2024 an. 20 Mar. 21 Apr. 1 Jun. 14 Sept. 30 Oct. 13 Nov. 4 Dec. 1 Dec. 31 Sold merchandise inventory to Kourtney Wadia, $1,300, on account. Ignore Cost of Goods Sold. Sold merchandise inventory to Derek Macha, $2,900, on account. Ignore Cost of Goods Sold. Received amount due from Derek Macha. Wrote off Kourtney Wadia's account as encollectible after repeated efforts to collect from her. Received $1,300 from Kourtney Wadia along with a letter apologizing for being so late. Reinstated Wadia's account in full and recorded the cash receipt. Sold merchandise inventory to Aaron Landscape Installation, $1,900, on account. Ignore Cost of Goods Sold. Aaron Landscape Installation declared bankruptcy and Meadow View wrote off Aaron's account as uncollectible. Sold merchandise inventory to Energy Design and Landscape, $17,000, on account. Ignore Cost of Goods Sold. Estimated that bad debts expense for the year was $5,100.

2024 an. 20 Mar. 21 Apr. 1 Jun. 14 Sept. 30 Oct. 13 Nov. 4 Dec. 1 Dec. 31 Sold merchandise inventory to Kourtney Wadia, $1,300, on account. Ignore Cost of Goods Sold. Sold merchandise inventory to Derek Macha, $2,900, on account. Ignore Cost of Goods Sold. Received amount due from Derek Macha. Wrote off Kourtney Wadia's account as encollectible after repeated efforts to collect from her. Received $1,300 from Kourtney Wadia along with a letter apologizing for being so late. Reinstated Wadia's account in full and recorded the cash receipt. Sold merchandise inventory to Aaron Landscape Installation, $1,900, on account. Ignore Cost of Goods Sold. Aaron Landscape Installation declared bankruptcy and Meadow View wrote off Aaron's account as uncollectible. Sold merchandise inventory to Energy Design and Landscape, $17,000, on account. Ignore Cost of Goods Sold. Estimated that bad debts expense for the year was $5,100.

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter13: Accounting For Merchandise Inventory

Section: Chapter Questions

Problem 1CE: LO1 If the ending inventory is overstated by 10,000, indicate what, if anything, is incorrect about...

Related questions

Topic Video

Question

please dont provide answer in an image format thank you

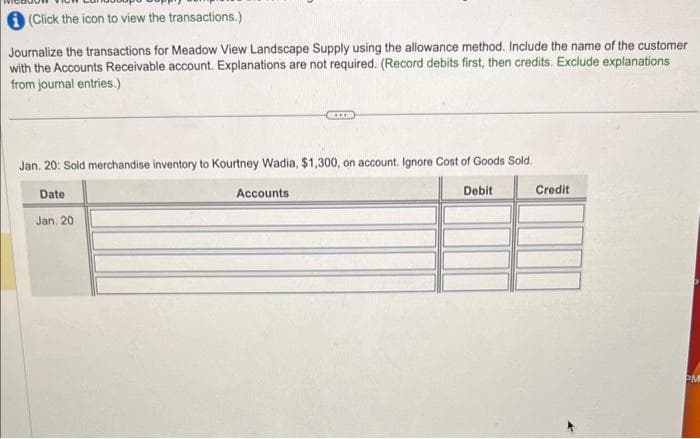

Transcribed Image Text:(Click the icon to view the transactions.)

Journalize the transactions for Meadow View Landscape Supply using the allowance method. Include the name of the customer

with the Accounts Receivable account. Explanations are not required. (Record debits first, then credits. Exclude explanations

from journal entries.)

Jan. 20: Sold merchandise inventory to Kourtney Wadia, $1,300, on account. Ignore Cost of Goods Sold.

Date

Jan. 20

......

Accounts:

Debit

Credit

PM

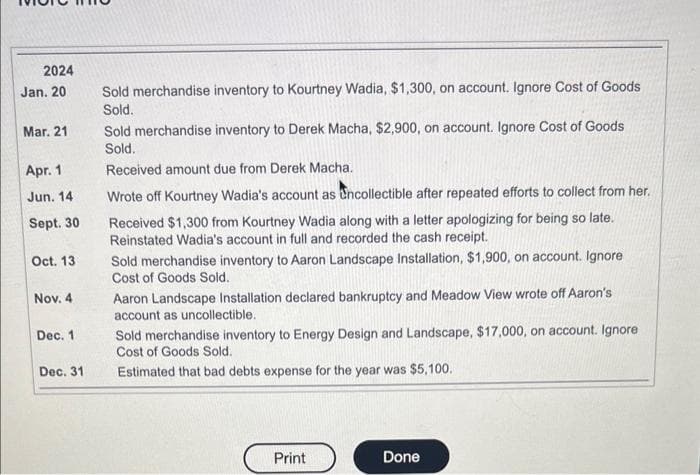

Transcribed Image Text:2024

Jan. 20

Mar. 21

Apr. 1

Jun. 14

Sept. 30

Oct. 13

Nov. 4

Dec. 1

Dec. 31

Sold merchandise inventory to Kourtney Wadia, $1,300, on account. Ignore Cost of Goods

Sold.

Sold merchandise inventory to Derek Macha, $2,900, on account. Ignore Cost of Goods

Sold.

Received amount due from Derek Macha.

Wrote off Kourtney Wadia's account as encollectible after repeated efforts to collect from her.

Received $1,300 from Kourtney Wadia along with a letter apologizing for being so late.

Reinstated Wadia's account in full and recorded the cash receipt.

Sold merchandise inventory to Aaron Landscape Installation, $1,900, on account. Ignore

Cost of Goods Sold.

Aaron Landscape Installation declared bankruptcy and Meadow View wrote off Aaron's

account as uncollectible.

Sold merchandise inventory to Energy Design and Landscape, $17,000, on account. Ignore

Cost of Goods Sold.

Estimated that bad debts expense for the year was $5,100.

Print

Done

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning