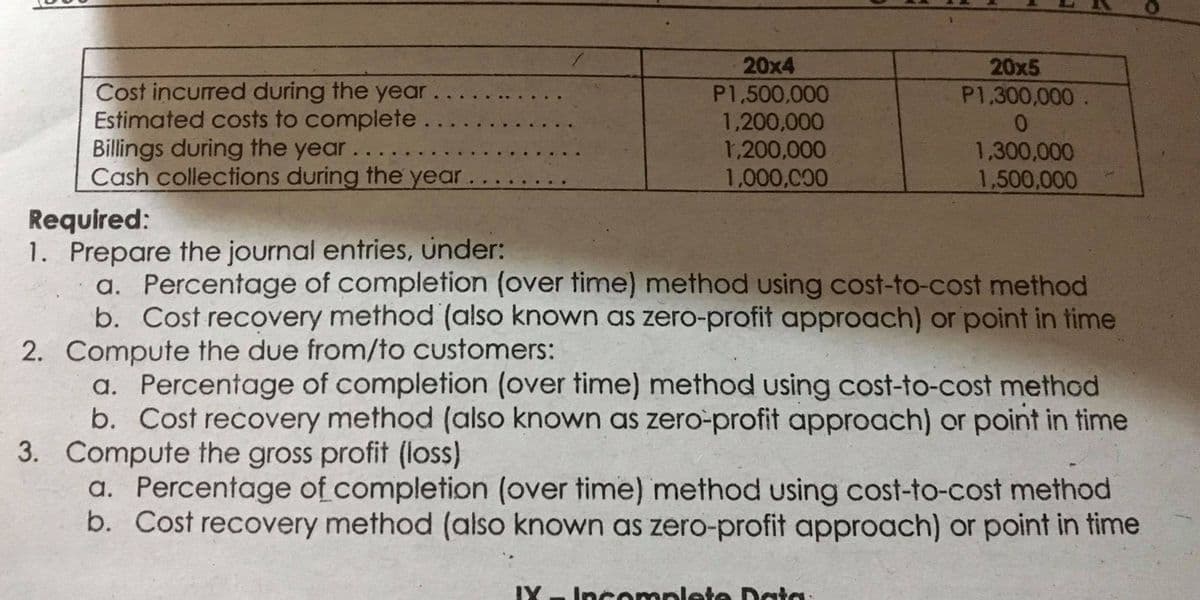

20x4 20x5 Cost incurred during the year. Estimated costs to complete Billings during the year. Cash collections during the year P1,300,000. P1,500,000 1,200,000 1,200,000 1,300,000 1,500,000 1,000,C00 Required: 1. Prepare the journal entries, under: a. Percentage of completion (over time) method using cost-to-cost method b. Cost recovery method (also known as zero-profit approach) or point in time 2. Compute the due from/to customers: a. Percentage of completion (over time) method using cost-to-cost method b. Cost recovery method (also known as zero-profit approach) or point in time 3. Compute the gross profit (loss) a. Percentage of completion (over time) method using cost-to-cost method b. Cost recovery method (also known as zero-profit approach) or point in time

20x4 20x5 Cost incurred during the year. Estimated costs to complete Billings during the year. Cash collections during the year P1,300,000. P1,500,000 1,200,000 1,200,000 1,300,000 1,500,000 1,000,C00 Required: 1. Prepare the journal entries, under: a. Percentage of completion (over time) method using cost-to-cost method b. Cost recovery method (also known as zero-profit approach) or point in time 2. Compute the due from/to customers: a. Percentage of completion (over time) method using cost-to-cost method b. Cost recovery method (also known as zero-profit approach) or point in time 3. Compute the gross profit (loss) a. Percentage of completion (over time) method using cost-to-cost method b. Cost recovery method (also known as zero-profit approach) or point in time

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter8: Revenue Recognition, Receivables, And Advances From Customers

Section: Chapter Questions

Problem 34E

Related questions

Question

prepare the

Transcribed Image Text:20x4

20x5

P1,300,000.

Cost incurred during the year

Estimated costs to complete

Billings during the year

Cash collections during the year.

P1,500,000

1,200,000

1,200,000

1,000,C00

1,300,000

1,500,000

Required:

1. Prepare the journal entries, under:

a. Percentage of completion (over time) method using cost-to-cost method

b. Cost recovery method (also known as zero-profit approach) or point in time

2. Compute the due from/to customers:

a. Percentage of completion (over time) method using cost-to-cost method

b. Cost recovery method (also known as zero-profit approach) or point in time

3. Compute the gross profit (loss)

a. Percentage of completion (over time) method using cost-to-cost method

b. Cost recovery method (also known as zero-profit approach) or point in time

IY - Inc omplete Data:

Transcribed Image Text:Vl - Methods of Construction Accounting-Unprofitable Contract (Estimated Gross Loss)

NeCombs Contractors received a contract to construct a mental health facility for P2,500,.000.

Construction was begun in 20x4 and completed in 20x5. Cost and other data are presented

below:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning