8. Assuming you require a 15% rate of return, what will the net present value be? Initial Investment Cash Flow 9 700 1 2 3. 4 6. Year 1 530 1 600 4 150 5 550 2 080 before tax Cash Flow 7 000 after tax 1 100 1 200 3 000 4 000 1 500 A) R-358.57 B) R-223.68 C) R-130.78 D) R-228.05 9. A loan of R1.75 million was made to a farmer, bonded against fixed property at an interest rate of 7.25% per year compounded quarterly. The farmer agreed to pay off the loan in equal quarterly instalments over a period of 15 years. What are the equal quarterly payments the farmer needs to make? A) R29 167 B) R48 085 C) R134 292 D) None of the above 10.A loan of R1.75 million was made to a farmer, bonded against fixed property at

8. Assuming you require a 15% rate of return, what will the net present value be? Initial Investment Cash Flow 9 700 1 2 3. 4 6. Year 1 530 1 600 4 150 5 550 2 080 before tax Cash Flow 7 000 after tax 1 100 1 200 3 000 4 000 1 500 A) R-358.57 B) R-223.68 C) R-130.78 D) R-228.05 9. A loan of R1.75 million was made to a farmer, bonded against fixed property at an interest rate of 7.25% per year compounded quarterly. The farmer agreed to pay off the loan in equal quarterly instalments over a period of 15 years. What are the equal quarterly payments the farmer needs to make? A) R29 167 B) R48 085 C) R134 292 D) None of the above 10.A loan of R1.75 million was made to a farmer, bonded against fixed property at

Chapter13: Tax Credits And Payment Procedures

Section: Chapter Questions

Problem 25P: LO.2 Oak Corporation has the following general business credit carryovers. If the general business...

Related questions

Question

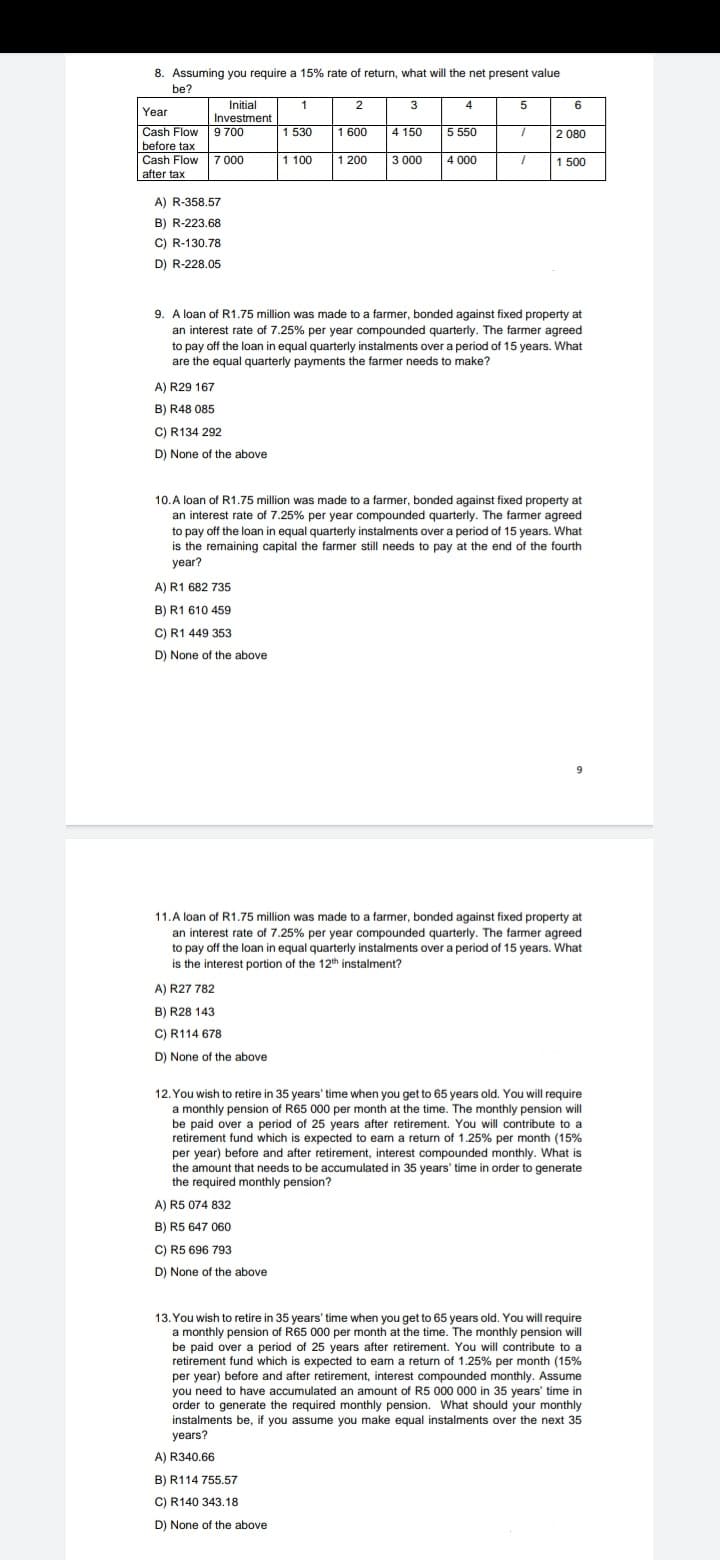

Transcribed Image Text:8. Assuming you require a 15% rate of return, what will the net present value

be?

Initial

Investment

3

4

6

Year

Cash Flow

9 700

1 530

1600

4 150

5 550

2 080

before tax

Cash Flow

7 000

1 100

1 200

3 000

4 000

1 500

after tax

A) R-358.57

B) R-223.68

C) R-130.78

D) R-228.05

9. A loan of R1.75 million was made to a farmer, bonded against fixed property at

an interest rate of 7.25% per year compounded quarterly. The farmer agreed

to pay off the loan in equal quarterly instalments over a period of 15 years. What

are the equal quarterly payments the farmer needs to make?

A) R29 167

B) R48 085

C) R134 292

D) None of the above

10.A loan of R1.75 million was made to a farmer, bonded against fixed property at

an interest rate of 7.25% per year compounded quarterly. The farmer agreed

to pay off the loan in equal quarterly instalments over a period of 15 years. What

is the remaining capital the farmer still needs to pay at the end of the fourth

year?

A) R1 682 735

B) R1 610 459

C) R1 449 353

D) None of the above

11.A loan of R1.75 million was made to a farmer, bonded against fixed property at

an interest rate of 7.25% per year compounded quarterly. The farmer agreed

to pay off the loan in equal quarterly instalments over a period of 15 years. What

is the interest portion of the 12th instalment?

A) R27 782

B) R28 143

C) R114 678

D) None of the above

12. You wish to retire in 35 years' time when you get to 65 years old. You will require

a monthly pension of R65 000 per month at the time. The monthly pension will

be paid over a period of 25 years after retirement. You will contribute to a

retirement fund which is expected to eam a return of 1.25% per month (15%

per year) before and after retirement, interest compounded monthly. What is

the amount that needs to be accumulated in 35 years' time in order to generate

the required monthly pension?

A) R5 074 832

B) R5 647 060

C) R5 696 793

D) None of the above

13. You wish to retire in 35 years' time when you get to 65 years old. You will require

a monthly pension of R65 000 per month at the time. The monthly pension will

be paid over a period of 25 years after retirement. You will contribute to a

retirement fund which is expected to eam a return of 1.25% per month (15%

per year) before and after retirement, interest compounded monthly. Assume

you need to have accumulated an amount of R5 000 000 in 35 years' time in

order to generate the required monthly pension. What should your monthly

instalments be, if you assume you make equal instalments over the next 35

years?

A) R340.66

B) R114 755.57

C) R140 343.18

D) None of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College