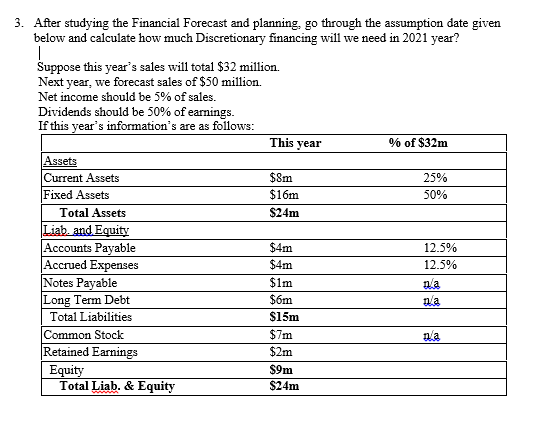

3. After studying the Financial Forecast and planning, go through the assumption date given below and calculate how much Discretionary financing will we need in 2021 year? Šuppose this year's sales will total $32 million. Next year, we forecast sales of $50 million. Net income should be 5% of sales. Dividends should be 50% of earnings. If this year's information's are as follows: This year % of $32m Assets Current Assets Fixed Assets Total Assets Liab. and Equity Accounts Payable |Accrued Expenses Notes Payable Long Term Debt Total Liabilities Common Stock Retained Earnings Equity Total Liab. & Equity $8m 25% $16m 50% $24m $4m $4m $1m 12.5% 12.5% ala $6m ala $15m $7m ala $2m $9m $24m

3. After studying the Financial Forecast and planning, go through the assumption date given below and calculate how much Discretionary financing will we need in 2021 year? Šuppose this year's sales will total $32 million. Next year, we forecast sales of $50 million. Net income should be 5% of sales. Dividends should be 50% of earnings. If this year's information's are as follows: This year % of $32m Assets Current Assets Fixed Assets Total Assets Liab. and Equity Accounts Payable |Accrued Expenses Notes Payable Long Term Debt Total Liabilities Common Stock Retained Earnings Equity Total Liab. & Equity $8m 25% $16m 50% $24m $4m $4m $1m 12.5% 12.5% ala $6m ala $15m $7m ala $2m $9m $24m

Chapter16: Working Capital Policy And Short-term Financing

Section: Chapter Questions

Problem 11P

Related questions

Question

100%

Transcribed Image Text:3. After studying the Financial Forecast and planning, go through the assumption date given

below and calculate how much Discretionary financing will we need in 2021 year?

Suppose this year's sales will total $32 million.

Next year, we forecast sales of $50 million.

Net income should be 5% of sales.

Dividends should be 50% of earnings.

If this year's information's are as follows:

This year

% of $32m

Assets

Current Assets

Fixed Assets

$8m

25%

$16m.

50%

Total Assets

$24m

Liab, and Equity

Accounts Payable

Accrued Expenses

Notes Payable

Long Term Debt

$4m

12.5%

$4m

12.5%

$1m

nla

$6m

Total Liabilities

$15m

Common Stock

Retained Earnings

Equity

Total Liab. & Equity

$7m

nla

$2m

$9m

$24m

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT