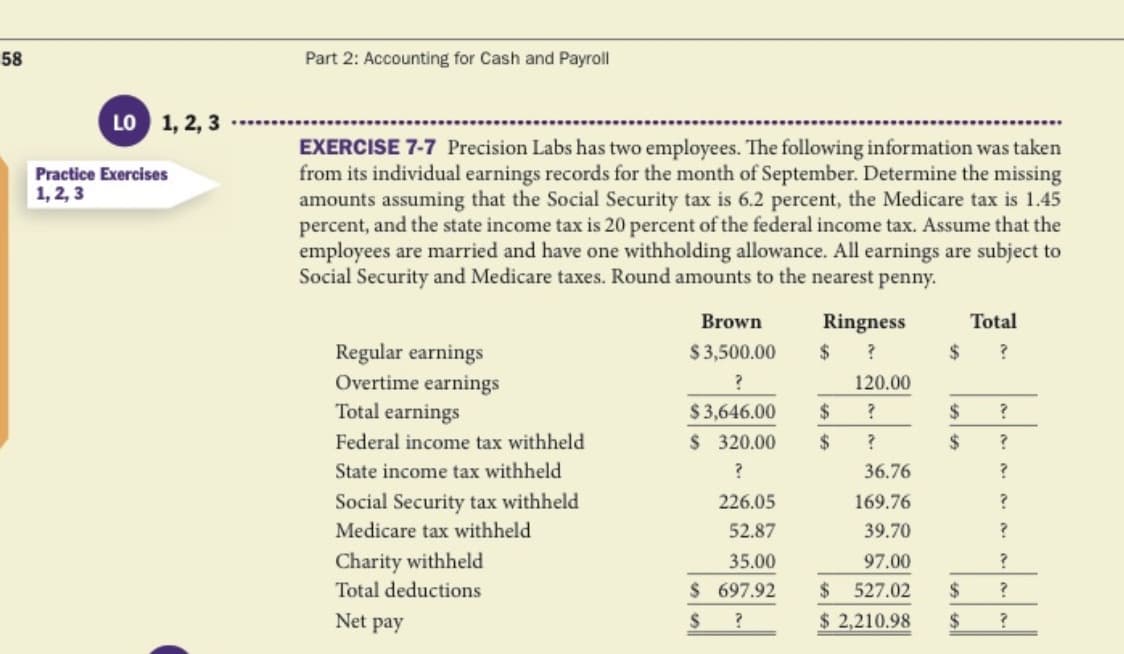

58 Part 2: Accounting for Cash and Payroll LO 1, 2, 3 EXERCISE 7-7 Precision Labs has two employees. The following information was taken from its individual earnings records for the month of September. Determine the missing amounts assuming that the Social Security tax is 6.2 percent, the Medicare tax is 1.45 percent, and the state income tax is 20 percent of the federal income tax. Assume that the employees are married and have one withholding allowance. All earnings are subject to Social Security and Medicare taxes. Round amounts to the nearest penny. Practice Exercises 1,2,3 Brown Ringness Total Regular earnings Overtime earnings Total earnings $3,500.00 2$ 24 120.00 $3,646.00 24 24 Federal income tax withheld $ 320.00 2$ 2$ State income tax withheld 36.76 169.76 Social Security tax withheld Medicare tax withheld 226.05 52.87 39.70 Charity withheld 35.00 97.00 $ 697.92 $ 527.02 $ 2,210.98 Total deductions 2$ Net pay 2$

58 Part 2: Accounting for Cash and Payroll LO 1, 2, 3 EXERCISE 7-7 Precision Labs has two employees. The following information was taken from its individual earnings records for the month of September. Determine the missing amounts assuming that the Social Security tax is 6.2 percent, the Medicare tax is 1.45 percent, and the state income tax is 20 percent of the federal income tax. Assume that the employees are married and have one withholding allowance. All earnings are subject to Social Security and Medicare taxes. Round amounts to the nearest penny. Practice Exercises 1,2,3 Brown Ringness Total Regular earnings Overtime earnings Total earnings $3,500.00 2$ 24 120.00 $3,646.00 24 24 Federal income tax withheld $ 320.00 2$ 2$ State income tax withheld 36.76 169.76 Social Security tax withheld Medicare tax withheld 226.05 52.87 39.70 Charity withheld 35.00 97.00 $ 697.92 $ 527.02 $ 2,210.98 Total deductions 2$ Net pay 2$

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 12EB: Reference Figure 12.15 and use the following information to complete the requirements. A. Determine...

Related questions

Question

Transcribed Image Text:58

Part 2: Accounting for Cash and Payroll

LO 1, 2, 3

EXERCISE 7-7 Precision Labs has two employees. The following information was taken

from its individual earnings records for the month of September. Determine the missing

amounts assuming that the Social Security tax is 6.2 percent, the Medicare tax is 1.45

percent, and the state income tax is 20 percent of the federal income tax. Assume that the

employees are married and have one withholding allowance. All earnings are subject to

Social Security and Medicare taxes. Round amounts to the nearest penny.

Practice Exercises

1,2,3

Brown

Ringness

Total

Regular earnings

Overtime earnings

Total earnings

$3,500.00

2$

24

120.00

$3,646.00

24

24

Federal income tax withheld

$ 320.00

2$

2$

State income tax withheld

36.76

169.76

Social Security tax withheld

Medicare tax withheld

226.05

52.87

39.70

Charity withheld

35.00

97.00

$ 697.92

$ 527.02

$ 2,210.98

Total deductions

2$

Net pay

2$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning