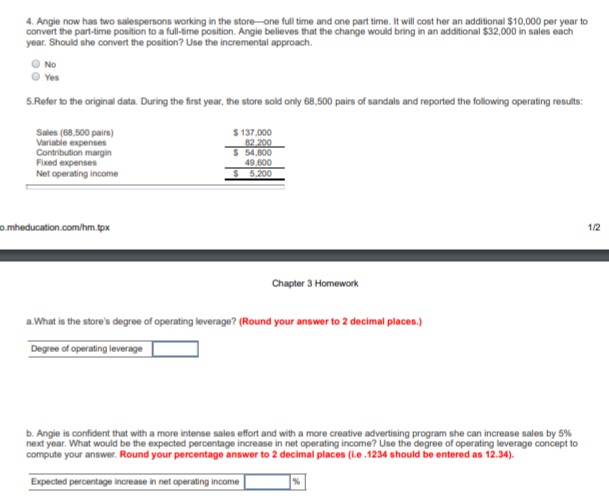

4. Angie now has two salespersons working in the store-one full time and one part time. It will cost her an additional $10,000 per year to convert the part-time position to a full-time position. Angie believes that the change would bring in an additional $32,000 in sales each year. Should she convert the position? Use the incremental approach. No Yes 5.Refer to the original data. During the first year, the store sold only 68,500 pairs of sandals and reported the following operating results $137,000 82 200 $ 54,800 49,600 Sales (68,500 pairs) Variable expenses Contribution margin Fixed expenses Net operating income $ 5,200 1/2 o.mheducation.com/hm.tpx Chapter 3 Homework a.What is the store's degree of operating leverage? (Round your answer to 2 decimal places.) Degree of operating leverage b. Angie is confident that with a more intense sales effort and with a more creative advertising program she can increase sales by 5 % next year. What would be the expected percentage increase in net operating income? Use the degree of operating leverage concept to compute your answer. Round your percentage answer to 2 decimal places (Le .1234 should be entered as 12.34) % Expected percentage increase in net operating income

4. Angie now has two salespersons working in the store-one full time and one part time. It will cost her an additional $10,000 per year to convert the part-time position to a full-time position. Angie believes that the change would bring in an additional $32,000 in sales each year. Should she convert the position? Use the incremental approach. No Yes 5.Refer to the original data. During the first year, the store sold only 68,500 pairs of sandals and reported the following operating results $137,000 82 200 $ 54,800 49,600 Sales (68,500 pairs) Variable expenses Contribution margin Fixed expenses Net operating income $ 5,200 1/2 o.mheducation.com/hm.tpx Chapter 3 Homework a.What is the store's degree of operating leverage? (Round your answer to 2 decimal places.) Degree of operating leverage b. Angie is confident that with a more intense sales effort and with a more creative advertising program she can increase sales by 5 % next year. What would be the expected percentage increase in net operating income? Use the degree of operating leverage concept to compute your answer. Round your percentage answer to 2 decimal places (Le .1234 should be entered as 12.34) % Expected percentage increase in net operating income

Chapter10: Capital Budgeting: Decision Criteria And Real Option

Section: Chapter Questions

Problem 19P

Related questions

Question

Angie Silva has recently opened The Sandal Shop in Brisbane, Australia, a store that specializes in fashionable sandals. Angie has just received a degree in business and she is anxious to apply the principles she has learned to her business. In time, she hopes to open a chain of sandal shops. As a first step, she has prepared the following analysis for her new store:

| Sales price per pair of sandals | $ | 2.00 | |

| Variable expenses per pair of sandals | 1.20 | ||

| Contribution margin per pair of sandals | $ | 0.80 | |

| Fixed expenses per year: | |||

| Building rental | $ | 9,000 | |

| Equipment |

5,000 | ||

| Selling | 17,600 | ||

| Administrative | 18,000 | ||

| Total fixed expenses | $ | 49,600 |

Transcribed Image Text:4. Angie now has two salespersons working in the store-one full time and one part time. It will cost her an additional $10,000 per year to

convert the part-time position to a full-time position. Angie believes that the change would bring in an additional $32,000 in sales each

year. Should she convert the position? Use the incremental approach.

No

Yes

5.Refer to the original data. During the first year, the store sold only 68,500 pairs of sandals and reported the following operating results

$137,000

82 200

$ 54,800

49,600

Sales (68,500 pairs)

Variable expenses

Contribution margin

Fixed expenses

Net operating income

$ 5,200

1/2

o.mheducation.com/hm.tpx

Chapter 3 Homework

a.What is the store's degree of operating leverage? (Round your answer to 2 decimal places.)

Degree of operating leverage

b. Angie is confident that with a more intense sales effort and with a more creative advertising program she can increase sales by 5 %

next year. What would be the expected percentage increase in net operating income? Use the degree of operating leverage concept to

compute your answer. Round your percentage answer to 2 decimal places (Le .1234 should be entered as 12.34)

%

Expected percentage increase in net operating income

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning