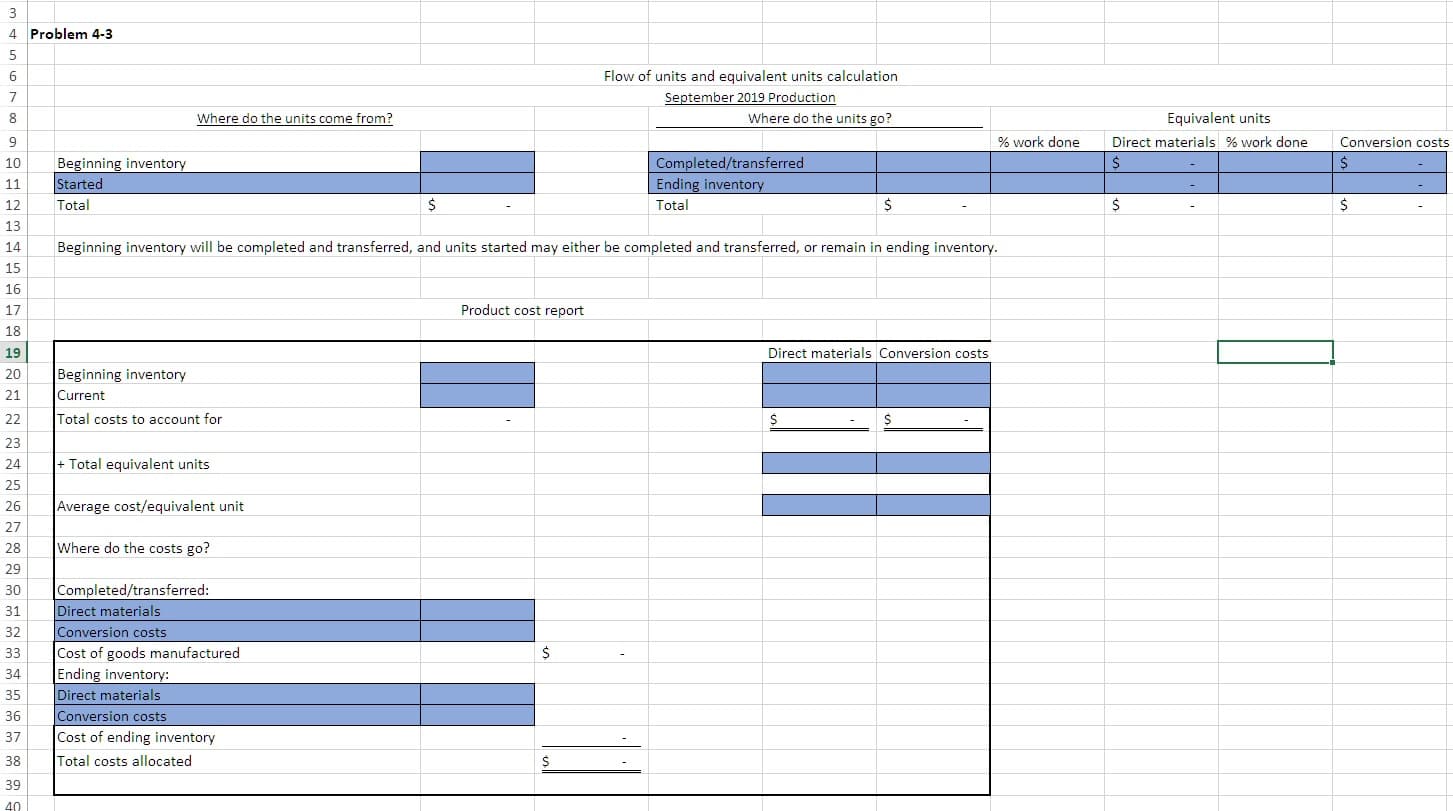

3 4 Problem 4-3 Flow of units and equivalent units calculation 6 September 2019 Production 7 Equivalent units Where do the units come from? Where do the units go? 8 % work done Direct materials % work done Conversion costs 9 Beginning inventory Started Completed/transferred $ 10 Ending inventory 11 $ $ $ $ Total Total 12 13 Beginning inventory will be completed and transferred, and units started may either be completed and transferred, or remain in ending inventory. 14 15 16 Product cost report 17 18 Direct materials Conversion costs 19 Beginning inventory 20 21 Current Total costs to account for 22 $ 23 Total equivalent units 24 25 Average cost/equivalent unit 26 27 Where do the costs go? 28 29 Completed/transferred: Direct materials Conversion costs Cost of goods manufactured Ending inventory: Direct materials 30 31 32 $ 33 34 35 Conversion costs 36 Cost of ending inventory 37 Total costs allocated 38 39 40

3 4 Problem 4-3 Flow of units and equivalent units calculation 6 September 2019 Production 7 Equivalent units Where do the units come from? Where do the units go? 8 % work done Direct materials % work done Conversion costs 9 Beginning inventory Started Completed/transferred $ 10 Ending inventory 11 $ $ $ $ Total Total 12 13 Beginning inventory will be completed and transferred, and units started may either be completed and transferred, or remain in ending inventory. 14 15 16 Product cost report 17 18 Direct materials Conversion costs 19 Beginning inventory 20 21 Current Total costs to account for 22 $ 23 Total equivalent units 24 25 Average cost/equivalent unit 26 27 Where do the costs go? 28 29 Completed/transferred: Direct materials Conversion costs Cost of goods manufactured Ending inventory: Direct materials 30 31 32 $ 33 34 35 Conversion costs 36 Cost of ending inventory 37 Total costs allocated 38 39 40

Accounting Information Systems

11th Edition

ISBN:9781337552127

Author:Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Chapter15: Integrated Production Processes (ipps)

Section: Chapter Questions

Problem 2P: Study Figure 15.8, showing the level 0 DFD of the cost accounting system. Note that the raw...

Related questions

Topic Video

Question

100%

I'm having trouble with a lot of my

Riley Manufacturing Corporation produces a cosmetic product in three consecutive processes. The costs of Department 1 for May 2019 were as follows:

| Cost of beginning inventory | ||

| Direct materials | $9800 | |

| Conversion costs | $16,480 | |

| Costs added in Department 1: | ||

| Direct materials | $295,120 | |

| Direct labor | $298,550 | |

| Manufacturing overhead | $203,130 | $796,800 |

Department 1 handled the following units during May:

| Units in process, May 1, 2019 | 2000 |

| Units started in Department 1 | 40,000 |

| Units transferred to Department 2 | 39,000 |

| Units in process, May 31, 2019 | 3000 |

On average, the May 1 units were 30% complete. The May 31 units were 60% complete. Materials are added at the beginning of the process, and conversion costs occur evenly throughout the process in Department 1. Riley uses the weighted average method for

Required:

See the attached screenshot of the spreadsheet.

Transcribed Image Text:3

4 Problem 4-3

Flow of units and equivalent units calculation

6

September 2019 Production

7

Equivalent units

Where do the units come from?

Where do the units go?

8

% work done

Direct materials % work done

Conversion costs

9

Beginning inventory

Started

Completed/transferred

$

10

Ending inventory

11

$

$

$

$

Total

Total

12

13

Beginning inventory will be completed and transferred, and units started may either be completed and transferred, or remain in ending inventory.

14

15

16

Product cost report

17

18

Direct materials Conversion costs

19

Beginning inventory

20

21

Current

Total costs to account for

22

$

23

Total equivalent units

24

25

Average cost/equivalent unit

26

27

Where do the costs go?

28

29

Completed/transferred:

Direct materials

Conversion costs

Cost of goods manufactured

Ending inventory:

Direct materials

30

31

32

$

33

34

35

Conversion costs

36

Cost of ending inventory

37

Total costs allocated

38

39

40

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting Information Systems

Finance

ISBN:

9781337552127

Author:

Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting Information Systems

Finance

ISBN:

9781337552127

Author:

Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning