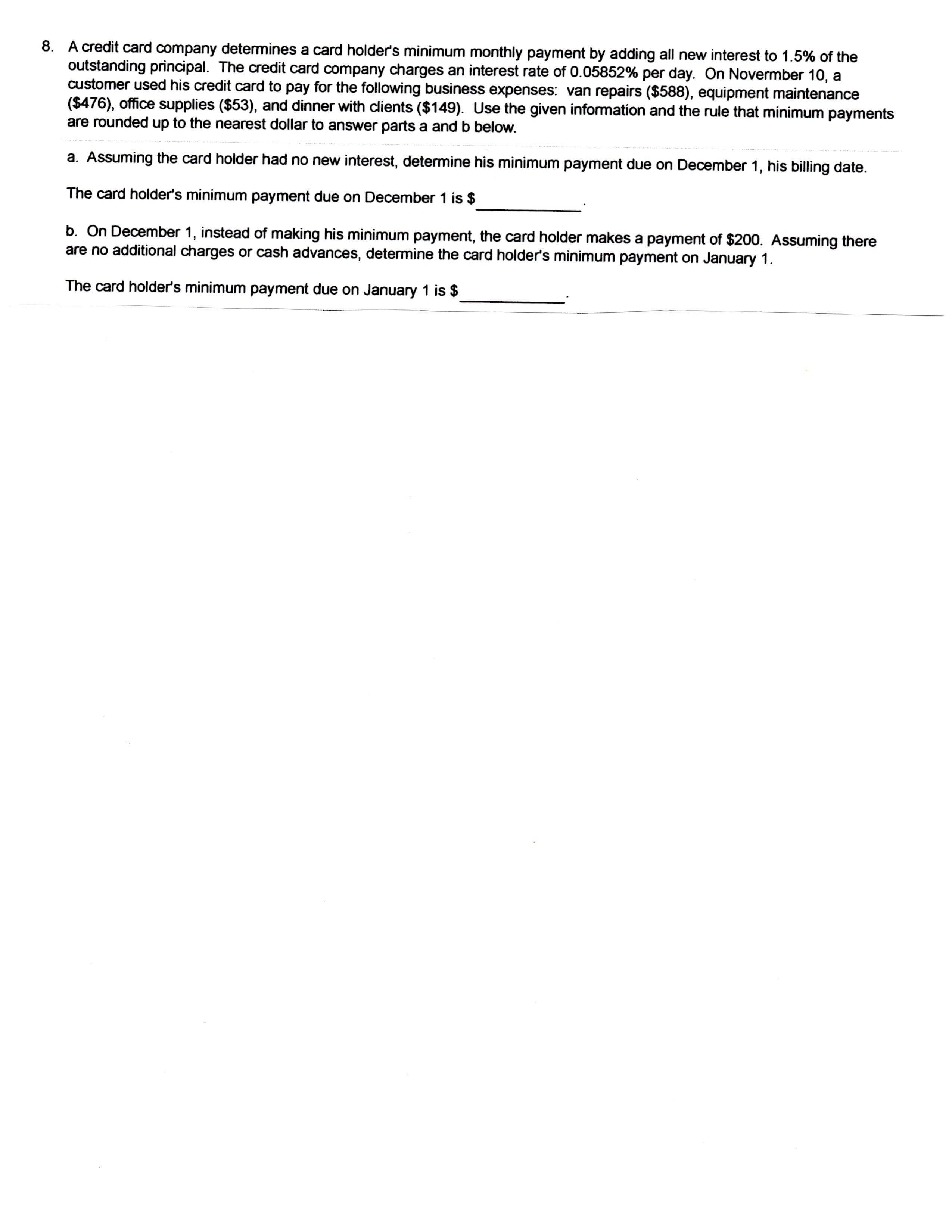

8. A credit card company determines a card holder's minimum monthly payment by adding all new interest to 1.5% of the outstanding principal. The credit card company charges an interest rate of 0.05852% per day. On Novermber 10, a customer used his credit card to pay for the following business expenses: van repairs ($588), equipment maintenance ($476), office supplies ($53), and dinner with clients ($149). Use the given information and the rule that minimum payments are rounded up to the nearest dollar to answer parts a and b below. a. Assuming the card holder had no new interest, determine his minimum payment due on December 1, his billing date The card holder's minimum payment due on December 1 is $ b. On December 1, instead of making his minimum payment, the card holder makes a payment of $200. Assuming there are no additional charges or cash advances, determine the card holder's minimum payment on January 1 The card holder's minimum payment due on January 1 is $

8. A credit card company determines a card holder's minimum monthly payment by adding all new interest to 1.5% of the outstanding principal. The credit card company charges an interest rate of 0.05852% per day. On Novermber 10, a customer used his credit card to pay for the following business expenses: van repairs ($588), equipment maintenance ($476), office supplies ($53), and dinner with clients ($149). Use the given information and the rule that minimum payments are rounded up to the nearest dollar to answer parts a and b below. a. Assuming the card holder had no new interest, determine his minimum payment due on December 1, his billing date The card holder's minimum payment due on December 1 is $ b. On December 1, instead of making his minimum payment, the card holder makes a payment of $200. Assuming there are no additional charges or cash advances, determine the card holder's minimum payment on January 1 The card holder's minimum payment due on January 1 is $

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

ChapterD: Notes Payable And Notes Receivable

Section: Chapter Questions

Problem 5P

Related questions

Question

Transcribed Image Text:8. A credit card company determines a card holder's minimum monthly payment by adding all new interest to 1.5% of the

outstanding principal. The credit card company charges an interest rate of 0.05852% per day. On Novermber 10, a

customer used his credit card to pay for the following business expenses: van repairs ($588), equipment maintenance

($476), office supplies ($53), and dinner with clients ($149). Use the given information and the rule that minimum payments

are rounded up to the nearest dollar to answer parts a and b below.

a. Assuming the card holder had no new interest, determine his minimum payment due on December 1, his billing date

The card holder's minimum payment due on December 1 is $

b. On December 1, instead of making his minimum payment, the card holder makes a payment of $200. Assuming there

are no additional charges or cash advances, determine the card holder's minimum payment on January 1

The card holder's minimum payment due on January 1 is $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT