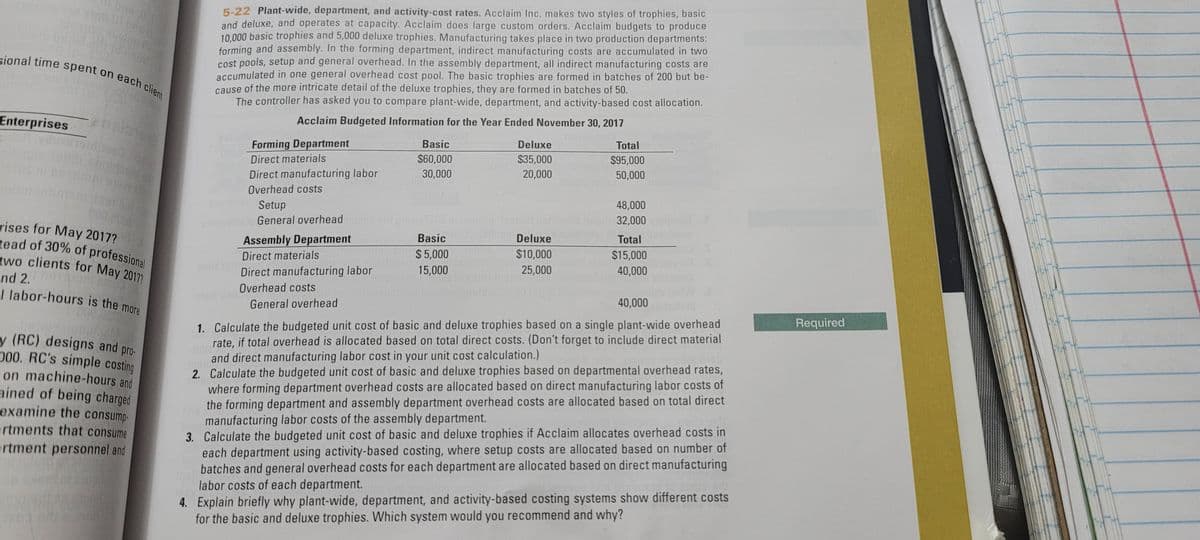

5-22 Plant-wide, department, and activity-cost rates. Acclaim Inc. makes two styles of trophies, basic and deluxe, and operates at capacity. Acclaim does large custom orders. Acclaim budgets to produce 10.000 basic trophies and 5,000 deluxe trophies, Manufacturing takes place in two production departments: forming and assembly. In the forming department, indirect manufacturing costs are accumulated in two cost pools, setup and general overhead. In the assembly department, all indirect manufacturing costs are accumulated in one general overhead cost pool. The basic trophies are formed in batches of 200 but be- cause of the more intricate detail of the deluxe trophies, they are formed in batches of 50. The controller has asked you to compare plant-wide, department, and activity-based cost allocation. Acclaim Budgeted Information for the Year Ended November 30, 2017 Forming Department Basic Deluxe Total $60,000 30,000 Direct materials $35,000 20,000 $95,000 Direct manufacturing labor Overhead costs Setup General overhead 50,000 48,000 32,000 Basic Deluxe Total Assembly Department Direct materials $5,000 $10,000 $15,000 40,000 Direct manufacturing labor 15,000 25,000 Overhead costs General overhead 40,000 1. Calculate the budgeted unit cost of basic and deluxe trophies based on a single plant-wide overhead rate, if total overhead is allocated based on total direct costs. (Don't forget to include direct material and direct manufacturing labor cost in your unit cost calculation.) 2. Calculate the budgeted unit cost of basic and deluxe trophies based on departmental overhead rates, where forming department overhead costs are allocated based on direct manufacturing labor costs of the forming department and assembly department overhead costs are allocated based on total direct manufacturing labor costs of the assembly department. 3. Calculate the budgeted unit cost of basic and deluxe trophies if Acclaim allocates overhead costs in each department using activity-based costing, where setup costs are allocated based on number of batches and general overhead costs for each department are allocated based on direct manufacturing labor costs of each department. lifforont ponte

