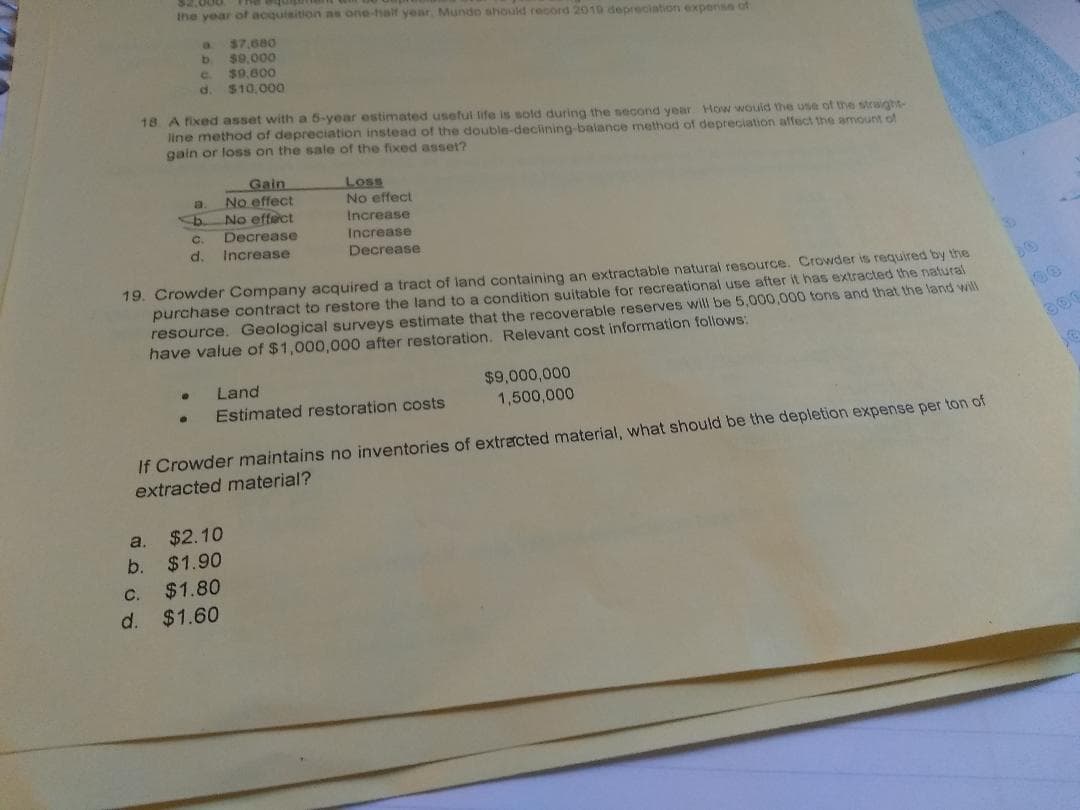

32.000 the year of acquisition as one-half year Mundo should record 2019 depreciation expenss of $7.680 $9,000 $9.600 $10,000 C. 18 A fixed asset with a 5-year estimated useful life is sold during the second year How would the use of the straight line method of depreciation instead of the double-declining-baiance method of depreciation affect the amount of gain or loss on the sale of the fixed asset? Gain No effect No effect Decrease Loss No effect Increase Increase d. Increase Decrease 19. Crowder Company acquired a tract of land containing an extractable naturai resource. Crowder is required by the purchase contract to restore the land to a condition suitable for recreational use after it has extracted the natural resource. Geological surveys estimate that the recoverable reserves will be 5,000,000 tons and that the land will have value of $1,000,000 after restoration. Relevant cost information follows: $9,000,000 1,500,000 Land Estimated restoration costs If Crowder maintains no inventories of extrarcted material, what should be the depletion expense per ton of extracted material? $2.10 a. $1.90 b. $1.80 $1.60 C. d.

32.000 the year of acquisition as one-half year Mundo should record 2019 depreciation expenss of $7.680 $9,000 $9.600 $10,000 C. 18 A fixed asset with a 5-year estimated useful life is sold during the second year How would the use of the straight line method of depreciation instead of the double-declining-baiance method of depreciation affect the amount of gain or loss on the sale of the fixed asset? Gain No effect No effect Decrease Loss No effect Increase Increase d. Increase Decrease 19. Crowder Company acquired a tract of land containing an extractable naturai resource. Crowder is required by the purchase contract to restore the land to a condition suitable for recreational use after it has extracted the natural resource. Geological surveys estimate that the recoverable reserves will be 5,000,000 tons and that the land will have value of $1,000,000 after restoration. Relevant cost information follows: $9,000,000 1,500,000 Land Estimated restoration costs If Crowder maintains no inventories of extrarcted material, what should be the depletion expense per ton of extracted material? $2.10 a. $1.90 b. $1.80 $1.60 C. d.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter8: Operating Assets: Property, Plant, And Equipment, And Intangibles

Section: Chapter Questions

Problem 8.5E: Change in Estimate Assume that Bloomer Company purchased a new machine on January 1, 2016, for...

Related questions

Question

100%

please answer question 19

Transcribed Image Text:32.000

the year of acquisition as one-half year Mundo should record 2019 depreciation expenss of

$7.680

$9,000

$9.600

$10,000

C.

18 A fixed asset with a 5-year estimated useful life is sold during the second year How would the use of the straight

line method of depreciation instead of the double-declining-baiance method of depreciation affect the amount of

gain or loss on the sale of the fixed asset?

Gain

No effect

No effect

Decrease

Loss

No effect

Increase

Increase

d.

Increase

Decrease

19. Crowder Company acquired a tract of land containing an extractable naturai resource. Crowder is required by the

purchase contract to restore the land to a condition suitable for recreational use after it has extracted the natural

resource. Geological surveys estimate that the recoverable reserves will be 5,000,000 tons and that the land will

have value of $1,000,000 after restoration. Relevant cost information follows:

$9,000,000

1,500,000

Land

Estimated restoration costs

If Crowder maintains no inventories of extrarcted material, what should be the depletion expense per ton of

extracted material?

$2.10

a.

$1.90

b.

$1.80

$1.60

C.

d.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning