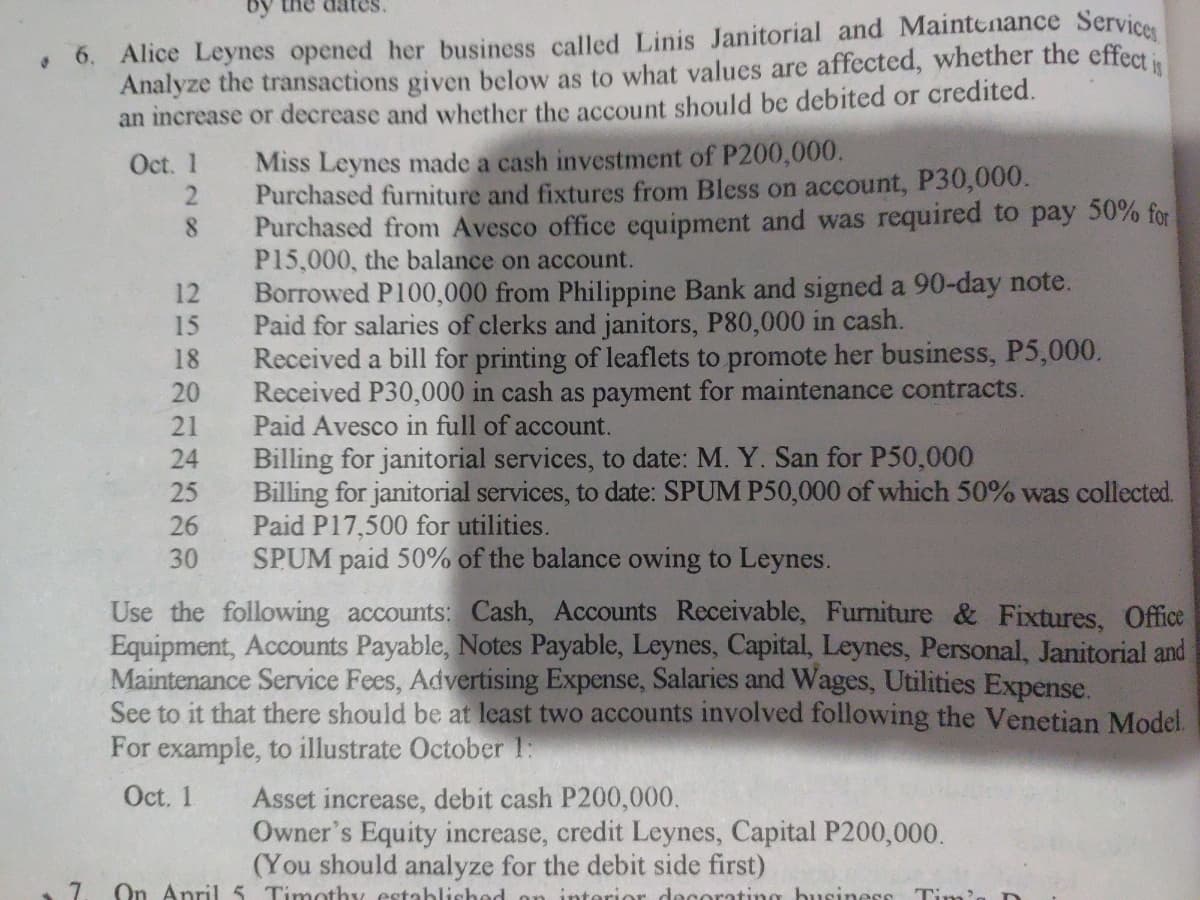

6. Alice Leynes opened her business called Linis Analyze the transactions given below as to what values are affected, whether the effecti an increase or decrease and whether the account should be debited or credited. Oct. 1 2 8 12 15 18 20 21 24 25 26 30 Miss Leynes made a cash investment of P200,000. Purchased furniture and fixtures from Bless on account, P30,000. Purchased from Avesco office equipment and was required to pay 50% for P15,000, the balance on account. Borrowed P100,000 from Philippine Bank and signed a 90-day note. Paid for salaries of clerks and janitors, P80,000 in cash. Received a bill for printing of leaflets to promote her business, P5,000. Received P30,000 in cash as payment for maintenance contracts. Paid Avesco in full of account. Billing for janitorial services, to date: M. Y. San for P50,000 Billing for janitorial services, to date: SPUM P50,000 of which 50% was collected. Paid P17,500 for utilities. SPUM paid 50% of the balance owing to Leynes. Use the following accounts: Cash, Accounts Receivable, Furniture & Fixtures, Office Equipment, Accounts Payable, Notes Payable, Leynes, Capital, Leynes, Personal, Janitorial and Maintenance Service Fees, Advertising Expense, Salaries and Wages, Utilities Expense. See to it that there should be at least two accounts involved following the Venetian Model. For example, to illustrate October 1: Oct. 1 Asset increase, debit cash P200,000. Owner's Equity increase, credit Leynes, Capital P200,000. (You should analyze for the debit side first)

6. Alice Leynes opened her business called Linis Analyze the transactions given below as to what values are affected, whether the effecti an increase or decrease and whether the account should be debited or credited. Oct. 1 2 8 12 15 18 20 21 24 25 26 30 Miss Leynes made a cash investment of P200,000. Purchased furniture and fixtures from Bless on account, P30,000. Purchased from Avesco office equipment and was required to pay 50% for P15,000, the balance on account. Borrowed P100,000 from Philippine Bank and signed a 90-day note. Paid for salaries of clerks and janitors, P80,000 in cash. Received a bill for printing of leaflets to promote her business, P5,000. Received P30,000 in cash as payment for maintenance contracts. Paid Avesco in full of account. Billing for janitorial services, to date: M. Y. San for P50,000 Billing for janitorial services, to date: SPUM P50,000 of which 50% was collected. Paid P17,500 for utilities. SPUM paid 50% of the balance owing to Leynes. Use the following accounts: Cash, Accounts Receivable, Furniture & Fixtures, Office Equipment, Accounts Payable, Notes Payable, Leynes, Capital, Leynes, Personal, Janitorial and Maintenance Service Fees, Advertising Expense, Salaries and Wages, Utilities Expense. See to it that there should be at least two accounts involved following the Venetian Model. For example, to illustrate October 1: Oct. 1 Asset increase, debit cash P200,000. Owner's Equity increase, credit Leynes, Capital P200,000. (You should analyze for the debit side first)

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter2: T Accounts, Debits And Credits, Trial Balance, And Financial Statements

Section: Chapter Questions

Problem 4QY: R. Nelson invests his personal computer, with a fair market value of 2,500, in the business. How...

Related questions

Question

Chapter 5: Question 6 Alice Leynes "Linis Janitorial and Maintenance Services"

Use the following accounts: Cash, Accounts Receivable, Furniture & Fixtures, Office Equipment, Accounts Payable, Notes Payable, Leynes, Capital, Leynes, Personal, Janitorial and Maintenance Service Fees, Advertising Expense, Salaries and Wages, Utilities Expense. See to it that there should be at least two accounts involved following the Venetian Model. For example, to illustrate October 1

Transcribed Image Text:by

. 6. Alice Leynes opened her business called Linis Janitorial and Maintenance Services

Analyze the transactions given below as to what values are affected, whether the effect i

an increase or decrease and whether the account should be debited or credited.

7

Oct. 1

2

8

12

15

18

20

21

24

25

26

30

Miss Leynes made a cash investment of P200,000.

Purchased furniture and fixtures from Bless on account, P30,000.

Purchased from Avesco office equipment and was required to pay 50% for

P15,000, the balance on account.

Borrowed P100,000 from Philippine Bank and signed a 90-day note.

Paid for salaries of clerks and janitors, P80,000 in cash.

Received a bill for printing of leaflets to promote her business, P5,000.

Received P30,000 in cash as payment for maintenance contracts.

Paid Avesco in full of account.

Billing for janitorial services, to date: M. Y. San for P50,000

Billing for janitorial services, to date: SPUM P50,000 of which 50% was collected.

Paid P17,500 for utilities.

SPUM paid 50% of the balance owing to Leynes.

Use the following accounts: Cash, Accounts Receivable, Furniture & Fixtures, Office

Equipment, Accounts Payable, Notes Payable, Leynes, Capital, Leynes, Personal, Janitorial and

Maintenance Service Fees, Advertising Expense, Salaries and Wages, Utilities Expense.

See to it that there should be at least two accounts involved following the Venetian Model.

For example, to illustrate October 1:

Oct. 1

Asset increase, debit cash P200,000.

Owner's Equity increase, credit Leynes, Capital P200,000.

(You should analyze for the debit side first)

On April 5 Timothy established on interior decorating business Tim'

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub