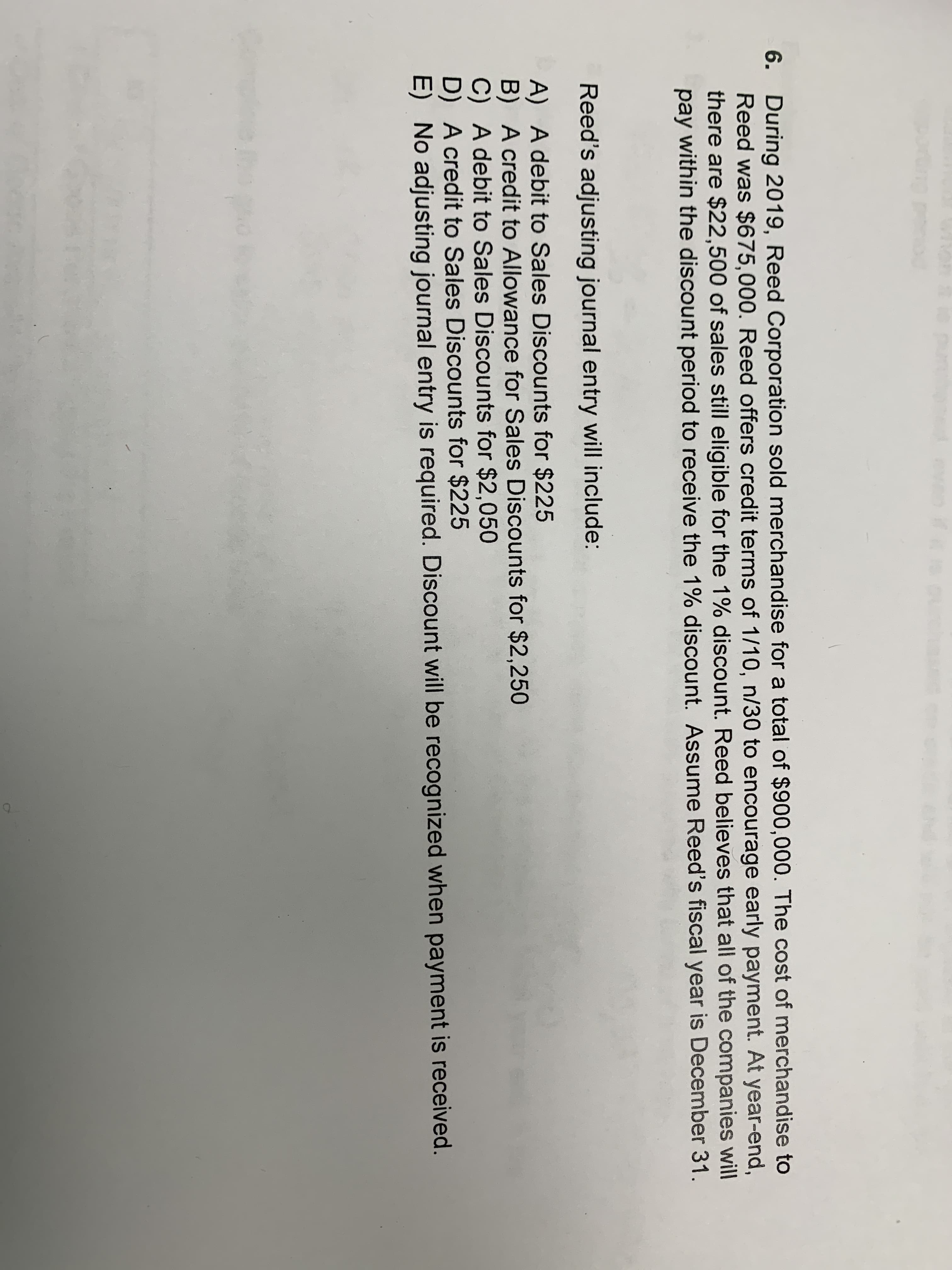

6. During 2019, Reed Corporation sold merchandise for a total of $900,000. The cost of merchandise to Reed was $675,000. Reed offers credit terms of 1/10, n/30 to encourage early payment. At year-end, there are $22,500 of sales still eligible for the 1% discount. Reed believes that all of the companies will pay within the discount period to receive the 1% discount. Assume Reed's fiscal year is December 31. Reed's adjusting journal entry will include: A) A debit to Sales Discounts for $225 B) A credit to Allowance for Sales Discounts for $2,250 C) A debit to Sales Discounts for $2,050 D) A credit to Sales Discounts for $225 E) No adjusting journal entry is required. Discount will be recognized when payment is received.

6. During 2019, Reed Corporation sold merchandise for a total of $900,000. The cost of merchandise to Reed was $675,000. Reed offers credit terms of 1/10, n/30 to encourage early payment. At year-end, there are $22,500 of sales still eligible for the 1% discount. Reed believes that all of the companies will pay within the discount period to receive the 1% discount. Assume Reed's fiscal year is December 31. Reed's adjusting journal entry will include: A) A debit to Sales Discounts for $225 B) A credit to Allowance for Sales Discounts for $2,250 C) A debit to Sales Discounts for $2,050 D) A credit to Sales Discounts for $225 E) No adjusting journal entry is required. Discount will be recognized when payment is received.

Chapter9: Accounting For Receivables

Section: Chapter Questions

Problem 15EA: Resin Milling issued a $390,500 note on January 1, 2018 to a customer in exchange for merchandise....

Related questions

Question

Transcribed Image Text:6. During 2019, Reed Corporation sold merchandise for a total of $900,000. The cost of merchandise to

Reed was $675,000. Reed offers credit terms of 1/10, n/30 to encourage early payment. At year-end,

there are $22,500 of sales still eligible for the 1% discount. Reed believes that all of the companies will

pay within the discount period to receive the 1% discount. Assume Reed's fiscal year is December 31.

Reed's adjusting journal entry will include:

A) A debit to Sales Discounts for $225

B) A credit to Allowance for Sales Discounts for $2,250

C) A debit to Sales Discounts for $2,050

D) A credit to Sales Discounts for $225

E) No adjusting journal entry is required. Discount will be recognized when payment is received.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning