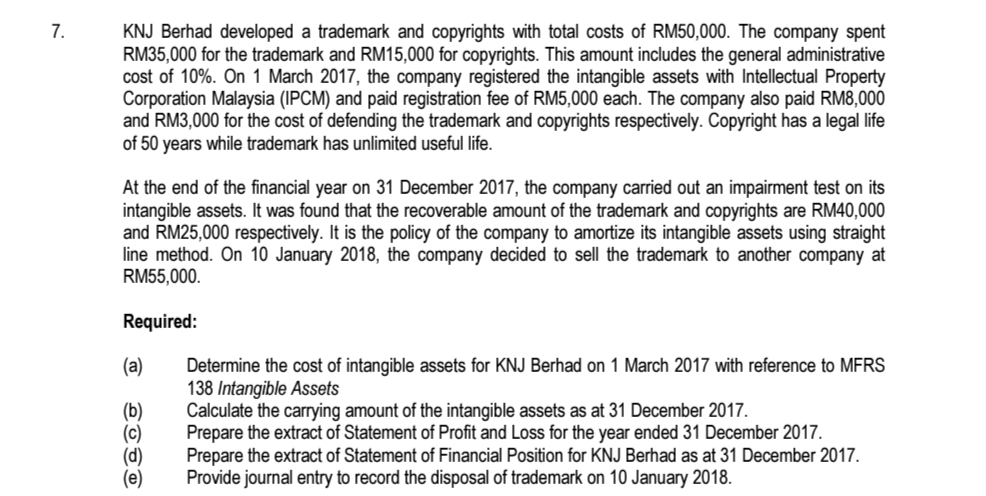

7. KNJ Berhad developed a trademark and copyrights with total costs of RM50,000. The company spent RM35,000 for the trademark and RM15,000 for copyrights. This amount includes the general administrative cost of 10%. On 1 March 2017, the company registered the intangible assets with Intellectual Property Corporation Malaysia (IPCM) and paid registration fee of RM5,000 each. The company also paid RM8,000 and RM3,000 for the cost of defending the trademark and copyrights respectively. Copyright has a legal life of 50 years while trademark has unlimited useful life. At the end of the financial year on 31 December 2017, the company carried out an impairment test on its intangible assets. It was found that the recoverable amount of the trademark and copyrights are RM40,000 and RM25,000 respectively. It is the policy of the company to amortize its intangible assets using straight line method. On 10 January 2018, the company decided to sell the trademark to another company at RM55,000. Required: Determine the cost of intangible assets for KNJ Berhad on 1 March 2017 with reference to MFRS 138 Intangible Assets Calculate the carrying amount of the intangible assets as at 31 December 2017. Prepare the extract of Statement of Profit and Loss for the year ended 31 December 2017. (a) (b) (c)

7. KNJ Berhad developed a trademark and copyrights with total costs of RM50,000. The company spent RM35,000 for the trademark and RM15,000 for copyrights. This amount includes the general administrative cost of 10%. On 1 March 2017, the company registered the intangible assets with Intellectual Property Corporation Malaysia (IPCM) and paid registration fee of RM5,000 each. The company also paid RM8,000 and RM3,000 for the cost of defending the trademark and copyrights respectively. Copyright has a legal life of 50 years while trademark has unlimited useful life. At the end of the financial year on 31 December 2017, the company carried out an impairment test on its intangible assets. It was found that the recoverable amount of the trademark and copyrights are RM40,000 and RM25,000 respectively. It is the policy of the company to amortize its intangible assets using straight line method. On 10 January 2018, the company decided to sell the trademark to another company at RM55,000. Required: Determine the cost of intangible assets for KNJ Berhad on 1 March 2017 with reference to MFRS 138 Intangible Assets Calculate the carrying amount of the intangible assets as at 31 December 2017. Prepare the extract of Statement of Profit and Loss for the year ended 31 December 2017. (a) (b) (c)

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter12: Intangibles

Section: Chapter Questions

Problem 7MC

Related questions

Question

Transcribed Image Text:7.

KNJ Berhad developed a trademark and copyrights with total costs of RM50,000. The company spent

RM35,000 for the trademark and RM15,000 for copyrights. This amount includes the general administrative

cost of 10%. On 1 March 2017, the company registered the intangible assets with Intellectual Property

Corporation Malaysia (IPCM) and paid registration fee of RM5,000 each. The company also paid RM8,000

and RM3,000 for the cost of defending the trademark and copyrights respectively. Copyright has a legal life

of 50 years while trademark has unlimited useful life.

At the end of the financial year on 31 December 2017, the company carried out an impairment test on its

intangible assets. It was found that the recoverable amount of the trademark and copyrights are RM40,000

and RM25,000 respectively. It is the policy of the company to amortize its intangible assets using straight

line method. On 10 January 2018, the company decided to sell the trademark to another company at

RM55,000.

Required:

Determine the cost of intangible assets for KNJ Berhad on 1 March 2017 with reference to MFRS

138 Intangible Assets

Calculate the carrying amount of the intangible assets as at 31 December 2017.

Prepare the extract of Statement of Profit and Loss for the year ended 31 December 2017.

(a)

(b)

(c)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning