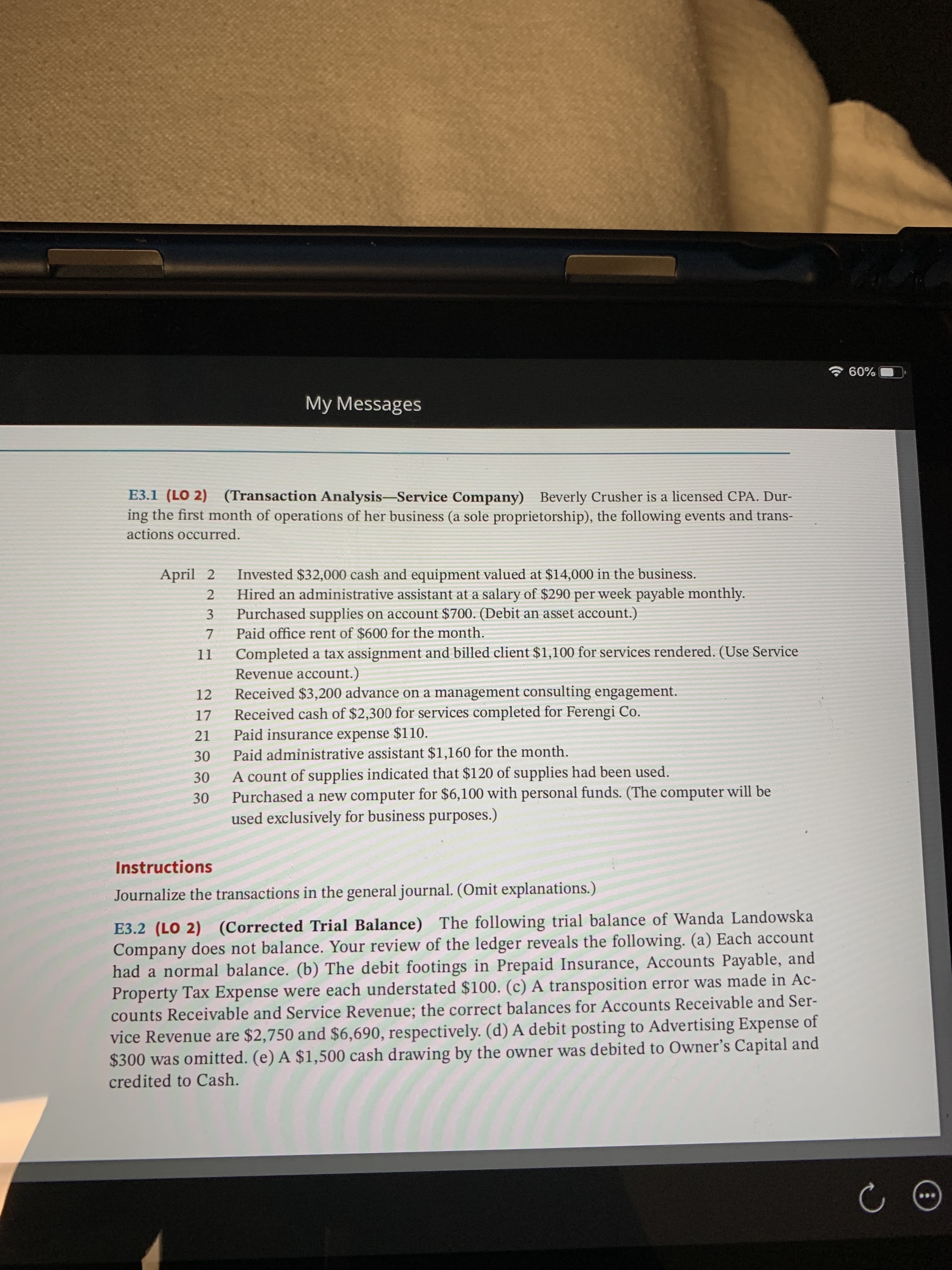

令60% My Messages E3.1 (LO 2) (Transaction Analysis-Service Company) Beverly Crusher is a licensed CPA. Dur- ing the first month of operations of her business (a sole proprietorship), the following events and trans- actions occurred. Invested $32,000 cash and equipment valued at $14,000 in the business. Hired an administrative assistant at a salary of $290 per week payable monthly. Purchased supplies on account $700. (Debit an asset account.) Paid office rent of $600 for the month. April 2 3 7. Completed a tax assignment and billed client $1,100 for services rendered. (Use Service Revenue account.) Received $3,200 advance on a management consulting engagement. 11 12 Received cash of $2,300 for services completed for Ferengi Co. Paid insurance expense $110. 17 21 Paid administrative assistant $1,160 for the month. 30 A count of supplies indicated that $120 of supplies had been used. Purchased a new computer for $6,100 with personal funds. (The computer will be used exclusively for business purposes.) 30 30 Instructions Journalize the transactions in the general journal. (Omit explanations.) E3.2 (LO 2) (Corrected Trial Balance) The following trial balance of Wanda Landowska Company does not balance. Your review of the ledger reveals the following. (a) Each account had a normal balance. (b) The debit footings in Prepaid Insurance, Accounts Payable, and Property Tax Expense were each understated $100. (c) A transposition error was made in Ac- counts Receivable and Service Revenue; the correct balances for Accounts Receivable and Ser- vice Revenue are $2,750 and $6,690, respectively. (d) A debit posting to Advertising Expense of $300 was omitted. (e) A $1,500 cash drawing by the owner was debited to Owner's Capital and credited to Cash.

令60% My Messages E3.1 (LO 2) (Transaction Analysis-Service Company) Beverly Crusher is a licensed CPA. Dur- ing the first month of operations of her business (a sole proprietorship), the following events and trans- actions occurred. Invested $32,000 cash and equipment valued at $14,000 in the business. Hired an administrative assistant at a salary of $290 per week payable monthly. Purchased supplies on account $700. (Debit an asset account.) Paid office rent of $600 for the month. April 2 3 7. Completed a tax assignment and billed client $1,100 for services rendered. (Use Service Revenue account.) Received $3,200 advance on a management consulting engagement. 11 12 Received cash of $2,300 for services completed for Ferengi Co. Paid insurance expense $110. 17 21 Paid administrative assistant $1,160 for the month. 30 A count of supplies indicated that $120 of supplies had been used. Purchased a new computer for $6,100 with personal funds. (The computer will be used exclusively for business purposes.) 30 30 Instructions Journalize the transactions in the general journal. (Omit explanations.) E3.2 (LO 2) (Corrected Trial Balance) The following trial balance of Wanda Landowska Company does not balance. Your review of the ledger reveals the following. (a) Each account had a normal balance. (b) The debit footings in Prepaid Insurance, Accounts Payable, and Property Tax Expense were each understated $100. (c) A transposition error was made in Ac- counts Receivable and Service Revenue; the correct balances for Accounts Receivable and Ser- vice Revenue are $2,750 and $6,690, respectively. (d) A debit posting to Advertising Expense of $300 was omitted. (e) A $1,500 cash drawing by the owner was debited to Owner's Capital and credited to Cash.

Chapter3: Analyzing And Recording Transactions

Section: Chapter Questions

Problem 19EB: A business has the following transactions: A. The business is started by receiving cash from an...

Related questions

Question

Transcribed Image Text:令60%

My Messages

E3.1 (LO 2) (Transaction Analysis-Service Company) Beverly Crusher is a licensed CPA. Dur-

ing the first month of operations of her business (a sole proprietorship), the following events and trans-

actions occurred.

Invested $32,000 cash and equipment valued at $14,000 in the business.

Hired an administrative assistant at a salary of $290 per week payable monthly.

Purchased supplies on account $700. (Debit an asset account.)

Paid office rent of $600 for the month.

April 2

3

7.

Completed a tax assignment and billed client $1,100 for services rendered. (Use Service

Revenue account.)

Received $3,200 advance on a management consulting engagement.

11

12

Received cash of $2,300 for services completed for Ferengi Co.

Paid insurance expense $110.

17

21

Paid administrative assistant $1,160 for the month.

30

A count of supplies indicated that $120 of supplies had been used.

Purchased a new computer for $6,100 with personal funds. (The computer will be

used exclusively for business purposes.)

30

30

Instructions

Journalize the transactions in the general journal. (Omit explanations.)

E3.2 (LO 2) (Corrected Trial Balance) The following trial balance of Wanda Landowska

Company does not balance. Your review of the ledger reveals the following. (a) Each account

had a normal balance. (b) The debit footings in Prepaid Insurance, Accounts Payable, and

Property Tax Expense were each understated $100. (c) A transposition error was made in Ac-

counts Receivable and Service Revenue; the correct balances for Accounts Receivable and Ser-

vice Revenue are $2,750 and $6,690, respectively. (d) A debit posting to Advertising Expense of

$300 was omitted. (e) A $1,500 cash drawing by the owner was debited to Owner's Capital and

credited to Cash.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,