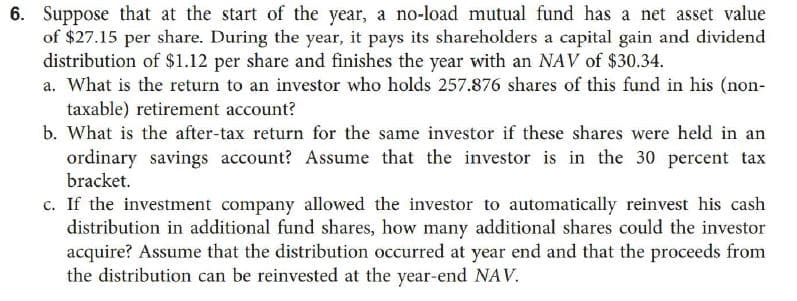

6. Suppose that at the start of the year, a no-load mutual fund has a net asset value of $27.15 per share. During the year, it pays its shareholders a capital gain and dividend distribution of $1.12 per share and finishes the year with an NAV of $30.34. a. What is the return to an investor who holds 257.876 shares of this fund in his (non- taxable) retirement account? b. What is the after-tax return for the same investor if these shares were held in an ordinary savings account? Assume that the investor is in the 30 percent tax bracket. c. If the investment company allowed the investor to automatically reinvest his cash distribution in additional fund shares, how many additional shares could the investor acquire? Assume that the distribution occurred at year end and that the proceeds from the distribution can be reinvested at the year-end NAV.

6. Suppose that at the start of the year, a no-load mutual fund has a net asset value of $27.15 per share. During the year, it pays its shareholders a capital gain and dividend distribution of $1.12 per share and finishes the year with an NAV of $30.34. a. What is the return to an investor who holds 257.876 shares of this fund in his (non- taxable) retirement account? b. What is the after-tax return for the same investor if these shares were held in an ordinary savings account? Assume that the investor is in the 30 percent tax bracket. c. If the investment company allowed the investor to automatically reinvest his cash distribution in additional fund shares, how many additional shares could the investor acquire? Assume that the distribution occurred at year end and that the proceeds from the distribution can be reinvested at the year-end NAV.

PFIN (with PFIN Online, 1 term (6 months) Printed Access Card) (New, Engaging Titles from 4LTR Press)

6th Edition

ISBN:9781337117005

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter13: Investing In Mutual Funds, Etfs, And Real Estate

Section: Chapter Questions

Problem 7FPE

Related questions

Question

Transcribed Image Text:6. Suppose that at the start of the year, a no-load mutual fund has a net asset value

of $27.15 per share. During the year, it pays its shareholders a capital gain and dividend

distribution of $1.12 per share and finishes the year with an NAV of $30.34.

a. What is the return to an investor who holds 257.876 shares of this fund in his (non-

taxable) retirement account?

b. What is the after-tax return for the same investor if these shares were held in an

ordinary savings account? Assume that the investor is in the 30 percent tax

bracket.

c. If the investment company allowed the investor to automatically reinvest his cash

distribution in additional fund shares, how many additional shares could the investor

acquire? Assume that the distribution occurred at year end and that the proceeds from

the distribution can be reinvested at the year-end NAV.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 3 images

Recommended textbooks for you

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning