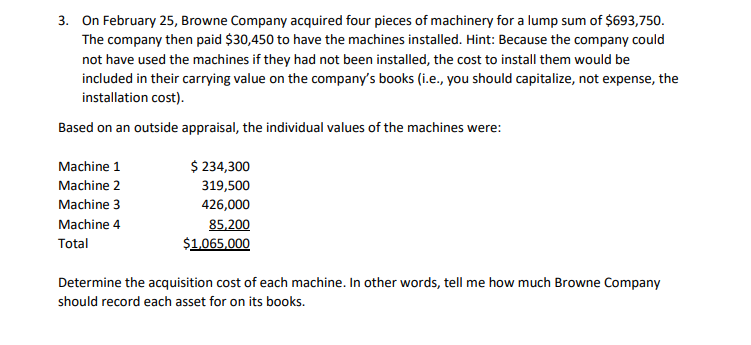

3. On February 25, Browne Company acquired four pieces of machinery for a lump sum of $693,750. The company then paid $30,450 to have the machines installed. Hint: Because the company could not have used the machines if they had not been installed, the cost to install them would be included in their carrying value on the company's books (i.e., you should capitalize, not expense, the installation cost). Based on an outside appraisal, the individual values of the machines were: Machine 1 Machine 2 $ 234,300 319 500

3. On February 25, Browne Company acquired four pieces of machinery for a lump sum of $693,750. The company then paid $30,450 to have the machines installed. Hint: Because the company could not have used the machines if they had not been installed, the cost to install them would be included in their carrying value on the company's books (i.e., you should capitalize, not expense, the installation cost). Based on an outside appraisal, the individual values of the machines were: Machine 1 Machine 2 $ 234,300 319 500

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 5Q: For each of the following transactions, state whether the cost would be capitalized (C) or recorded...

Related questions

Question

3

Transcribed Image Text:3. On February 25, Browne Company acquired four pieces of machinery for a lump sum of $693,750.

The company then paid $30,450 to have the machines installed. Hint: Because the company could

not have used the machines if they had not been installed, the cost to install them would be

included in their carrying value on the company's books (i.e., you should capitalize, not expense, the

installation cost).

Based on an outside appraisal, the individual values of the machines were:

Machine 1

Machine 2

Machine 3

Machine 4

Total

$ 234,300

319,500

426,000

85,200

$1,065,000

Determine the acquisition cost of each machine. In other words, tell me how much Browne Company

should record each asset for on its books.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning