9. Angela and Thomas are planning to start a new business. Thomas will invest cash in the business but not be involved in day-to-day operations. Angela plans to work full-time overseeing business operations. The two currently project that the business will generate $200,000 of annual taxable income before consideration of any payments to Angela for her services. Both agree that Angela's services are worth $100,000 Angela and Thomas plan to form a passthrough entity but are unsure whether to choose a partnership or an S corporation. In either case, they will be equal owners of the entity. Given their other sources of income, both Thomas and Angela have a 37 percent marginal tax rate on ordinary income. (Ignore any payroll or self employment tax consequences.) a. If the business is operated as a partnership, calculate ordinary income allocated to each owner, and explain the treatment by the partnership and by Angela of her $100,000 payment for services. b. If the business is operated as an S corporation, calculate ordinary income allocated to each owner, and explain the treatment by the corporation and by Angela of her $100,000 payment for services c. Given your analysis, explain to Angela and Thomas whether and to what extent income tax consequences should control their choice of entity

9. Angela and Thomas are planning to start a new business. Thomas will invest cash in the business but not be involved in day-to-day operations. Angela plans to work full-time overseeing business operations. The two currently project that the business will generate $200,000 of annual taxable income before consideration of any payments to Angela for her services. Both agree that Angela's services are worth $100,000 Angela and Thomas plan to form a passthrough entity but are unsure whether to choose a partnership or an S corporation. In either case, they will be equal owners of the entity. Given their other sources of income, both Thomas and Angela have a 37 percent marginal tax rate on ordinary income. (Ignore any payroll or self employment tax consequences.) a. If the business is operated as a partnership, calculate ordinary income allocated to each owner, and explain the treatment by the partnership and by Angela of her $100,000 payment for services. b. If the business is operated as an S corporation, calculate ordinary income allocated to each owner, and explain the treatment by the corporation and by Angela of her $100,000 payment for services c. Given your analysis, explain to Angela and Thomas whether and to what extent income tax consequences should control their choice of entity

Chapter13: Choice Of Business Entity—general Tax And Nontax Factors/formation

Section: Chapter Questions

Problem 47P

Related questions

Question

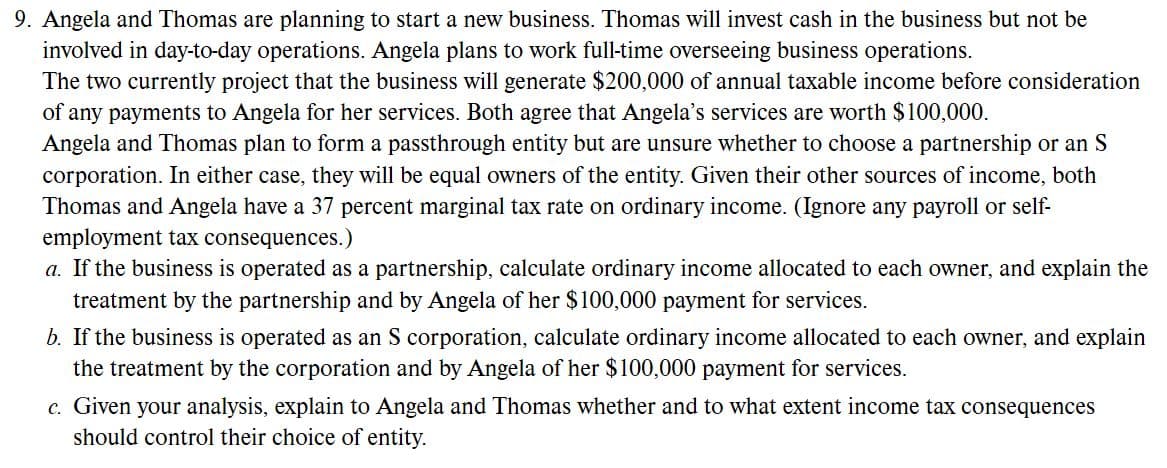

Transcribed Image Text:9. Angela and Thomas are planning to start a new business. Thomas will invest cash in the business but not be

involved in day-to-day operations. Angela plans to work full-time overseeing business operations.

The two currently project that the business will generate $200,000 of annual taxable income before consideration

of any payments to Angela for her services. Both agree that Angela's services are worth $100,000

Angela and Thomas plan to form a passthrough entity but are unsure whether to choose a partnership or an S

corporation. In either case, they will be equal owners of the entity. Given their other sources of income, both

Thomas and Angela have a 37 percent marginal tax rate on ordinary income. (Ignore any payroll or self

employment tax consequences.)

a. If the business is operated as a partnership, calculate ordinary income allocated to each owner, and explain the

treatment by the partnership and by Angela of her $100,000 payment for services.

b. If the business is operated as an S corporation, calculate ordinary income allocated to each owner, and explain

the treatment by the corporation and by Angela of her $100,000 payment for services

c. Given your analysis, explain to Angela and Thomas whether and to what extent income tax consequences

should control their choice of entity

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 2 images

Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning