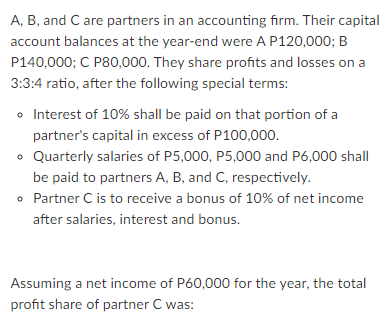

A, B, and C are partners in an accounting firm. Their capita account balances at the year-end were A P120,000; B P140,000; C P80,000. They share profits and losses on a 3:3:4 ratio, after the following special terms: • Interest of 10% shall be paid on that portion of a partner's capital in excess of P100,000. • Quarterly salaries of P5,000, P5,000 and P6,000 shall be paid to partners A, B, and C, respectively. • Partner C is to receive a bonus of 10% of net income after salaries, interest and bonus. Assuming a net income of P60,000 for the year, the total profit share of partner C was:

A, B, and C are partners in an accounting firm. Their capita account balances at the year-end were A P120,000; B P140,000; C P80,000. They share profits and losses on a 3:3:4 ratio, after the following special terms: • Interest of 10% shall be paid on that portion of a partner's capital in excess of P100,000. • Quarterly salaries of P5,000, P5,000 and P6,000 shall be paid to partners A, B, and C, respectively. • Partner C is to receive a bonus of 10% of net income after salaries, interest and bonus. Assuming a net income of P60,000 for the year, the total profit share of partner C was:

Chapter19: Corporations: Distributions Not In Complete Liquidation

Section: Chapter Questions

Problem 1BCRQ

Related questions

Question

Transcribed Image Text:A, B, and C are partners in an accounting firm. Their capital

account balances at the year-end were A P120,000; B

P140,000; C P80,000. They share profits and losses on a

3:3:4 ratio, after the following special terms:

o Interest of 10% shall be paid on that portion of a

partner's capital in excess of P100,000.

• Quarterly salaries of P5,000, P5,000 and P6,000 shall

be paid to partners A, B, and C, respectively.

• Partner C is to receive a bonus of 10% of net income

after salaries, interest and bonus.

Assuming a net income of P60,000 for the year, the total

profit share of partner C was:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning