2016 2017 1. Units of D4H produced and sold 2. Selling price 3. Direct materials (kilograms) 4. Direct material cost per kilogram 200 210 $40,000 $42,000 300,000 310,000 $8.50 5. Manufacturing capacity in units of D4H 6. Total conversion costs 7. Conversion cost per unit of capacity (row 6 ÷ row 5) 8. Selling and customer-service capacity 9. Total selling and customer-service costs 250 250 $2,000,000 $2,025,000 $8,000 $8,100 100 customers 95 customers $1,000,000 $940,500 10. Selling and customer-service capacity cost per customer (row 9 + row 8) $10,000 $9,900 Stanmore produces no defective machines, but it wants to reduce direct materials usage per D4H machine in 2017. Conversion costs in each year depend on production capacity defined in terms of D4H units that can be produced, not the actual units produced. Selling and customer-service costs depend on the num- ber of customers that Stanmore can support, not the actual number of customers it serves. Stanmore has 75 customers in 2016 and 80 customers in 2017. 1. Is Stanmore's strategy one of product differentiation or cost leadership? Explain briefly. 2. Describe briefly key measures that you would include in Stanmore's balanced scorecard and the rea- sons for doing so. Required

2016 2017 1. Units of D4H produced and sold 2. Selling price 3. Direct materials (kilograms) 4. Direct material cost per kilogram 200 210 $40,000 $42,000 300,000 310,000 $8.50 5. Manufacturing capacity in units of D4H 6. Total conversion costs 7. Conversion cost per unit of capacity (row 6 ÷ row 5) 8. Selling and customer-service capacity 9. Total selling and customer-service costs 250 250 $2,000,000 $2,025,000 $8,000 $8,100 100 customers 95 customers $1,000,000 $940,500 10. Selling and customer-service capacity cost per customer (row 9 + row 8) $10,000 $9,900 Stanmore produces no defective machines, but it wants to reduce direct materials usage per D4H machine in 2017. Conversion costs in each year depend on production capacity defined in terms of D4H units that can be produced, not the actual units produced. Selling and customer-service costs depend on the num- ber of customers that Stanmore can support, not the actual number of customers it serves. Stanmore has 75 customers in 2016 and 80 customers in 2017. 1. Is Stanmore's strategy one of product differentiation or cost leadership? Explain briefly. 2. Describe briefly key measures that you would include in Stanmore's balanced scorecard and the rea- sons for doing so. Required

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter11: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 11.2E: Identify cost graphs The following cost graphs illustrate various types of cost behavior: For each...

Related questions

Question

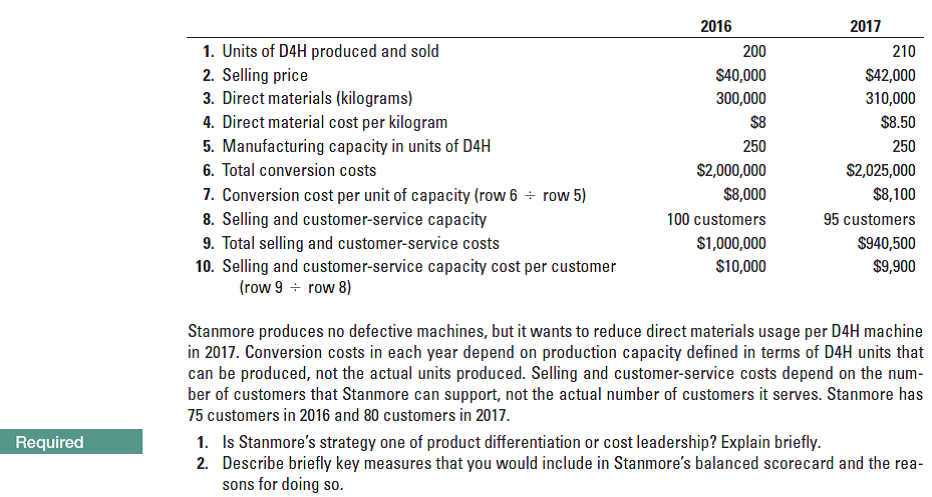

Strategy, balanced scorecard. Stanmore Corporation makes a special-purpose machine, D4H, used in the textile industry. Stanmore has designed the D4H machine for 2017 to be distinct from its competitors. It has been generally regarded as a superior machine. Stanmore presents the following data for 2016 and 2017.

Transcribed Image Text:2016

2017

1. Units of D4H produced and sold

2. Selling price

3. Direct materials (kilograms)

4. Direct material cost per kilogram

200

210

$40,000

$42,000

300,000

310,000

$8.50

5. Manufacturing capacity in units of D4H

6. Total conversion costs

7. Conversion cost per unit of capacity (row 6 ÷ row 5)

8. Selling and customer-service capacity

9. Total selling and customer-service costs

250

250

$2,000,000

$2,025,000

$8,000

$8,100

100 customers

95 customers

$1,000,000

$940,500

10. Selling and customer-service capacity cost per customer

(row 9 + row 8)

$10,000

$9,900

Stanmore produces no defective machines, but it wants to reduce direct materials usage per D4H machine

in 2017. Conversion costs in each year depend on production capacity defined in terms of D4H units that

can be produced, not the actual units produced. Selling and customer-service costs depend on the num-

ber of customers that Stanmore can support, not the actual number of customers it serves. Stanmore has

75 customers in 2016 and 80 customers in 2017.

1. Is Stanmore's strategy one of product differentiation or cost leadership? Explain briefly.

2. Describe briefly key measures that you would include in Stanmore's balanced scorecard and the rea-

sons for doing so.

Required

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College