5-22 Plant-wide, department, and activity-cost rates. Acclaim Inc. makes two styles of trophies, basic and deluxe, and operates at capacity. Acclaim does large custom orders. Acclaim budgets to produce 10.000 basic trophies and 5,000 deluxe trophies, Manufacturing takes place in two production departments: forming and assembly. In the forming department, indirect manufacturing costs are accumulated in two cost pools, setup and general overhead. In the assembly department, all indirect manufacturing costs are accumulated in one general overhead cost pool. The basic trophies are formed in batches of 200 but be- cause of the more intricate detail of the deluxe trophies, they are formed in batches of 50. The controller has asked you to compare plant-wide, department, and activity-based cost allocation. Acclaim Budgeted Information for the Year Ended November 30, 2017 Forming Department Basic Deluxe Total $60,000 30,000 Direct materials $35,000 20,000 $95,000 Direct manufacturing labor Overhead costs Setup General overhead 50,000 48,000 32,000 Basic Deluxe Total Assembly Department Direct materials $5,000 $10,000 $15,000 40,000 Direct manufacturing labor 15,000 25,000 Overhead costs General overhead 40,000 1. Calculate the budgeted unit cost of basic and deluxe trophies based on a single plant-wide overhead rate, if total overhead is allocated based on total direct costs. (Don't forget to include direct material and direct manufacturing labor cost in your unit cost calculation.) 2. Calculate the budgeted unit cost of basic and deluxe trophies based on departmental overhead rates, where forming department overhead costs are allocated based on direct manufacturing labor costs of the forming department and assembly department overhead costs are allocated based on total direct manufacturing labor costs of the assembly department. 3. Calculate the budgeted unit cost of basic and deluxe trophies if Acclaim allocates overhead costs in each department using activity-based costing, where setup costs are allocated based on number of batches and general overhead costs for each department are allocated based on direct manufacturing labor costs of each department. lifforont ponte

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter8: Budgeting

Section: Chapter Questions

Problem 4CMA: Krouse Company produces two products, forged putter heads and laminated putter heads, which are sold...

Related questions

Question

Transcribed Image Text:two clients for May 2017?

sional time spent on each client

tead of 30% of professional

5-22 Plant-wide, department, and activity-cost rates. Acclaim Inc. makes two styles of trophies, basic

and deluxe, and operates at capacity. Acclaim does large custom orders. Acclaim budgets to produce

10.000 basic trophies and 5,000 deluxe trophies. Manufacturing takes place in two production departments:

forming and assembly. In the forming department, indirect manufacturing costs are accumulated in two

cost pools, setup and general overhead. In the assembly department, all indirect manufacturing costs are

accumulated in one general overhead cost pool. The basic trophies are formed in batches of 200 but be-

cause of the more intricate detail of the deluxe trophies, they are formed in batches of 50.

The controller has asked you to compare plant-wide, department, and activity-based cost allocation.

Enterprises

do

Acclaim Budgeted Information for the Year Ended November 30, 2017

Forming Department

Basic

Deluxe

Total

Direct materials

$60,000

$35,000

$95,000

Direct manufacturing labor

30,000

20,000

50,000

Overhead costs

Setup

48,000

rises for May 2017?

olls t General overhead

p10 dose of hetols

32,000

Assembly Department

Basic

Deluxe

Total

Direct materials

$ 5,000

$10,000

$15,000

Direct manufacturing labor

15,000

25,000

40,000

nd 2.

I labor-hours is the more

Overhead costs

en

General overhead

40,000

1. Calculate the budgeted unit cost of basic and deluxe trophies based on a single plant-wide overhead

rate, if total overhead is allocated based on total direct costs. (Don't forget to include direct material

and direct manufacturing labor cost in your unit cost calculation.)

2. Calculate the budgeted unit cost of basic and deluxe trophies based on departmental overhead rates,

where forming department overhead costs are allocated based on direct manufacturing labor costs of

the forming department and assembly department overhead costs are allocated based on total direct

manufacturing labor costs of the assembly department.

3. Calculate the budgeted unit cost of basic and deluxe trophies if Acclaim allocates overhead costs in

each department using activity-based costing, where setup costs are allocated based on number of

batches and general overhead costs for each department are allocated based on direct manufacturing

labor costs of each department.

4. Explain briefly why plant-wide, department, and activity-based costing systems show different costs

for the basic and deluxe trophies. Which system would you recommend and why?

Required

y (RC) designs and pro-

000. RC's simple costing

on machine-hours and

ained of being charged

examine the consump-

artments that consume

artment personnel and

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning