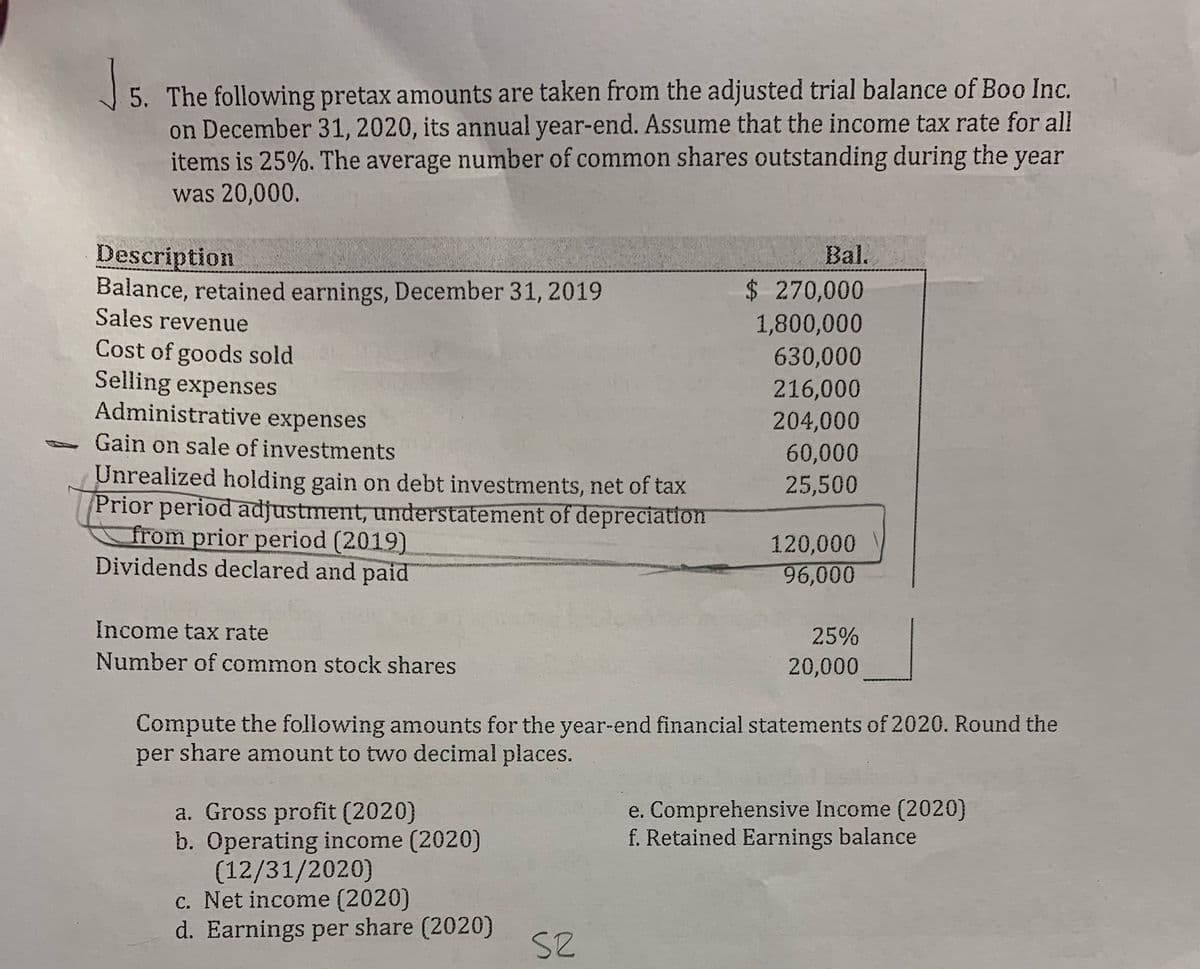

5. The following pretax amounts are taken from the adjusted trial balance of Boo Inc. on December 31, 2020, its annual year-end. Assume that the income tax rate for all items is 25%. The average number of common shares outstanding during the year was 20,000. Description Balance, retained earnings, December 31, 2019 Sales revenue Bal. $ 270,000 1,800,000 630,000 Cost of goods sold Selling expenses Administrative expenses 216,000 204,000 Gain on sale of investments 60,000 25,500 Unrealized holding gain on debt investments, net of tax Prior period adjustment, understatement of depreciatfon from prior period (2019) Dividends declared and paid 120,000 96,000 Income tax rate 25% Number of common stock shares 20,000 Compute the following amounts for the year-end financial statements of 2020. Round the per share amount to two decimal places. e. Comprehensive Income (2020) f. Retained Earnings balance a. Gross profit (2020) b. Operating income (2020) (12/31/2020) c. Net income (2020) d. Earnings per share (2020)

5. The following pretax amounts are taken from the adjusted trial balance of Boo Inc. on December 31, 2020, its annual year-end. Assume that the income tax rate for all items is 25%. The average number of common shares outstanding during the year was 20,000. Description Balance, retained earnings, December 31, 2019 Sales revenue Bal. $ 270,000 1,800,000 630,000 Cost of goods sold Selling expenses Administrative expenses 216,000 204,000 Gain on sale of investments 60,000 25,500 Unrealized holding gain on debt investments, net of tax Prior period adjustment, understatement of depreciatfon from prior period (2019) Dividends declared and paid 120,000 96,000 Income tax rate 25% Number of common stock shares 20,000 Compute the following amounts for the year-end financial statements of 2020. Round the per share amount to two decimal places. e. Comprehensive Income (2020) f. Retained Earnings balance a. Gross profit (2020) b. Operating income (2020) (12/31/2020) c. Net income (2020) d. Earnings per share (2020)

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 2P

Related questions

Question

100%

i have completed this in excel but would like to compare my answers

Transcribed Image Text:5. The following pretax amounts are taken from the adjusted trial balance of Boo Inc.

on December 31, 2020, its annual year-end. Assume that the income tax rate for all

items is 25%. The average number of common shares outstanding during the year

was 20,000.

Description

Balance, retained earnings, December 31, 2019

Sales revenue

Bal.

$ 270,000

1,800,000

Cost of goods sold

Selling expenses

Administrative expenses

630,000

216,000

204,000

Gain on sale of investments

60,000

Unrealized holding gain on debt investments, net of tax

Prior period adjustment, understatement of depreciation

from prior period (2019)

Dividends declared and paid

25,500

120,000

96,000

Income tax rate

25%

Number of common stock shares

20,000

Compute the following amounts for the year-end financial statements of 2020. Round the

per share amount to two decimal places.

e. Comprehensive Income (2020)

f. Retained Earnings balance

a. Gross profit (2020)

b. Operating income (2020)

(12/31/2020)

c. Net income (2020)

d. Earnings per share (2020)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning