories Finished goods Work in process Raw materials and supplies $232,893 7,068 49,937 $244,379 10,516 43,861 289,898 298,756 82,085 Less: LIFO reserve ৪6,025 Total (as reported) $203,873 $216,671 Cost of goods sold Current assets (as reported) Current liabilities $809,956 $561,395 $343,405 $780,771 $669,340 $432,321 Suppose the following information is from the 2014 annual report of American Greetings Corporation (all dollars in thousands). The notes to the company's financial statements also include the following information. Finished products, work in process, and raw material inventories are carried at the lower-of-cost-or-market. The last-in, first-out (LIFO) cost method is used for approximately 75% of the domestic inventories in 2014 and approximately 70% in 2013. The foreign subsidiaries principally use the first-in, first-out (FIFO) method. Display material and factory supplies are carried at average-cost. Instructions 1. Define each of the following: finished goods, work in process, and raw materials. 2. What might be a possible explanation for why the company uses FIFO for its nondomestic inventories? 3. Calculate the company's inventory turnover and days in inventory for 2013 and 2014. (2012 inventory was $182,618.) Discuss the implications of any change in the ratios. 4. What percentage of total inventory does the 2014 LIFO reserve represent? If the company used FIFO in 2014, what would be the value of its inventory? Do you consider this difference a "material" amount from the perspective of an analyst? Which value accurately represents the value of the company's inventory? 5. Calculate the company's 2014 current ratio with the numbers as reported, then recalculate after adjusting for the LIFO reserve.

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Hello, Please I want the solution for numbers 4 & 5. Thanks.

Transcribed Image Text:2014

2013

Inventories

Finished goods

Work in process

Raw materials and supplies

$232,893

7,068

49,937

$244,379

10,516

43,861

289,898

298,756

82,085

Less: LIFO reserve

৪6,025

Total (as reported)

$203,873

$216,671

Cost of goods sold

Current assets (as reported)

Current liabilities

$809,956

$561,395

$343,405

$780,771

$669,340

$432,321

Suppose the following information is from the 2014 annual report of American Greetings Corporation (all dollars

in thousands). The notes to the company's financial statements also include the following information. Finished

products, work in process, and raw material inventories are carried at the lower-of-cost-or-market. The last-in,

first-out (LIFO) cost method is used for approximately 75% of the domestic inventories in 2014 and

approximately 70% in 2013. The foreign subsidiaries principally use the first-in, first-out (FIFO) method. Display

material and factory supplies are carried at average-cost. Instructions

1. Define each of the following: finished goods, work in process, and raw materials.

2. What might be a possible explanation for why the company uses FIFO for its nondomestic inventories?

3. Calculate the company's inventory turnover and days in inventory for 2013 and 2014. (2012 inventory was

$182,618.) Discuss the implications of any change in the ratios.

4. What percentage of total inventory does the 2014 LIFO reserve represent? If the company used FIFO in 2014,

what would be the value of its inventory? Do you consider this difference a "material" amount from the

perspective of an analyst? Which value accurately represents the value of the company's inventory?

5. Calculate the company's 2014 current ratio with the numbers as reported, then recalculate after adjusting for

the LIFO reserve.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education