550 job for Mrs. Mercado. She had hired him to mow her lawn and ower bed in the front of her house. Mrs. Mercado paid him $250 and later. sisted that he take a break. He withdrew S120 from his checking ra nice evening with his girlfriend, Melissa. They went in Melissa's t in a landscaping truck wasnt exactly what they were looking for n his VISA card for an oil change and some other minor maintenance lome & Garden Center $175 on his account.

550 job for Mrs. Mercado. She had hired him to mow her lawn and ower bed in the front of her house. Mrs. Mercado paid him $250 and later. sisted that he take a break. He withdrew S120 from his checking ra nice evening with his girlfriend, Melissa. They went in Melissa's t in a landscaping truck wasnt exactly what they were looking for n his VISA card for an oil change and some other minor maintenance lome & Garden Center $175 on his account.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter5: Internal Control And Cash

Section: Chapter Questions

Problem 2SEQ

Related questions

Question

100%

Follow the steps below to complete the Final of the Lawn Ranger practice set.

For this part of the assignment enter the transactions for the

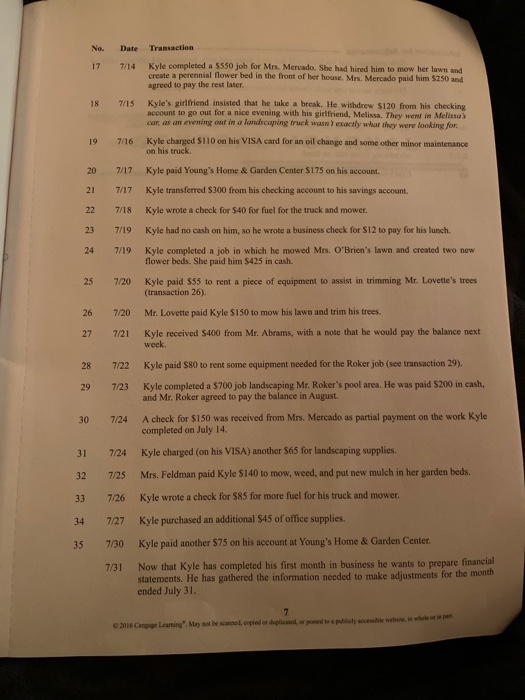

Transcribed Image Text:No.

Date

Transaction

Kyle completed a $550 job for Mrs. Mercado. She had hired him to mow her lawn and

create a perennial flower bed in the front of her house. Mrs. Mercado paid him $250 and

agreed to pay the rest later.

17

7/14

Kyle's girlfriend insisted that he take a break. He withdrew $120 from his checking

account to go out for a nice evening with his girlfriend, Melissa. They went in Melissa's

car, as an evening out in a landscaping truck wasnt exacily what they were looking for.

18

7/15

Kyle charged SI10 on his VISA card for an oil change and some other minor maintenance

on his truck.

19

7/16

20

7/17

Kyle paid Young's Home & Garden Center S175 on his account.

21

7/17

Kyle transferred S300 from his checking account to his savings account.

22

7/18

Kyle wrote a check for $40 for fuel for the truck and mower.

23

7/19

Kyle had no cash on him, so he wrote a business check for S12 to pay for his lunch.

Kyle completed a job in which he mowed Mrs. O'Brien's lawn and created two new

flower beds. She paid him $425 in cash.

24

7/19

Kyle paid $55 to rent a piece of equipment to assist in trimming Mr. Lovette's trees

(transaction 26).

25

7/20

26

7/20

Mr. Lovette paid Kyle $150 to mow his lawn and trim his trees.

Kyle received $400 from Mr. Abrams, with a note that he would pay the balance next

week.

27

7/21

28

Kyle paid $80 to rent some equipment needed for the Roker job (see transaction 29).

7/22

Kyle completed a $700 job landscaping Mr. Roker's pool area. He was paid S200 in cash,

and Mr. Roker agreed to pay the balance in August.

29

7/23

A check for $150 was received from Mrs. Mercado as partial payment on the work Kyle

completed on July 14.

30

7/24

7/24

Kyle charged (on his VISA) another $65 for landscaping supplies.

31

32

7/25

Mrs. Feldman paid Kyle $140 to mow, weed, and put new mulch in her garden beds.

33

7/26

Kyle wrote a check for $85 for more fuel for his truck and mower.

7/27

Kyle purchased an additional $45 of office supplies.

34

35

7/30

Kyle paid another $75 on his account at Young's Home & Garden Center.

Now that Kyle has completed his first month in business he wants to prepare financial

statements. He has gathered the information needed to make adjustments for the month

ended July 31.

7/31

2016 Cengage Leaning". May aot be scanned, copied or duplicated, or posed to a publicly accesshle website, in whele or in pa

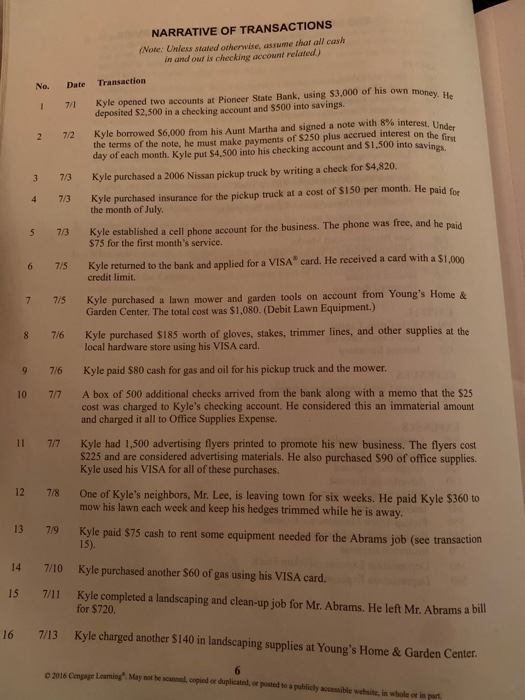

Transcribed Image Text:NARRATIVE OF TRANSACTIONS

(Note: Unless stated otherwise, assume that all cash

in and out is checking account related)

Date

Transaction

No.

Kyle opened two accounts at Pioneer State Bank, using 53,000 of his own money, H.

deposited $2,500 in a checking account and $500 into savings.

7/1

Kyle borrowed $6,000 from his Aunt Martha and signed a note with 8% interest, Und.

the terms of the note, he must make payments of $250 plus accrued interest on the fir

day of each month. Kyle put $4,500 into his checking account and S1,500 into savings

7/2

7/3

Kyle purchased a 2006 Nissan pickup truck by writing a check for $4,820.

3.

Kyle purchased insurance for the pickup truck at a cost of $150 per month. He pajd fo

the month of July.

4

7/3

Kyle established a cell phone account for the business. The phone was free, and he paid

$75 for the first month's service.

7/3

Kyle returned to the bank and applied for a VISA" card. He received a card with a $1,000

credit limit.

7/5

Kyle purchased a lawn mower and garden tools on account from Young's Home &

Garden Center. The total cost was $1,080. (Debit Lawn Equipment.)

7/5

Kyle purchased $185 worth of gloves, stakes, trimmer lines, and other supplies at the

local hardware store using his VISA card.

8.

7/6

9.

Kyle paid $80 cash for gas and oil for his pickup truck and the mower.

7/6

A box of 500 additional checks arrived from the bank along with a memo that the $25

cost was charged to Kyle's checking account. He considered this an immaterial amount

and charged it all to Office Supplies Expense.

7/7

Kyle had 1,500 advertising flyers printed to promote his new business. The flyers cost

$225 and are considered advertising materials. He also purchased $90 of office supplies.

Kyle used his VISA for all of these purchases.

11

7/7

12

One of Kyle's neighbors, Mr. Lee, is leaving town for six weeks. He paid Kyle $360 to

mow his lawn each week and keep his hedges trimmed while he is away.

7/8

13

7/9

Kyle paid $75 cash to rent some equipment needed for the Abrams job (see transaction

15).

14

7/10 Kyle purchased another S60 of gas using his VISA card.

7/11 Kyle completed a landscaping and clean-up job for Mr. Abrams. He left Mr. Abrams a bill

for $720.

15

16

7/13 Kyle charged another $140 in landscaping supplies at Young's Home & Garden Center.

6.

eI6 Cmae Leaming". May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part

10

%D

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage