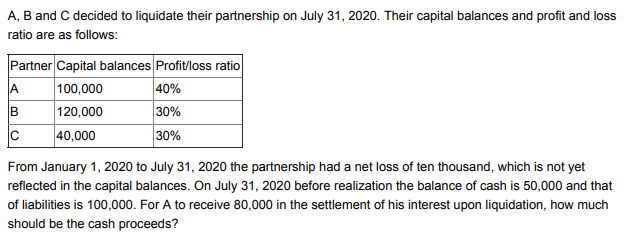

A, B and C decided to liquidate their partnership on July 31, 2020. Their capital balances and profit and loss ratio are as follows: Partner Capital balances Profit/loss ratio A 100,000 B 120,000 40,000 40% 30% 30% From January 1, 2020 to July 31, 2020 the partnership had a net loss of ten thousand, which is not yet reflected in the capital balances. On July 31, 2020 before realization the balance of cash is 50,000 and that of liabilities is 100,000. For A to receive 80,000 in the settlement of his interest upon liquidation, how much should be the cash proceeds?

A, B and C decided to liquidate their partnership on July 31, 2020. Their capital balances and profit and loss ratio are as follows: Partner Capital balances Profit/loss ratio A 100,000 B 120,000 40,000 40% 30% 30% From January 1, 2020 to July 31, 2020 the partnership had a net loss of ten thousand, which is not yet reflected in the capital balances. On July 31, 2020 before realization the balance of cash is 50,000 and that of liabilities is 100,000. For A to receive 80,000 in the settlement of his interest upon liquidation, how much should be the cash proceeds?

Chapter21: Partnerships

Section: Chapter Questions

Problem 57P

Related questions

Question

Transcribed Image Text:A, B and C decided to liquidate their partnership on July 31, 2020. Their capital balances and profit and loss

ratio are as follows:

Partner Capital balances Profit/loss ratio

A

100,000

120,000

40,000

40%

B

30%

30%

From January 1, 2020 to July 31, 2020 the partnership had a net loss of ten thousand, which is not yet

reflected in the capital balances. On July 31, 2020 before realization the balance of cash is 50,000 and that

of liabilities is 100,000. For A to receive 80,000 in the settlement of his interest upon liquidation, how much

should be the cash proceeds?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT