4. MC.11.162 A company issued $1,000,000 of 30-year, 8% callable bonds on April 1, with interest payable on April 1 and October 1. The fiscal year of the company is the calendar year. What is the journal entry needed when the bonds are issued at face value? a. debit Cash and Discount on Bonds Payable, credit Bonds Payable b. debit Cash, credit Bonds Payable Oe. debit Bonds Payable, credit Cash d. debit Cash, credit Premium on Bonds Payable and Bonds Payable 5. MC.11.163 A company issued $1,000,000 of 30-year, 8% callable bonds on April 1, with interest payable on April 1 and October 1. The fiscal year of the company is the calendar year. The bonds are called at the end of year 3 for 104. What is the entry to record the redemption? (Assume the interest payment has been recorded separately.) a. Bonds Payable 1,000,000 Gain on Redemption of Bonds 40.000 Cash 1,040,000 b. Bonds Payable 1,000,000 Loss on Redemption of Bonds 40,000 Cash 1,040,000 De. Bonds Pavable 1,040,000 Cash 1,000,000 Loss on Redemption of Bonds 40,000 d. Bonds Payable 1,000,000 Cash 1,000,000

4. MC.11.162 A company issued $1,000,000 of 30-year, 8% callable bonds on April 1, with interest payable on April 1 and October 1. The fiscal year of the company is the calendar year. What is the journal entry needed when the bonds are issued at face value? a. debit Cash and Discount on Bonds Payable, credit Bonds Payable b. debit Cash, credit Bonds Payable Oe. debit Bonds Payable, credit Cash d. debit Cash, credit Premium on Bonds Payable and Bonds Payable 5. MC.11.163 A company issued $1,000,000 of 30-year, 8% callable bonds on April 1, with interest payable on April 1 and October 1. The fiscal year of the company is the calendar year. The bonds are called at the end of year 3 for 104. What is the entry to record the redemption? (Assume the interest payment has been recorded separately.) a. Bonds Payable 1,000,000 Gain on Redemption of Bonds 40.000 Cash 1,040,000 b. Bonds Payable 1,000,000 Loss on Redemption of Bonds 40,000 Cash 1,040,000 De. Bonds Pavable 1,040,000 Cash 1,000,000 Loss on Redemption of Bonds 40,000 d. Bonds Payable 1,000,000 Cash 1,000,000

Financial & Managerial Accounting

13th Edition

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter12: Long-Term Liabilities: Bonds And Notes

Section: Chapter Questions

Problem 12.2APR

Related questions

Question

Question 4

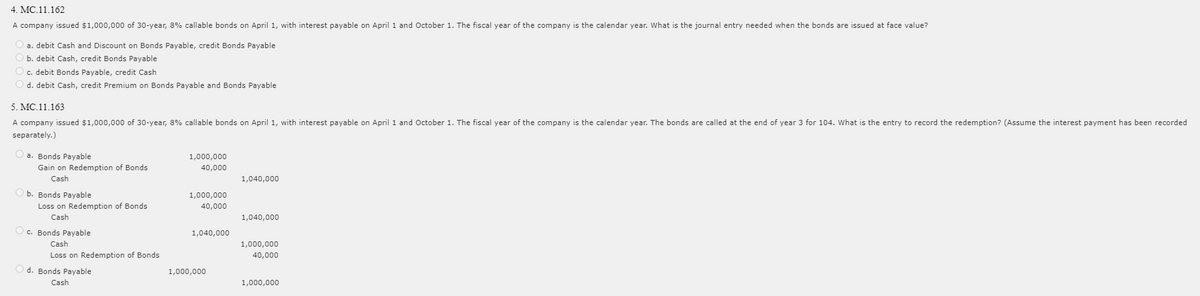

Transcribed Image Text:4. MC.11.162

A company issued $1,000,000 of 30-year, 8% callable bonds on April 1, with interest payable on April 1 and October 1. The fiscal year of the company is the calendar year. What is the journal entry needed when the bonds are issued at face value?

O a. debit Cash and Discount on Bonds Payable, credit Bonds Payable

O b. debit Cash, credit Bonds Payable

O c. debit Bonds Payable, credit Cash

O d. debit Cash, credit Premium on Bonds Payable and Bonds Payable

5. MC.11.163

A company issued $1,000,000 of 30-year, 8% callable bonds on April 1, with interest payable on April 1 and October 1. The fiscal year of the company is the calendar year. The bonds are called at the end of year 3 for 104. What is the entry to record the redemption? (Assume the interest payment has been recorded

separately.)

O a. Bonds Payable

1,000,000

Gain on Redemption of Bonds

40,000

Cash

1,040,000

O b. Bonds Payable

1,000,000

Loss on Redemption of Bonds

40,000

Cash

1,040,000

O c. Bonds Payable

1,040,000

Cash

1,000,000

Loss on Redemption of Bonds

40,000

O d. Bonds Payable

1,000,000

Cash

1,000,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College