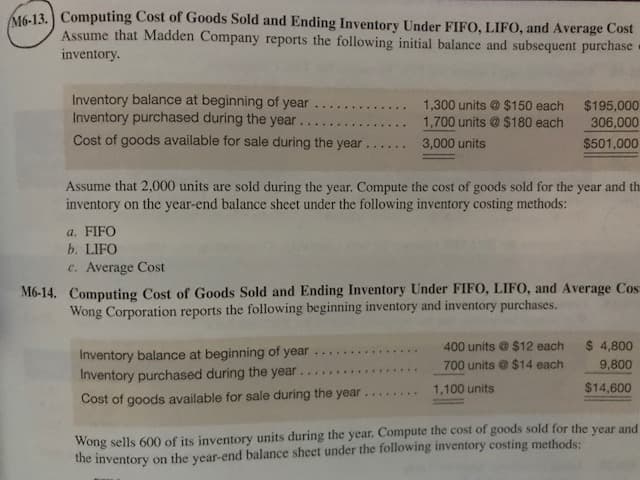

(613 Computing Cost of Goods Sold and Ending Inventory Uinder FIFo, LIFO, and Average Cost Computing Cost of Goods Sold and Ending Inventory Under 16- Assume that Madden Company reports the following initial balance and subsequent purcha inventorv. Inventory balance at beginning of year ......1,300 units$150 each $195,000 Inventory purchased during the year 1,700 units $180 each 306,000 Cost of goods available for sale during the year..... 3,000 units $501,000 Assume that 2,000 units are sold during the year. Compute the cost of goods sold for the year and th inventory on the year-end balance sheet under the following inventory costing methods: a. FIFO b. LIFO c. Average Cost M6-14. Computing Cost of Goods Sold and Ending Inventory Under FIFO, LIFO, and Average Cos Wong Corporation reports the following beginning inventory and inventory purchases. 400 units $12 each 4,800 Inventory balance at beginning of year . Inventory purchased during the year 700 units@$14 each Cost of goods available for sale during the year .....1,100 units 9,800 $14,600 Wong sells 600 of its inventory units during the year. Compute the cost of goods sold for the year the inventory on the year-end balance sheet under the following inventory costing methods: and

(613 Computing Cost of Goods Sold and Ending Inventory Uinder FIFo, LIFO, and Average Cost Computing Cost of Goods Sold and Ending Inventory Under 16- Assume that Madden Company reports the following initial balance and subsequent purcha inventorv. Inventory balance at beginning of year ......1,300 units$150 each $195,000 Inventory purchased during the year 1,700 units $180 each 306,000 Cost of goods available for sale during the year..... 3,000 units $501,000 Assume that 2,000 units are sold during the year. Compute the cost of goods sold for the year and th inventory on the year-end balance sheet under the following inventory costing methods: a. FIFO b. LIFO c. Average Cost M6-14. Computing Cost of Goods Sold and Ending Inventory Under FIFO, LIFO, and Average Cos Wong Corporation reports the following beginning inventory and inventory purchases. 400 units $12 each 4,800 Inventory balance at beginning of year . Inventory purchased during the year 700 units@$14 each Cost of goods available for sale during the year .....1,100 units 9,800 $14,600 Wong sells 600 of its inventory units during the year. Compute the cost of goods sold for the year the inventory on the year-end balance sheet under the following inventory costing methods: and

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter6: Cost Of Goods Sold And Inventory

Section: Chapter Questions

Problem 41BE: ( Appendix 6B) Inventory Costing Methods: Periodic Inventory Systems. Refer to the information for...

Related questions

Question

Transcribed Image Text:(613 Computing Cost of Goods Sold and Ending Inventory Uinder FIFo, LIFO, and Average Cost

Computing Cost of Goods Sold and Ending Inventory Under

16-

Assume that Madden Company reports the following initial balance and subsequent purcha

inventorv.

Inventory balance at beginning of year ......1,300 units$150 each $195,000

Inventory purchased during the year 1,700 units $180 each 306,000

Cost of goods available for sale during the year..... 3,000 units

$501,000

Assume that 2,000 units are sold during the year. Compute the cost of goods sold for the year and th

inventory on the year-end balance sheet under the following inventory costing methods:

a. FIFO

b. LIFO

c. Average Cost

M6-14. Computing Cost of Goods Sold and Ending Inventory Under FIFO, LIFO, and Average Cos

Wong Corporation reports the following beginning inventory and inventory purchases.

400 units $12 each 4,800

Inventory balance at beginning of year .

Inventory purchased during the year 700 units@$14 each

Cost of goods available for sale during the year .....1,100 units

9,800

$14,600

Wong sells 600 of its inventory units during the year. Compute the cost of goods sold for the year

the inventory on the year-end balance sheet under the following inventory costing methods:

and

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College