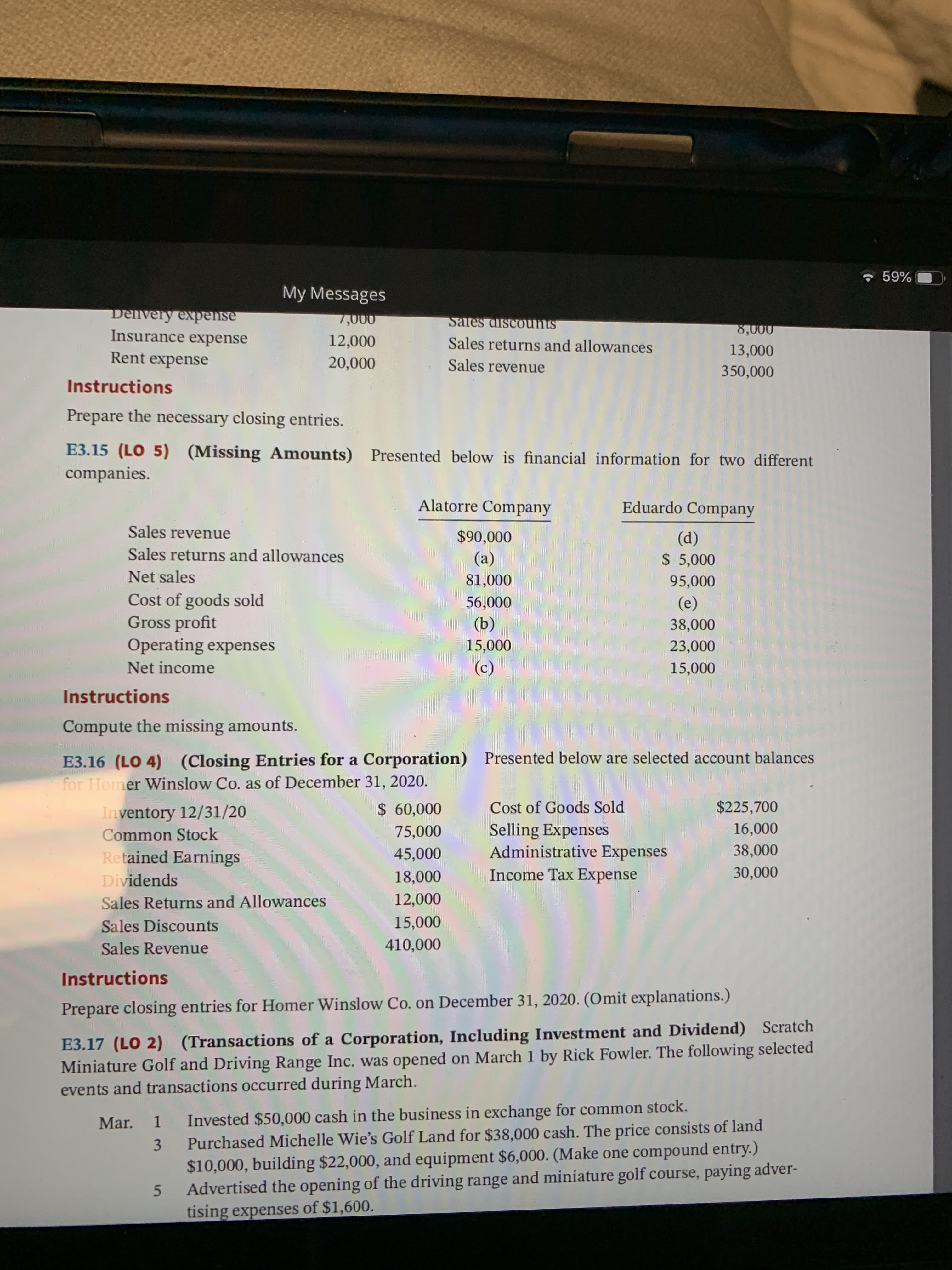

* 59% My Messages Denvery expense Insurance expense 7,000 Sales discounts 8,000 12,000 Sales returns and allowances 13,000 Rent expense 20,000 Sales revenue 350,000 Instructions Prepare the necessary closing entries. E3.15 (LO 5) (Missing Amounts) Presented below is financial information for two different companies. Alatorre Company Eduardo Company Sales revenue $90,000 (d) $ 5,000 Sales returns and allowances (a) Net sales 81,000 95,000 Cost of goods sold Gross profit Operating expenses 56,000 (e) (b) 38,000 15,000 23,000 (c) Net income 15,000 Instructions Compute the missing amounts. E3.16 (LO 4) (Closing Entries for a Corporation) for Homer Winslow Co. as of December 31, 2020. Presented below are selected account balances Cost of Goods Sold $225,700 $ 60,000 Inventory 12/31/20 Selling Expenses Administrative Expenses Income Tax Expense 16,000 75,000 Common Stock 38,000 Retained Earnings Dividends 45,000 30,000 18,000 12,000 Sales Returns and Allowances 15,000 Sales Discounts 410,000 Sales Revenue Instructions Prepare closing entries for Homer Winslow Co. on December 31, 2020. (Omit explanations.) E3.17 (LO 2) (Transactions of a Corporation, Including Investment and Dividend) Scratch Miniature Golf and Driving Range Inc. was opened on March 1 by Rick Fowler. The following selected events and transactions occurred during March. Invested $50,000 cash in the business in exchange for common stock. Purchased Michelle Wie's Golf Land for $38,000 cash. The price consists of land Mar. 3 $10,000, building $22,000, and equipment $6,000. (Make one compound entry.) Advertised the opening of the driving range and miniature golf course, paying adver- tising expenses of $1,600.

* 59% My Messages Denvery expense Insurance expense 7,000 Sales discounts 8,000 12,000 Sales returns and allowances 13,000 Rent expense 20,000 Sales revenue 350,000 Instructions Prepare the necessary closing entries. E3.15 (LO 5) (Missing Amounts) Presented below is financial information for two different companies. Alatorre Company Eduardo Company Sales revenue $90,000 (d) $ 5,000 Sales returns and allowances (a) Net sales 81,000 95,000 Cost of goods sold Gross profit Operating expenses 56,000 (e) (b) 38,000 15,000 23,000 (c) Net income 15,000 Instructions Compute the missing amounts. E3.16 (LO 4) (Closing Entries for a Corporation) for Homer Winslow Co. as of December 31, 2020. Presented below are selected account balances Cost of Goods Sold $225,700 $ 60,000 Inventory 12/31/20 Selling Expenses Administrative Expenses Income Tax Expense 16,000 75,000 Common Stock 38,000 Retained Earnings Dividends 45,000 30,000 18,000 12,000 Sales Returns and Allowances 15,000 Sales Discounts 410,000 Sales Revenue Instructions Prepare closing entries for Homer Winslow Co. on December 31, 2020. (Omit explanations.) E3.17 (LO 2) (Transactions of a Corporation, Including Investment and Dividend) Scratch Miniature Golf and Driving Range Inc. was opened on March 1 by Rick Fowler. The following selected events and transactions occurred during March. Invested $50,000 cash in the business in exchange for common stock. Purchased Michelle Wie's Golf Land for $38,000 cash. The price consists of land Mar. 3 $10,000, building $22,000, and equipment $6,000. (Make one compound entry.) Advertised the opening of the driving range and miniature golf course, paying adver- tising expenses of $1,600.

Chapter9: Accounting For Receivables

Section: Chapter Questions

Problem 18MC: Michelle Company reports $345,000 in credit sales and $267,500 in accounts receivable at the end of...

Related questions

Concept explainers

Question

3.15 and 3.16

Transcribed Image Text:* 59%

My Messages

Denvery expense

Insurance expense

7,000

Sales discounts

8,000

12,000

Sales returns and allowances

13,000

Rent expense

20,000

Sales revenue

350,000

Instructions

Prepare the necessary closing entries.

E3.15 (LO 5) (Missing Amounts) Presented below is financial information for two different

companies.

Alatorre Company

Eduardo Company

Sales revenue

$90,000

(d)

$ 5,000

Sales returns and allowances

(a)

Net sales

81,000

95,000

Cost of goods sold

Gross profit

Operating expenses

56,000

(e)

(b)

38,000

15,000

23,000

(c)

Net income

15,000

Instructions

Compute the missing amounts.

E3.16 (LO 4) (Closing Entries for a Corporation)

for Homer Winslow Co. as of December 31, 2020.

Presented below are selected account balances

Cost of Goods Sold

$225,700

$ 60,000

Inventory 12/31/20

Selling Expenses

Administrative Expenses

Income Tax Expense

16,000

75,000

Common Stock

38,000

Retained Earnings

Dividends

45,000

30,000

18,000

12,000

Sales Returns and Allowances

15,000

Sales Discounts

410,000

Sales Revenue

Instructions

Prepare closing entries for Homer Winslow Co. on December 31, 2020. (Omit explanations.)

E3.17 (LO 2) (Transactions of a Corporation, Including Investment and Dividend) Scratch

Miniature Golf and Driving Range Inc. was opened on March 1 by Rick Fowler. The following selected

events and transactions occurred during March.

Invested $50,000 cash in the business in exchange for common stock.

Purchased Michelle Wie's Golf Land for $38,000 cash. The price consists of land

Mar.

3

$10,000, building $22,000, and equipment $6,000. (Make one compound entry.)

Advertised the opening of the driving range and miniature golf course, paying adver-

tising expenses of $1,600.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning