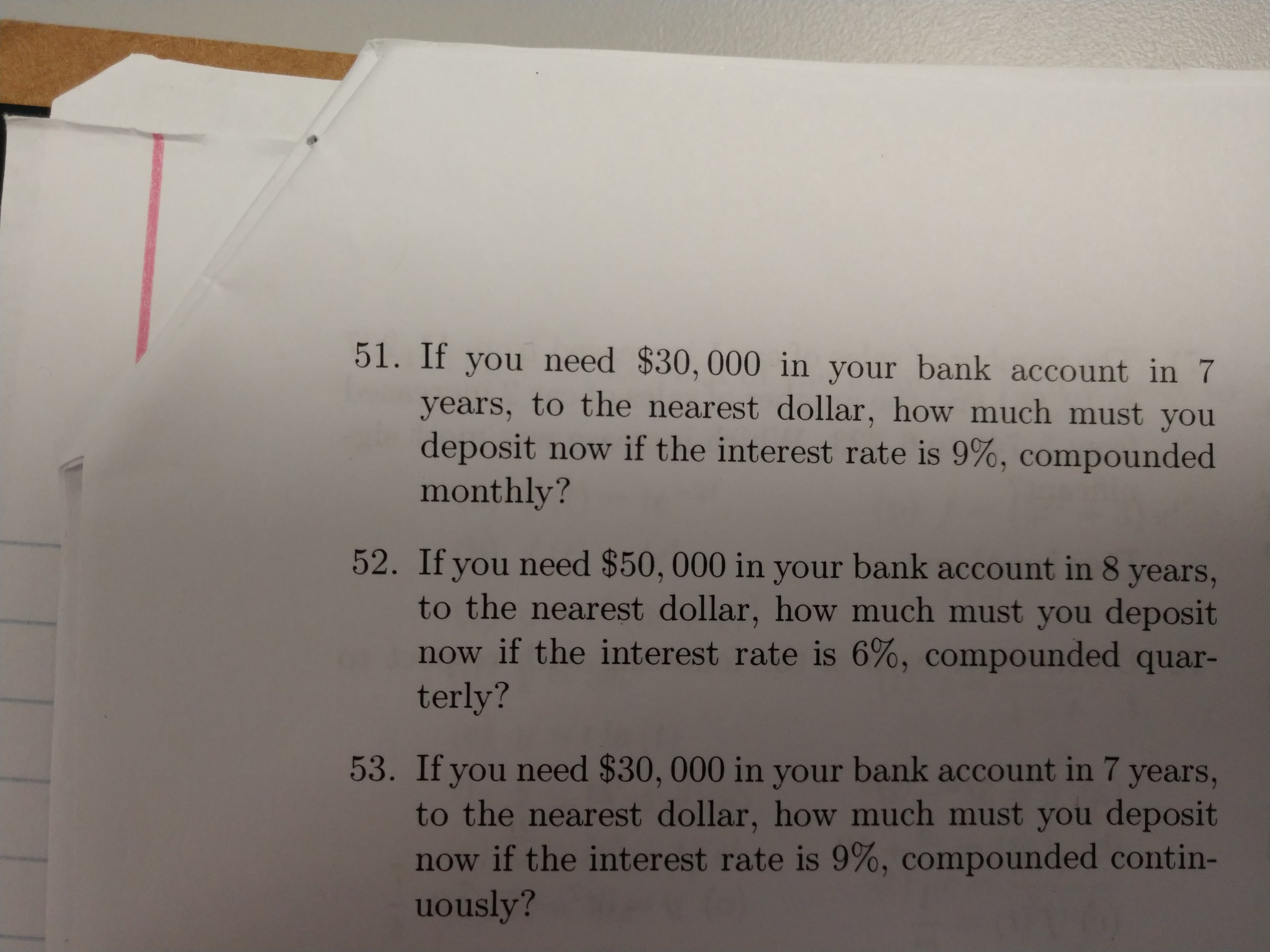

51. If you need $30,000 in your bank account in 7 years, to the nearest dollar, how much must you deposit now if the interest rate is 9%, compounded monthly? 52. If you need $50, 000 in your bank account in 8 years, to the nearest dollar, how much must you deposit now if the interest rate is 6%, compounded quar- terly? 53. If you need $30, 000 in your bank account in 7 years, to the nearest dollar, how much must you deposit now if the interest rate is 9%, compounded contin- uously?

51. If you need $30,000 in your bank account in 7 years, to the nearest dollar, how much must you deposit now if the interest rate is 9%, compounded monthly? 52. If you need $50, 000 in your bank account in 8 years, to the nearest dollar, how much must you deposit now if the interest rate is 6%, compounded quar- terly? 53. If you need $30, 000 in your bank account in 7 years, to the nearest dollar, how much must you deposit now if the interest rate is 9%, compounded contin- uously?

Intermediate Algebra

10th Edition

ISBN:9781285195728

Author:Jerome E. Kaufmann, Karen L. Schwitters

Publisher:Jerome E. Kaufmann, Karen L. Schwitters

Chapter11: Exponential And Logarithmic Functions

Section11.2: Applications Of Exponential Functions

Problem 27PS

Related questions

Question

Transcribed Image Text:51. If you need $30,000 in your bank account in 7

years, to the nearest dollar, how much must you

deposit now if the interest rate is 9%, compounded

monthly?

52. If you need $50, 000 in your bank account in 8 years,

to the nearest dollar, how much must you deposit

now if the interest rate is 6%, compounded quar-

terly?

53. If you need $30, 000 in your bank account in 7 years,

to the nearest dollar, how much must you deposit

now if the interest rate is 9%, compounded contin-

uously?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Intermediate Algebra

Algebra

ISBN:

9781285195728

Author:

Jerome E. Kaufmann, Karen L. Schwitters

Publisher:

Cengage Learning

Intermediate Algebra

Algebra

ISBN:

9781285195728

Author:

Jerome E. Kaufmann, Karen L. Schwitters

Publisher:

Cengage Learning