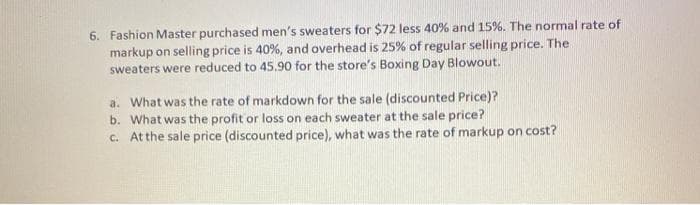

6. Fashion Master purchased men's sweaters for $72 less 40% and 15%. The normal rate of markup on selling price is 40%, and overhead is 25% of regular selling price. The sweaters were reduced to 45.90 for the store's Boxing Day Blowout. a. What was the rate of markdown for the sale (discounted Price)? b. What was the profit or loss on each sweater at the sale price? c. At the sale price (discounted price), what was the rate of markup on cost?

6. Fashion Master purchased men's sweaters for $72 less 40% and 15%. The normal rate of markup on selling price is 40%, and overhead is 25% of regular selling price. The sweaters were reduced to 45.90 for the store's Boxing Day Blowout. a. What was the rate of markdown for the sale (discounted Price)? b. What was the profit or loss on each sweater at the sale price? c. At the sale price (discounted price), what was the rate of markup on cost?

Chapter2: Computing Wages And Salaries

Section: Chapter Questions

Problem 21PB: Maria Cohen is employed as a salesperson in the mens department of Lees Fashions. In addition to her...

Related questions

Question

Transcribed Image Text:6. Fashion Master purchased men's sweaters for $72 less 40% and 15%. The normal rate of

markup on selling price is 40%, and overhead is 25% of regular selling price. The

sweaters were reduced to 45.90 for the store's Boxing Day Blowout.

a. What was the rate of markdown for the sale (discounted Price)?

b. What was the profit or loss on each sweater at the sale price?

C. At the sale price (discounted price), what was the rate of markup on cost?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you