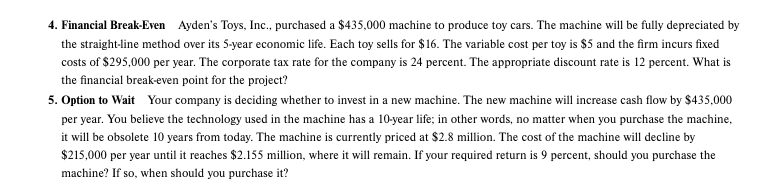

4. Financial Break-Even Ayden's Toys, Inc., purchased a $435,000 machine to produce toy cars. The machine will be fully depreciated by the straight-line method over its 5-year economic life. Each toy sells for $16. The variable cost per toy is $5 and the firm incurs fixed costs of $295,000 per year. The corporate tax rate for the company is 24 percent. The appropriate discount rate is 12 percent. What is the financial break-even point for the project? 5. Option to Wait Your company is deciding whether to invest in a new machine. The new machine will increase cash flow by $435,000 per year. You believe the technology used in the machine has a 10-year life; in other words, no matter when you purchase the machine, it will be obsolete 10 years from today. The machine is currently priced at $2.8 million. The cost of the machine will decline by $215,000 per year until it reaches $2.155 million, where it will remain. If your required return is 9 percent, should you purchase the machine? If so, when should you purchase it?

4. Financial Break-Even Ayden's Toys, Inc., purchased a $435,000 machine to produce toy cars. The machine will be fully depreciated by the straight-line method over its 5-year economic life. Each toy sells for $16. The variable cost per toy is $5 and the firm incurs fixed costs of $295,000 per year. The corporate tax rate for the company is 24 percent. The appropriate discount rate is 12 percent. What is the financial break-even point for the project? 5. Option to Wait Your company is deciding whether to invest in a new machine. The new machine will increase cash flow by $435,000 per year. You believe the technology used in the machine has a 10-year life; in other words, no matter when you purchase the machine, it will be obsolete 10 years from today. The machine is currently priced at $2.8 million. The cost of the machine will decline by $215,000 per year until it reaches $2.155 million, where it will remain. If your required return is 9 percent, should you purchase the machine? If so, when should you purchase it?

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter12: Liabilities: Off-balance-sheet Financing, Retirement Benefits, And Income Taxes

Section: Chapter Questions

Problem 27E

Related questions

Question

Transcribed Image Text:4. Financial Break-Even Ayden's Toys, Inc., purchased a $435,000 machine to produce toy cars. The machine will be fully depreciated by

the straight-line method over its 5-year economic life. Each toy sells for $16. The variable cost per toy is $5 and the firm incurs fixed

costs of $295,000 per year. The corporate tax rate for the company is 24 percent. The appropriate discount rate is 12 percent. What is

the financial break-even point for the project?

5. Option to Wait Your company is deciding whether to invest in a new machine. The new machine will increase cash flow by $435,000

per year. You believe the technology used in the machine has a 10-year life; in other words, no matter when you purchase the machine,

it will be obsolete 10 years from today. The machine is currently priced at $2.8 million. The cost of the machine will decline by

$215,000 per year until it reaches $2.155 million, where it will remain. If your required return is 9 percent, should you purchase the

machine? If so, when should you purchase it?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 6 images

Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning