7. Factors that impact the yield curve Aa Aa There are three factors that can affect the shape of the Treasury yield curve (rt, IPt, and MRPt) and five factors that can affect the shape of the corporate yield curve (r*t, IPt, MRPt, DRPt, and LPt). The yield curve reflects the aggregation of the impacts from these factors. Suppose the real risk-free rate and inflation rate are expected to remain at their current levels throughout the foreseeable future. Consider all factors that affect the yield curve. Then identify which of the following shapes that the U.S. Treasury yield curve can take. Check all that apply Upward-sloping yield curve Downward-sloping yield curve Inverted yield curve Identify whether each of the following statements is true or false. False Statements True If inflation is expected to decrease in the future and the real rate is expected to remain steady, then the Treasury yield curve is downward sloping. (Assume MRP 0.) All else equal, the yield on new bonds issued by a leveraged firm will be less than the yield on the new bonds issued by an unleveraged firm. The yield curve for a AA-rated corporate bond is expected to be above the U.S. Treasury bond yield curve. Yield curves of highly liquid assets will be lower than yield curves of relatively illiquid assets. A U.S. Treasury yield curve is plotted in the following graph: INTEREST RATE (% 5 4 3 1 5 10 15 20 25 30 YEARS TO MATURITY Based on an upward-sloping normal yield curve as shown, which of the following statements is correct? There is a positive maturity risk premium. Inflation must be expected to increase in the future If the pure expectations theory is correct, future short-term rates are expected to be higher than current short-term rates. Pure expectations theory must be correct.

7. Factors that impact the yield curve Aa Aa There are three factors that can affect the shape of the Treasury yield curve (rt, IPt, and MRPt) and five factors that can affect the shape of the corporate yield curve (r*t, IPt, MRPt, DRPt, and LPt). The yield curve reflects the aggregation of the impacts from these factors. Suppose the real risk-free rate and inflation rate are expected to remain at their current levels throughout the foreseeable future. Consider all factors that affect the yield curve. Then identify which of the following shapes that the U.S. Treasury yield curve can take. Check all that apply Upward-sloping yield curve Downward-sloping yield curve Inverted yield curve Identify whether each of the following statements is true or false. False Statements True If inflation is expected to decrease in the future and the real rate is expected to remain steady, then the Treasury yield curve is downward sloping. (Assume MRP 0.) All else equal, the yield on new bonds issued by a leveraged firm will be less than the yield on the new bonds issued by an unleveraged firm. The yield curve for a AA-rated corporate bond is expected to be above the U.S. Treasury bond yield curve. Yield curves of highly liquid assets will be lower than yield curves of relatively illiquid assets. A U.S. Treasury yield curve is plotted in the following graph: INTEREST RATE (% 5 4 3 1 5 10 15 20 25 30 YEARS TO MATURITY Based on an upward-sloping normal yield curve as shown, which of the following statements is correct? There is a positive maturity risk premium. Inflation must be expected to increase in the future If the pure expectations theory is correct, future short-term rates are expected to be higher than current short-term rates. Pure expectations theory must be correct.

Fundamentals of Financial Management, Concise Edition (with Thomson ONE - Business School Edition, 1 term (6 months) Printed Access Card) (MindTap Course List)

8th Edition

ISBN:9781285065137

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter8: Risk And Rates Of Return

Section: Chapter Questions

Problem 9Q: In Chapter 7, we saw that if the market interest rate, rd, for a given bond increased, the price of...

Related questions

Question

100%

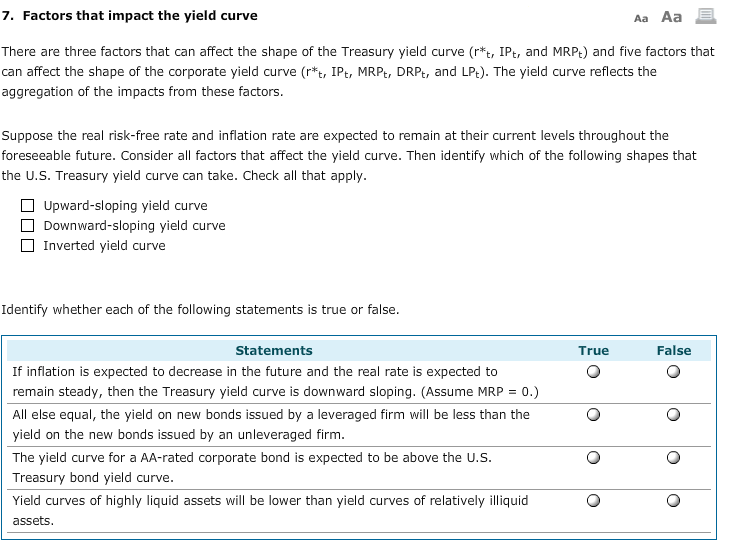

Transcribed Image Text:7. Factors that impact the yield curve

Aa Aa

There are three factors that can affect the shape of the Treasury yield curve (rt, IPt, and MRPt) and five factors that

can affect the shape of the corporate yield curve (r*t, IPt, MRPt, DRPt, and LPt). The yield curve reflects the

aggregation of the impacts from these factors.

Suppose the real risk-free rate and inflation rate are expected to remain at their current levels throughout the

foreseeable future. Consider all factors that affect the yield curve. Then identify which of the following shapes that

the U.S. Treasury yield curve can take. Check all that apply

Upward-sloping yield curve

Downward-sloping yield curve

Inverted yield curve

Identify whether each of the following statements is true or false.

False

Statements

True

If inflation is expected to decrease in the future and the real rate is expected to

remain steady, then the Treasury yield curve is downward sloping. (Assume MRP 0.)

All else equal, the yield on new bonds issued by a leveraged firm will be less than the

yield on the new bonds issued by an unleveraged firm.

The yield curve for a AA-rated corporate bond is expected to be above the U.S.

Treasury bond yield curve.

Yield curves of highly liquid assets will be lower than yield curves of relatively illiquid

assets.

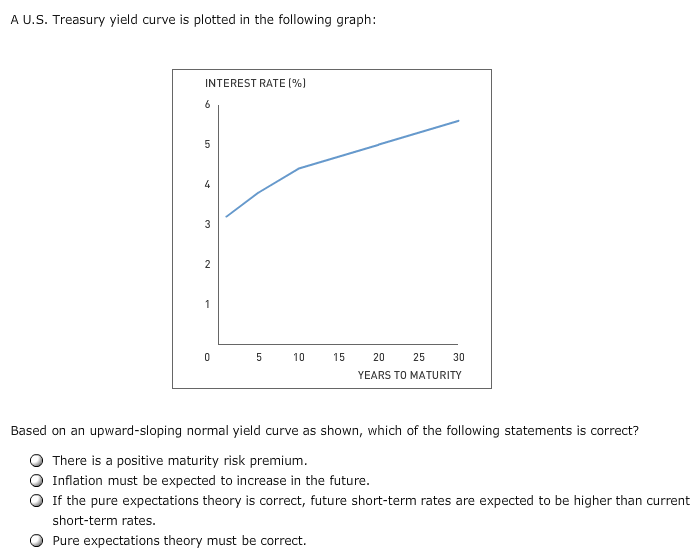

Transcribed Image Text:A U.S. Treasury yield curve is plotted in the following graph:

INTEREST RATE (%

5

4

3

1

5

10

15

20

25

30

YEARS TO MATURITY

Based on an upward-sloping normal yield curve as shown, which of the following statements is correct?

There is a positive maturity risk premium.

Inflation must be expected to increase in the future

If the pure expectations theory is correct, future short-term rates are expected to be higher than current

short-term rates.

Pure expectations theory must be correct.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT