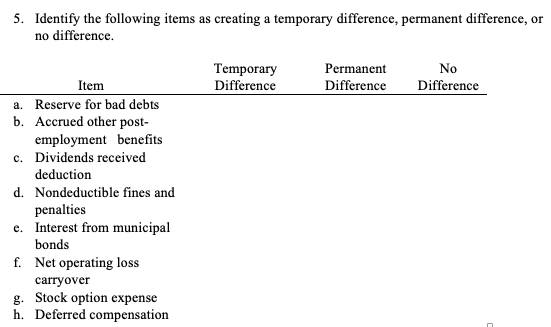

5. Identify the following items as creating a temporary difference, permanent difference, or no difference. No Temporary Difference Permanent Item Difference Difference a. Reserve for bad debts b. Accrued other post- employment benefits c. Dividends received deduction d. Nondeductible fines and penalties e. Interest from municipal bonds f. Net operating loss carryover g. Stock option expense h. Deferred compensation

5. Identify the following items as creating a temporary difference, permanent difference, or no difference. No Temporary Difference Permanent Item Difference Difference a. Reserve for bad debts b. Accrued other post- employment benefits c. Dividends received deduction d. Nondeductible fines and penalties e. Interest from municipal bonds f. Net operating loss carryover g. Stock option expense h. Deferred compensation

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter18: Accounting For Income Taxes

Section: Chapter Questions

Problem 7MC

Related questions

Question

Question in picture

Transcribed Image Text:5. Identify the following items as creating a temporary difference, permanent difference, or

no difference.

No

Temporary

Difference

Permanent

Item

Difference

Difference

a. Reserve for bad debts

b. Accrued other post-

employment benefits

c. Dividends received

deduction

d. Nondeductible fines and

penalties

e. Interest from municipal

bonds

f. Net operating loss

carryover

g. Stock option expense

h. Deferred compensation

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning