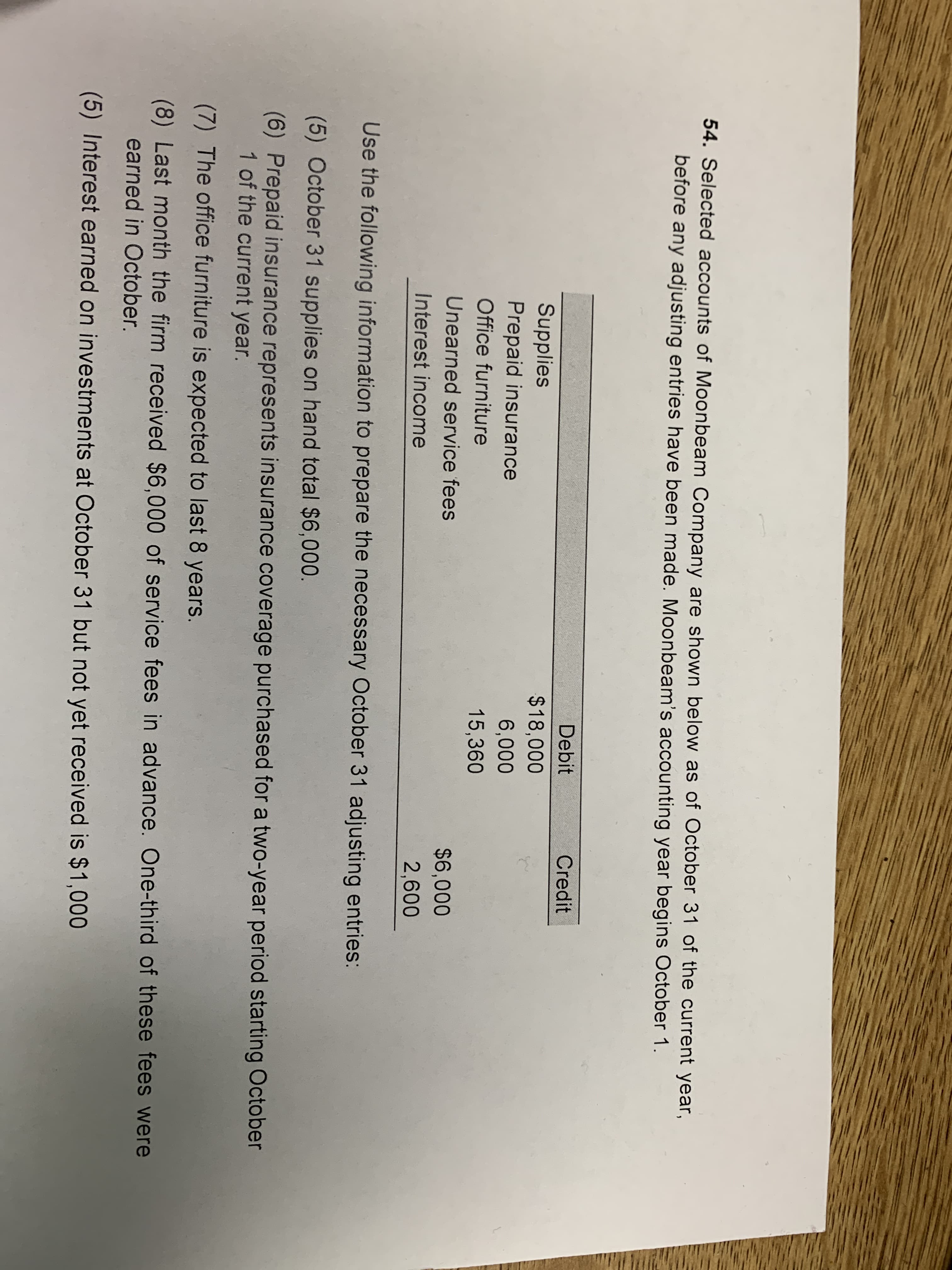

54. Selected accounts of Moonbeam Company are shown below as of October 31 of the current year, before any adjusting entries have been made. Moonbeam's accounting year begins October 1. Debit Credit Supplies Prepaid insurance $18,000 6,000 Office furniture 15,360 Unearned service fees $6,000 Interest income 2,600 Use the following information to prepare the necessary October 31 adjusting entries: (5) October 31 supplies on hand total $6,000. (6) Prepaid insurance represents insurance coverage purchased for a two-year period starting October 1 of the current year. (7) The office furniture is expected to last 8 years. (8) Last month the firm received $6,000 of service fees in advance. One-third of these fees were earned in October. (5) Interest earned on investments at October 31 but not yet received is $1,000

54. Selected accounts of Moonbeam Company are shown below as of October 31 of the current year, before any adjusting entries have been made. Moonbeam's accounting year begins October 1. Debit Credit Supplies Prepaid insurance $18,000 6,000 Office furniture 15,360 Unearned service fees $6,000 Interest income 2,600 Use the following information to prepare the necessary October 31 adjusting entries: (5) October 31 supplies on hand total $6,000. (6) Prepaid insurance represents insurance coverage purchased for a two-year period starting October 1 of the current year. (7) The office furniture is expected to last 8 years. (8) Last month the firm received $6,000 of service fees in advance. One-third of these fees were earned in October. (5) Interest earned on investments at October 31 but not yet received is $1,000

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter22: End-of-fiscal-period Work For A Corporation

Section: Chapter Questions

Problem 1AP

Related questions

Question

Transcribed Image Text:54. Selected accounts of Moonbeam Company are shown below as of October 31 of the current year,

before any adjusting entries have been made. Moonbeam's accounting year begins October 1.

Debit

Credit

Supplies

Prepaid insurance

$18,000

6,000

Office furniture

15,360

Unearned service fees

$6,000

Interest income

2,600

Use the following information to prepare the necessary October 31 adjusting entries:

(5) October 31 supplies on hand total $6,000.

(6) Prepaid insurance represents insurance coverage purchased for a two-year period starting October

1 of the current year.

(7) The office furniture is expected to last 8 years.

(8) Last month the firm received $6,000 of service fees in advance. One-third of these fees were

earned in October.

(5) Interest earned on investments at October 31 but not yet received is $1,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub