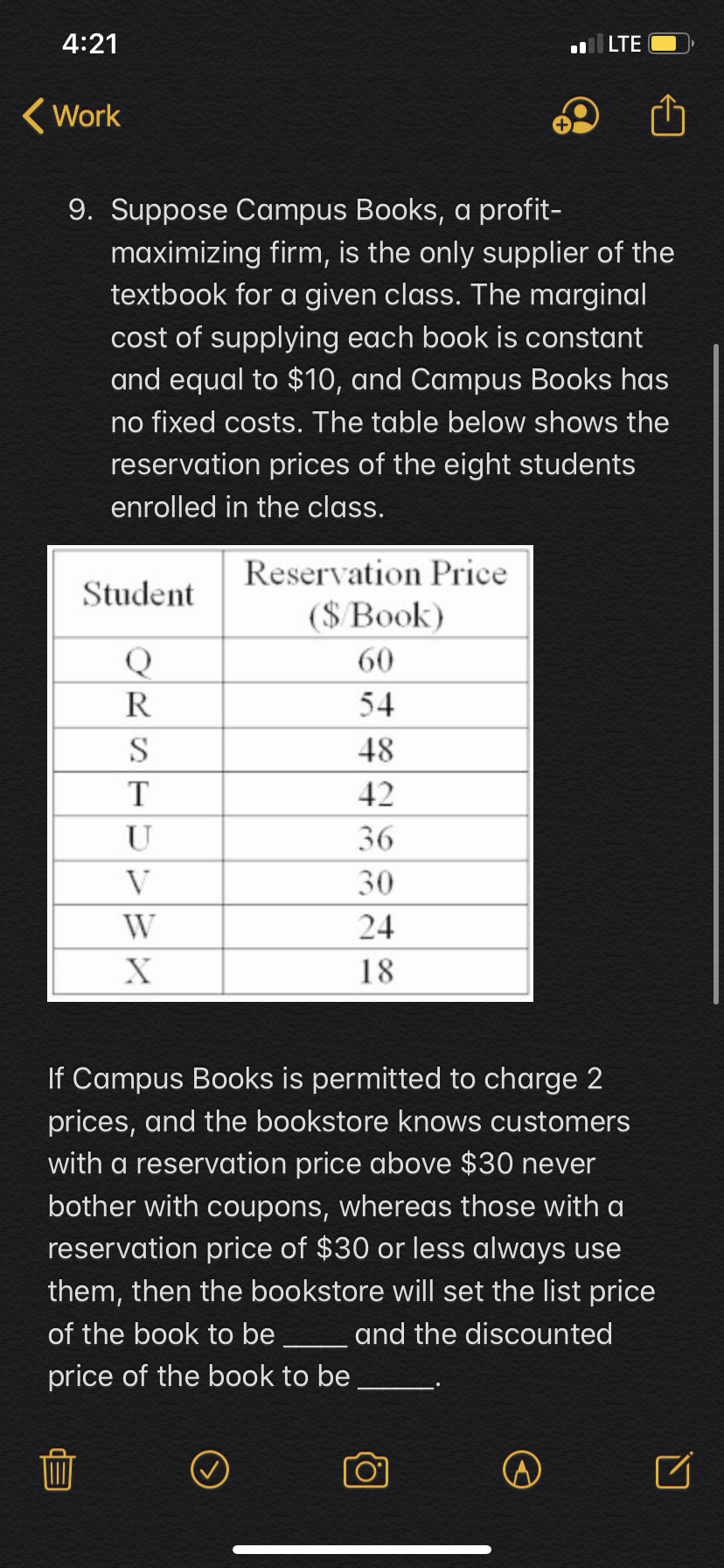

4:21 lLTE Work 9. Suppose Campus Books, a profit- maximizing firm, is the only supplier of the textbook for a given class. The marginal cost of supplying each book is constant and equal to $10, and Campus Books has no fixed costs. The table below shows the reservation prices of the eight students enrolled in the class. Reservation Price Student (SBook) 60 54 48 42 U 36 V 30 24 18 If Campus Books is permitted to charge 2 prices, and the bookstore knows customers with a reservation price above $30 never bother with coupons, whereas those with a reservation price of $30 or less always use them, then the bookstore will set the list price of the book to be and the discounted price of the book to be RST

4:21 lLTE Work 9. Suppose Campus Books, a profit- maximizing firm, is the only supplier of the textbook for a given class. The marginal cost of supplying each book is constant and equal to $10, and Campus Books has no fixed costs. The table below shows the reservation prices of the eight students enrolled in the class. Reservation Price Student (SBook) 60 54 48 42 U 36 V 30 24 18 If Campus Books is permitted to charge 2 prices, and the bookstore knows customers with a reservation price above $30 never bother with coupons, whereas those with a reservation price of $30 or less always use them, then the bookstore will set the list price of the book to be and the discounted price of the book to be RST

Chapter9: Monopoly

Section: Chapter Questions

Problem 12SQP

Related questions

Question

Transcribed Image Text:4:21

lLTE

Work

9. Suppose Campus Books, a profit-

maximizing firm, is the only supplier of the

textbook for a given class. The marginal

cost of supplying each book is constant

and equal to $10, and Campus Books has

no fixed costs. The table below shows the

reservation prices of the eight students

enrolled in the class.

Reservation Price

Student

(SBook)

60

54

48

42

U

36

V

30

24

18

If Campus Books is permitted to charge 2

prices, and the bookstore knows customers

with a reservation price above $30 never

bother with coupons, whereas those with a

reservation price of $30 or less always use

them, then the bookstore will set the list price

of the book to be

and the discounted

price of the book to be

RST

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning