A 6-month futures contract on British Pounds is available for a price of $1,3946. The size of each contract is GBP 62,500. You need to settle an outstanding payable of GBP 125,000 and you take a position in the contract at a time when the spot rate is $1.44 and 2.5 months remain for th contract to expire. Assume that the short term interest rate is 1.5% p.a. compounded continuously. Keeping this information in view a. You will acquire a long position in 1 futures contract b. You will take a neutral position in the contract at a total value of approximately 11 cents C You will acquire a long position in 1 futures contracts at a forward value of approximately 5 cents d. You will acquire a long position in 2 futures contracts at a total forward value of approximately 11 cents e. You will acquire a long position in 2 futures contracts at a value of 0

A 6-month futures contract on British Pounds is available for a price of $1,3946. The size of each contract is GBP 62,500. You need to settle an outstanding payable of GBP 125,000 and you take a position in the contract at a time when the spot rate is $1.44 and 2.5 months remain for th contract to expire. Assume that the short term interest rate is 1.5% p.a. compounded continuously. Keeping this information in view a. You will acquire a long position in 1 futures contract b. You will take a neutral position in the contract at a total value of approximately 11 cents C You will acquire a long position in 1 futures contracts at a forward value of approximately 5 cents d. You will acquire a long position in 2 futures contracts at a total forward value of approximately 11 cents e. You will acquire a long position in 2 futures contracts at a value of 0

Chapter5: Currency Derivatives

Section: Chapter Questions

Problem 26QA

Related questions

Question

Give typing answer with explanation and conclusion

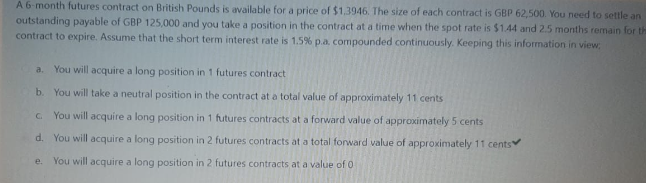

Transcribed Image Text:A 6-month futures contract on British Pounds is available for a price of $1.3946. The size of each contract is GBP 62,500. You need to settle an

outstanding payable of GBP 125,000 and you take a position in the contract at a time when the spot rate is $1.44 and 2.5 months remain for the

contract to expire. Assume that the short term interest rate is 1.5% p.a. compounded continuously. Keeping this information in view:

a. You will acquire a long position in 1 futures contract

b. You will take a neutral position in the contract at a total value of approximately 11 cents

G You will acquire a long

position in 1 futures contracts at a forward value of approximately 5 cents

d. You will acquire a long position in 2 futures contracts at a total forward value of approximately 11 cents

You will acquire a long position in 2 futures contracts at a value of 0.

e.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you