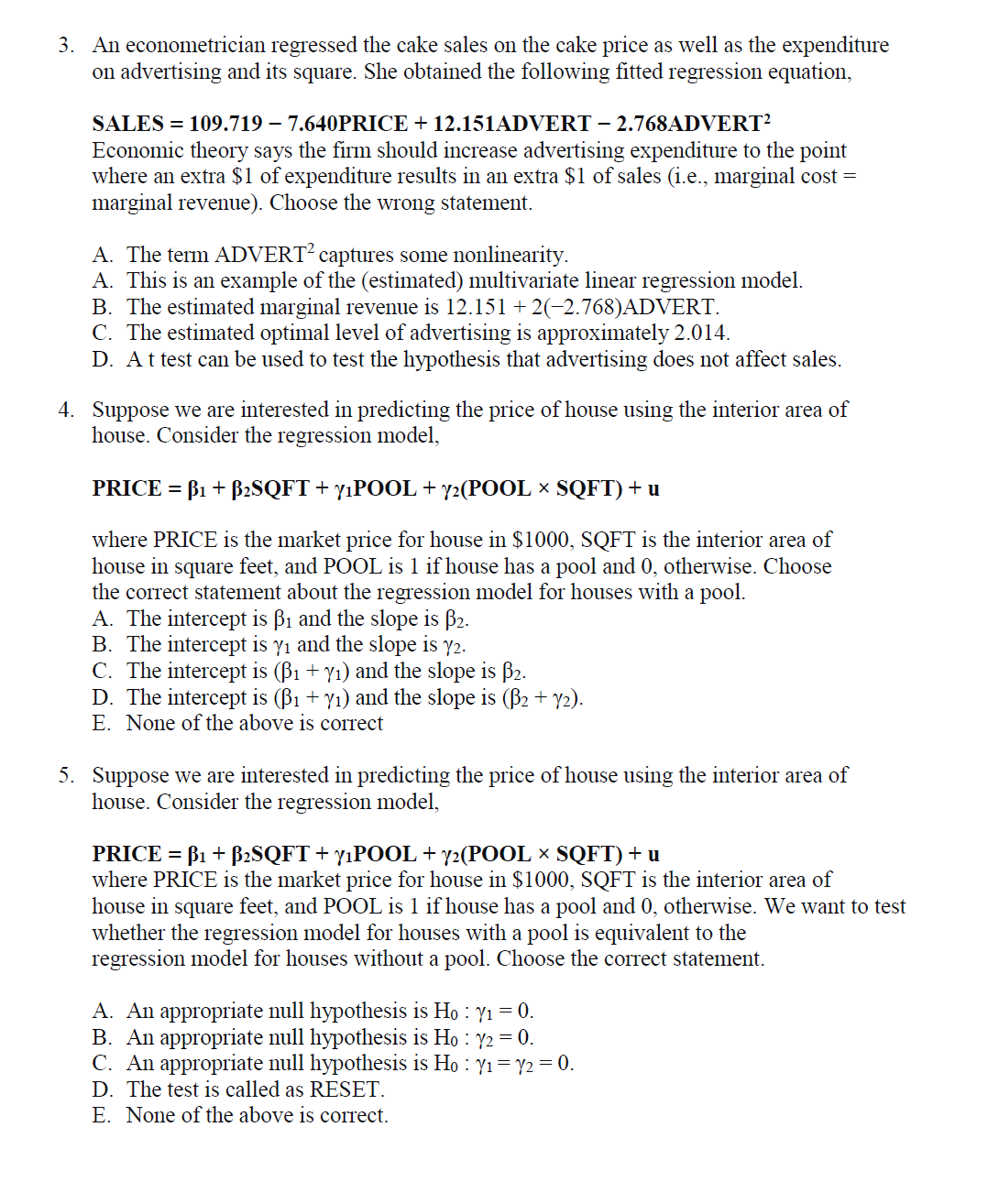

3. An econometrician regressed the cake sales on the cake price as well as the expenditure on advertising and its square. She obtained the following fitted regression equation, SALES = 109.719 – 7.640PRICE + 12.151ADVERT – 2.768ADVERT² Economic theory says the firm should increase advertising expenditure to the point where an extra $1 of expenditure results in an extra $1 of sales (i.e., marginal cost = marginal revenue). Choose the wrong statement. A. The term ADVERT² captures some nonlinearity. A. This is an example of the (estimated) multivariate linear regression model. B. The estimated marginal revenue is 12.151 +2(−2.768)ADVERT. C. The estimated optimal level of advertising is approximately 2.014. D. A t test can be used to test the hypothesis that advertising does not affect sales.

3. An econometrician regressed the cake sales on the cake price as well as the expenditure on advertising and its square. She obtained the following fitted regression equation, SALES = 109.719 – 7.640PRICE + 12.151ADVERT – 2.768ADVERT² Economic theory says the firm should increase advertising expenditure to the point where an extra $1 of expenditure results in an extra $1 of sales (i.e., marginal cost = marginal revenue). Choose the wrong statement. A. The term ADVERT² captures some nonlinearity. A. This is an example of the (estimated) multivariate linear regression model. B. The estimated marginal revenue is 12.151 +2(−2.768)ADVERT. C. The estimated optimal level of advertising is approximately 2.014. D. A t test can be used to test the hypothesis that advertising does not affect sales.

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter4: Estimating Demand

Section: Chapter Questions

Problem 8E

Related questions

Question

Transcribed Image Text:3. An econometrician regressed the cake sales on the cake price as well as the expenditure

on advertising and its square. She obtained the following fitted regression equation,

SALES = 109.719 – 7.640PRICE + 12.151ADVERT - 2.768ADVERT²

Economic theory says the firm should increase advertising expenditure to the point

where an extra $1 of expenditure results in an extra $1 of sales (i.e., marginal cost =

marginal revenue). Choose the wrong statement.

A. The term ADVERT2 captures some nonlinearity.

A. This is an example of the (estimated) multivariate linear regression model.

B. The estimated marginal revenue is 12.151 +2(−2.768)ADVERT.

C. The estimated optimal level of advertising is approximately 2.014.

D. A t test can be used to test the hypothesis that advertising does not affect sales.

4. Suppose we are interested in predicting the price of house using the interior area of

house. Consider the regression model,

PRICE = B1 + B2SQFT + yıPOOL + y2(POOL × SQFT) + u

where PRICE is the market price for house in $1000, SQFT is the interior area of

house in square feet, and POOL is 1 if house has a pool and 0, otherwise. Choose

the correct statement about the regression model for houses with a pool.

A. The intercept is ß₁ and the slope is ß₂.

B. The intercept is y₁ and the slope is y2.

C. The intercept is (ß₁ + y₁) and the slope is ³₂.

D. The intercept is (ß₁ + y₁) and the slope is (ß₂ + y2).

E. None of the above is correct

5. Suppose we are interested in predicting the price of house using the interior area of

house. Consider the regression model,

PRICE =B1 + B2SQFT + yıPOOL + 72(POOL × SQFT) + u

where PRICE is the market price for house in $1000, SQFT is the interior area of

house in square feet, and POOL is 1 if house has a pool and 0, otherwise. We want to test

whether the regression model for houses with a pool is equivalent to the

regression model for houses without a pool. Choose the correct statement.

A. An appropriate null hypothesis is Ho : y₁ = 0.

B. An appropriate null hypothesis is Ho: y2 = 0.

C. An appropriate null hypothesis is Ho : Y₁ = y2 = 0.

D. The test is called as RESET.

E. None of the above is correct.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning