328 Chapter 6 Problem 3 Sarena Wilkes, owner of the San Jose Café, is negotiating with the lessor regarding the lease of the building for the next five years. The lessor has proposed the following lease payment alternatives. Monthly fixed lease payment of $2,000. 1. Monthly fixed lease payment of $1,000 plus 3 percent of net sales. 2. Monthly variable lease payment of 6 percent of net sales. 3. Required: 1. What is the indifference point among the three proposals? 2. If expected average annual net sales are $350,000, which lease payment alternative should be recommended to Sarena Wilkes? 3. If expected average annual net sales are $500,000, which lease payment alternative should be recommended to Sarena Wilkes? Problem 4 The following monthly income statement has been prepared by Dwayne Kris, CPA, for Troy Caballo, the owner of the Caballo Inn. As Mr. Caballo's private consultant, you are asked to explain several cost relationships. Caballo Inn Income Statement For the month

328 Chapter 6 Problem 3 Sarena Wilkes, owner of the San Jose Café, is negotiating with the lessor regarding the lease of the building for the next five years. The lessor has proposed the following lease payment alternatives. Monthly fixed lease payment of $2,000. 1. Monthly fixed lease payment of $1,000 plus 3 percent of net sales. 2. Monthly variable lease payment of 6 percent of net sales. 3. Required: 1. What is the indifference point among the three proposals? 2. If expected average annual net sales are $350,000, which lease payment alternative should be recommended to Sarena Wilkes? 3. If expected average annual net sales are $500,000, which lease payment alternative should be recommended to Sarena Wilkes? Problem 4 The following monthly income statement has been prepared by Dwayne Kris, CPA, for Troy Caballo, the owner of the Caballo Inn. As Mr. Caballo's private consultant, you are asked to explain several cost relationships. Caballo Inn Income Statement For the month

Fundamentals of Financial Management (MindTap Course List)

15th Edition

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter20: Hybrid Financing: Preferred Stock, Leasing, Warrants, And Convertibles

Section: Chapter Questions

Problem 13IC: FISH CHIPS INC, PART I LEASE ANALYSIS Martha Millon, financial manager for Fish it Chips Inc., has...

Related questions

Question

I need help

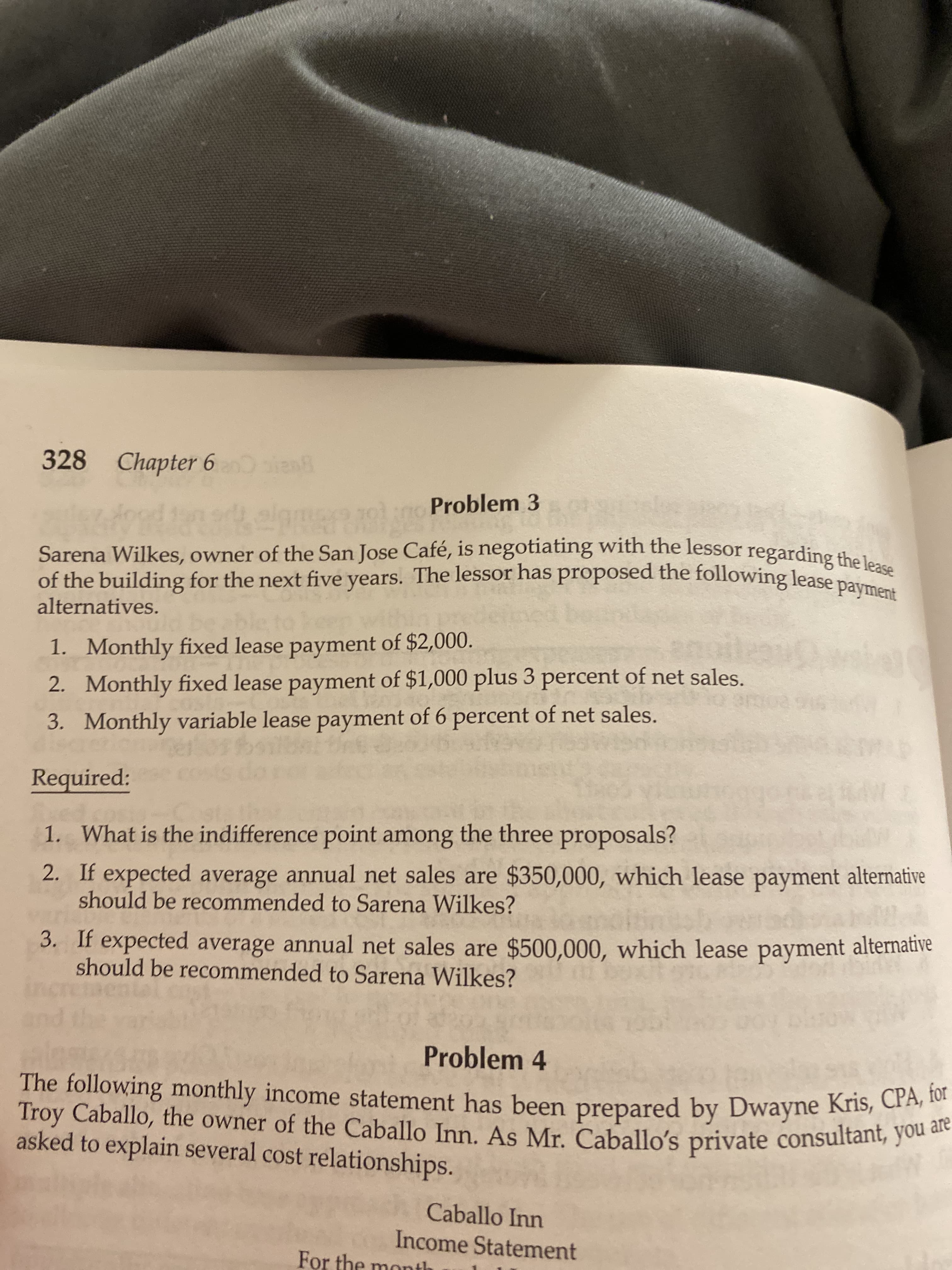

Transcribed Image Text:328 Chapter 6

Problem 3

Sarena Wilkes, owner of the San Jose Café, is negotiating with the lessor regarding the lease

of the building for the next five years. The lessor has proposed the following lease payment

alternatives.

Monthly fixed lease payment of $2,000.

1.

Monthly fixed lease payment of $1,000 plus 3 percent of net sales.

2.

Monthly variable lease payment of 6 percent of net sales.

3.

Required:

1. What is the indifference point among the three proposals?

2. If expected average annual net sales are $350,000, which lease payment alternative

should be recommended to Sarena Wilkes?

3. If expected average annual net sales are $500,000, which lease payment alternative

should be recommended to Sarena Wilkes?

Problem 4

The following monthly income statement has been prepared by Dwayne Kris, CPA, for

Troy Caballo, the owner of the Caballo Inn. As Mr. Caballo's private consultant, you are

asked to explain several cost relationships.

Caballo Inn

Income Statement

For the month

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 13 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning