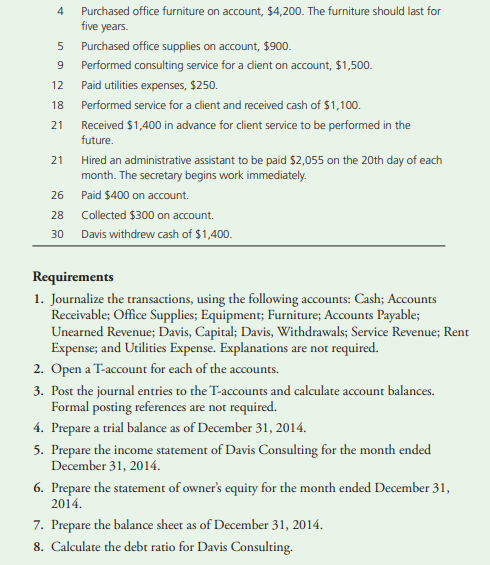

4 Purchased office furniture on account, $4,200. The furniture should last for five years. 5 Purchased office supplies on account, $900. 9 Performed consulting service for a dient on account, $1,500. 12 Paid utilities expenses, $250. 18 Performed service for a client and received cash of $1,100. 21 Received $1,400 in advance for client service to be performed in the future. 21 Hired an administrative assistant to be paid $2,055 on the 20th day of each month. The secretary begins work immediately. 26 Paid $400 on account. 28 Collected $300 on account. 30 Davis withdrew cash of $1,400. Requirements 1. Journalize the transactions, using the following accounts: Cash; Accounts Receivable; Office Supplies; Equipment; Furniture; Accounts Payable; Unearned Revenue; Davis, Capital; Davis, Withdrawals; Service Revenue; Rent Expense; and Utilities Expense. Explanations are not required. 2. Open a T-account for each of the accounts. 3. Post the journal entries to the T-accounts and calculate account balances. Formal posting references are not required. 4. Prepare a trial balance as of December 31, 2014. 5. Prepare the income statement of Davis Consulting for the month ended December 31, 2014. 6. Prepare the statement of owner's equity for the month ended December 31, 2014. 7. Prepare the balance sheet as of December 31, 2014. 8. Calculate the debt ratio for Davis Consulting.

4 Purchased office furniture on account, $4,200. The furniture should last for five years. 5 Purchased office supplies on account, $900. 9 Performed consulting service for a dient on account, $1,500. 12 Paid utilities expenses, $250. 18 Performed service for a client and received cash of $1,100. 21 Received $1,400 in advance for client service to be performed in the future. 21 Hired an administrative assistant to be paid $2,055 on the 20th day of each month. The secretary begins work immediately. 26 Paid $400 on account. 28 Collected $300 on account. 30 Davis withdrew cash of $1,400. Requirements 1. Journalize the transactions, using the following accounts: Cash; Accounts Receivable; Office Supplies; Equipment; Furniture; Accounts Payable; Unearned Revenue; Davis, Capital; Davis, Withdrawals; Service Revenue; Rent Expense; and Utilities Expense. Explanations are not required. 2. Open a T-account for each of the accounts. 3. Post the journal entries to the T-accounts and calculate account balances. Formal posting references are not required. 4. Prepare a trial balance as of December 31, 2014. 5. Prepare the income statement of Davis Consulting for the month ended December 31, 2014. 6. Prepare the statement of owner's equity for the month ended December 31, 2014. 7. Prepare the balance sheet as of December 31, 2014. 8. Calculate the debt ratio for Davis Consulting.

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter3: The Double-entry Framework

Section: Chapter Questions

Problem 6SEB: TRANSACTION ANALYSIS George Atlas started a business on June 1,20--. Analyze the following...

Related questions

Question

4,5,6,

Transcribed Image Text:Purchased office furniture on account, $4,200. The furniture should last for

five years.

4

5 Purchased office supplies on account, $900.

9

Performed consulting service for a dient on account, $1,500.

12 Paid utilities expenses, $250.

18

Performed service for a client and received cash of $1,100.

21

Received $1,400 in advance for client service to be performed in the

future.

Hired an administrative assistant to be paid $2,055 on the 20th day of each

month. The secretary begins work immediately.

21

26 Paid $400 on account.

28

Collected $300 on account.

30 Davis withdrew cash of $1,400.

Requirements

1. Journalize the transactions, using the following accounts: Cash; Accounts

Receivable; Office Supplies; Equipment; Furniture; Accounts Payable;

Unearned Revenue; Davis, Capital; Davis, Withdrawals; Service Revenue; Rent

Expense; and Utilities Expense. Explanations are not required.

2. Open a T-account for each of the accounts.

3. Post the journal entries to the T-accounts and calculate account balances.

Formal posting references are not required.

4. Prepare a trial balance as of December 31, 2014.

5. Prepare the income statement of Davis Consulting for the month ended

December 31, 2014.

6. Prepare the statement of owner's equity for the month ended December 31,

2014.

7. Prepare the balance sheet as of December 31, 2014.

8. Calculate the debt ratio for Davis Consulting.

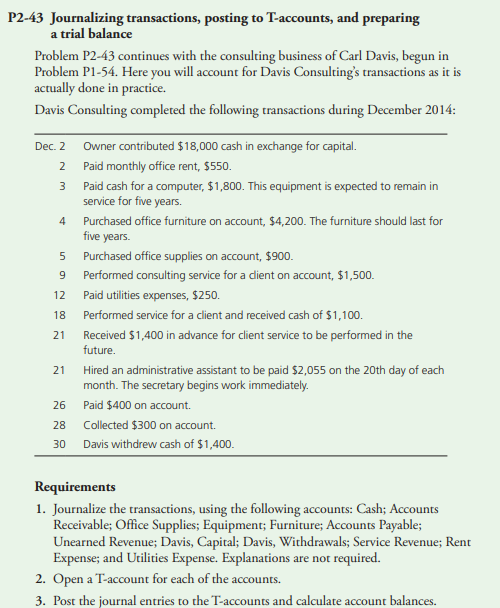

Transcribed Image Text:P2-43 Journalizing transactions, posting to T-accounts, and preparing

a trial balance

Problem P2-43 continues with the consulting business of Carl Davis, begun in

Problem P1-54. Here you will account for Davis Consulting's transactions as it is

actually done in practice.

Davis Consulting completed the following transactions during December 2014:

Dec. 2 Owner contributed $18,000 cash in exchange for capital.

2 Paid monthly office rent, $550.

3 Paid cash for a computer, $1,800. This equipment is expected to remain in

service for five years.

Purchased office furniture on account, $4,200. The furniture should last for

five years.

4

5 Purchased office supplies on account, $900.

9

Performed consulting service for a dient on account, $1,500.

Paid utilities expenses, $250.

12

18

Performed service for a client and received cash of $1,100.

Received $1,400 in advance for client service to be performed in the

future.

21

Hired an administrative assistant to be paid $2,055 on the 20th day of each

month. The secretary begins work immediately.

21

26

Paid $400 on account.

28 Collected $300 on account.

30 Davis withdrew cash of $1,400.

Requirements

1. Journalize the transactions, using the following accounts: Cash; Accounts

Receivable; Office Supplies; Equipment; Furniture; Accounts Payable;

Unearned Revenue; Davis, Capital; Davis, Withdrawals; Service Revenue; Rent

Expense; and Utilities Expense. Explanations are not required.

2. Open a T-account for each of the accounts.

3. Post the journal entries to the T-accounts and calculate account balances.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,