+4 mins 17.1 The debit side of a trial balance totals $800 more than the credit side. Which one of the following errors would fully account for the difference? $400 paid for plant maintenance has been correctly entered in the cash book and credited to the plant asset account. Credit note issued to a customer of $400 has been debited to trade receivables. C A receipt of $800 for commission receivable has been omitted from the records. The petty cash balance of $800 has been omitted from th 72

+4 mins 17.1 The debit side of a trial balance totals $800 more than the credit side. Which one of the following errors would fully account for the difference? $400 paid for plant maintenance has been correctly entered in the cash book and credited to the plant asset account. Credit note issued to a customer of $400 has been debited to trade receivables. C A receipt of $800 for commission receivable has been omitted from the records. The petty cash balance of $800 has been omitted from th 72

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter5: Accounting Systems

Section: Chapter Questions

Problem 19E: After Bunker Hill Assay Services Inc. had completed all postings for March in the current year...

Related questions

Question

In detail why b is correct.

Transcribed Image Text:44 mins

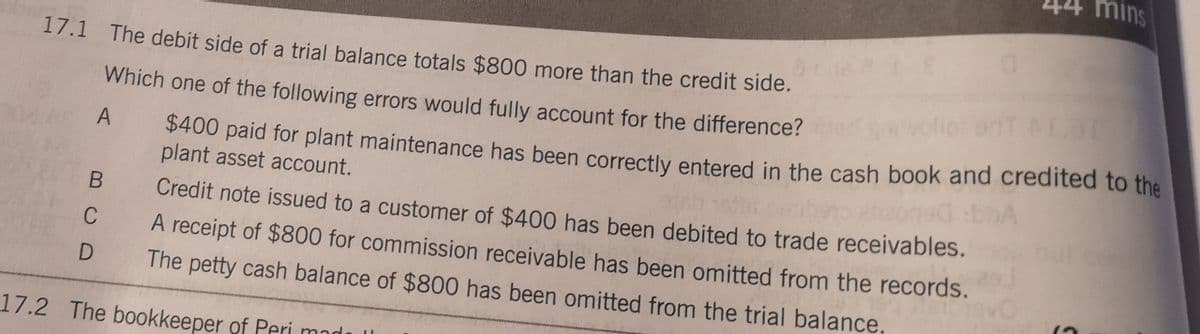

17.1 The debit side of a trial balance totals $800 more than the credit side.

Which one of the following errors would fully account for the difference?

$400 paid for plant maintenance has been correctly entered in the cash book and credited to the

plant asset account.

A

Credit note issued to a customer of $400 has been debited to trade receivables.

C

A receipt of $800 for commission receivable has been omitted from the records.

The petty cash balance of $800 has been omitted from the trial balance,

17.2 The bookkeeper of Peri mad

し

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,