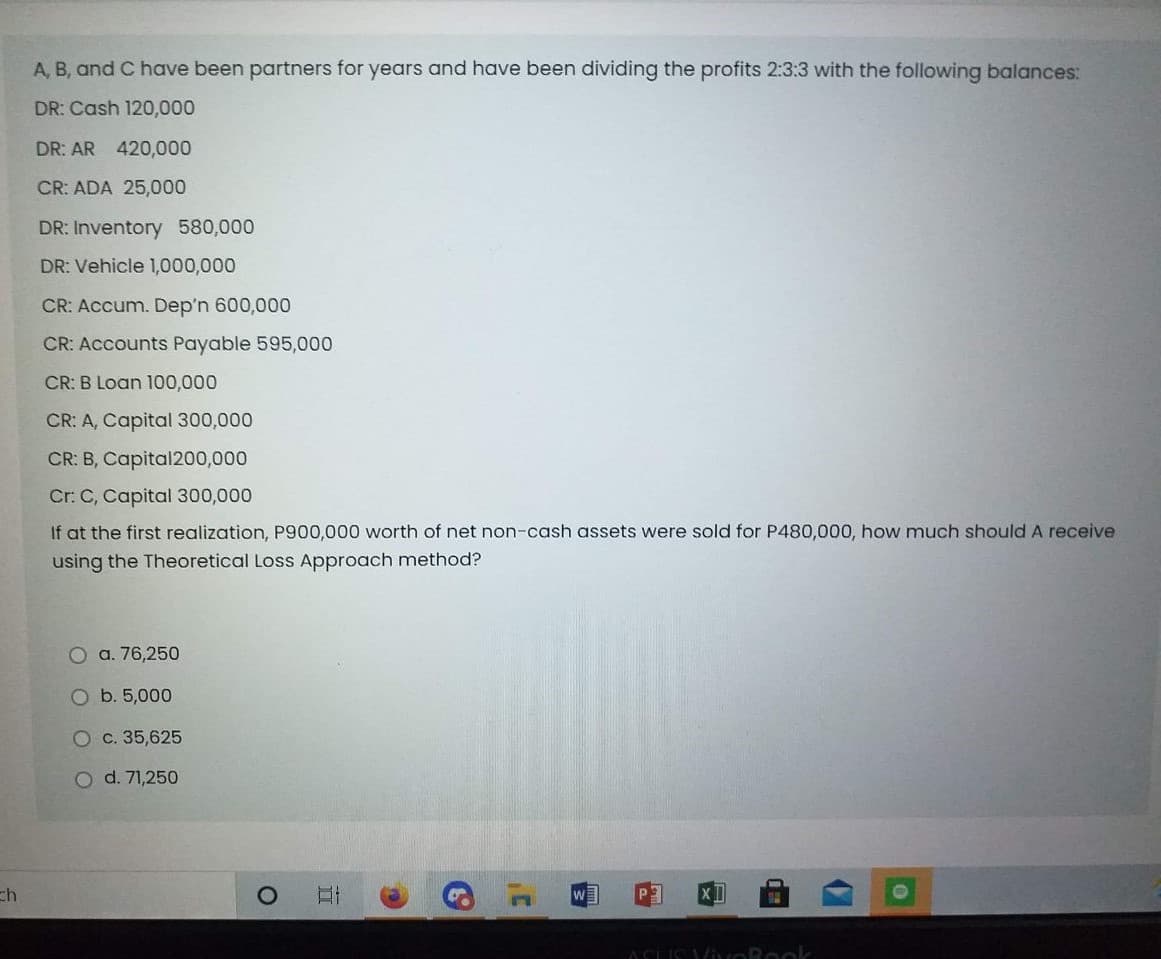

A, B, and C have been partners for years and have been dividing the profits 2:3:3 with the following balances: DR: Cash 120,000 DR: AR 420,000 CR: ADA 25,000 DR: Inventory 580,000 DR: Vehicle 1,000,000 CR: Accum. Dep'n 600,000 CR: Accounts Payable 595,000 CR: B Loan 100,000 CR: A, Capital 300,000 CR: B, Capital200,000 Cr: C, Capital 300,000 If at the first realization, P900,000 worth of net non-cash assets were sold for P480,000, how much should A receive using the Theoretical Loss Approach method? O a. 76,250 O b. 5,000 Oc. 35,625 O d. 71,250

Q: Moose, Booze and Goose are partners with capital balances of P 320,000, P 450,000 and P 520,000…

A: A partnership is an agreement between two or more parties to run a business and share its profits…

Q: Keith and Jim are partners. Keith has a capital balance of $49,000 and Jim has a capital balance of…

A: Total capital after new partner bill investment = $49,000 + $38,000 + $33,000 = $120,000

Q: A and B formed a partnership. The following are their contributions: Partners A B Cash 500,000 -…

A: Given: Particulars A B Accounts receivable 100,000 Building 700,000 Cash 500,000…

Q: 2. Partners Badecir and Magallanes each have a P300,000 capital balance and share profits and losses…

A: Partnership: A type of business forms where two or more partners start the business that includes…

Q: AB and C have been partnera for years and have been dividing the profits 2:33 with the following…

A: Partners are two or more people coming together with a similar interest with profit sharing ratio…

Q: Dowill & Co. is a partnership firm with partners Mr. A, Mr. B and Mr. C, charing profit and losses…

A:

Q: In a collective company with three partners, it has been decided that the capital of each partner…

A: Partnership: Partnership is a form of business organization in which two or more than two…

Q: 2) V and K were partners sharing profits and losses as 60% to V and 40% to K. Their Balance Sheet as…

A: The revaluation account is prepared to record changes in assets and liabilities at the time of…

Q: X, Y and Z were partners sharing profits in the proportion of 3:2:1. Y Retires from the business.…

A: Journal Entries: Particulars Dr. Cr. 1. Revaluation A/c Dr 18300…

Q: A, B and C are partners in an accounting firm. Their capital account balances at year-end were: A,…

A: Correct option is. C. P19,400 Total profit share of partner C is : P19,400 A B C Total…

Q: AB and C have been partner for years and have been dividing the profits 2:33 with the following…

A: Partnership is an arrangement where two are more persons come together with similar interests by…

Q: What amount of cash will Moose receive?

A: Given : Capital balances are given below : Moose = P 320,000 Booze = P 450,000 Goose = P 520,000…

Q: y a cash contribution by the deficient partner. Complete the liquidation chart below. Statement…

A: The statement of partnership liquidation is a visual representation of the partnership liquidation,…

Q: A B, and C have been partners for years and have been dividing the profits 2:3:3 with the following…

A: The organization can run its business through sole proprietorship business were only one person will…

Q: The accounts of Kelly, Loise, and Kyla, who share profits in a 5:3:2 ratio, are as follows on…

A: Liquidation of Partnership Firm: Dissolving a partnership firm entails ceasing to do business under…

Q: ack, Jill, Dick and Jane are partners with capitals of P 22,000, P 20,600, P 27,400 and P 18,000…

A: Given : Profit and loss ratio = 4:3:2:1

Q: 2) V and K were partners sharing profits and losses as 60% to V and 40% to K. Their Balance Sheet as…

A:

Q: The accounts of Kelly, Loise, and Kyla, who share profits in a 5:3:2 ratio, are as follows on…

A: Given Profit-sharing Ratio 5 : 3 : 2 Kyla Received 27500 on her final settlement.

Q: The following information was obtained from the records of Alben Traders, a partnership business…

A: Remaining profit = Net profit + Revenue - Expenses Remaining profit = -24,000

Q: Abe, Ben, and Cain are partners in the ratio of 3:4:2. Abe, Ben and Cain has a capital balance prior…

A: Since you have asked multiple questions, we will solve the first question for you . If you want any…

Q: The following transactions occurred in the formation of Enercon Service Makers partnership: 1. Perez…

A: 1 Cash a/c 500000 To Pervez capital 500000 (Being cash investment made by…

Q: Doy, Rey, May, and Fay are partners with capitals of P 22,000, P 20,600, P 27,400, and P 18,000…

A: The Indian Partnership Act, 1932 defines Partnership in the following terms: “ Partnership is the…

Q: Following is the balance sheet of the BDO Partnership: Cash $9,000 Liabilities $13,000…

A: During the termination of a partnership, a liquidation is the act of paying off liabilities, selling…

Q: A, B, and C have been partners for years and have been dividing the profits 2:3:3 with the following…

A: The organization can run as a sole proprietorship where a single person will be responsible for the…

Q: Moose, Booze and Goose are partners with capital balances of P 320,000, P 450,000 and P 520,000…

A: Cash available after amount paid to BOOZE = Total amount available for distribution - amount paid to…

Q: &and C have been partners for years and have been dividing the profits 2:3:3 with the following…

A: Partnership is an arrangement where two are more people join together with a similar interests to…

Q: A, B and C were partners sharing profits and losses in the proportion 5:3:2 respectively. Their…

A:

Q: В. Doy, Rey, May and Fay are partners with capitals of P 22,000, P 20,600, P 27,400 and P 18,000…

A: At the time of liquidation of the partnership firm, available cash should be given to the partners…

Q: o Leni and Isko are partners of Lenko Partnership which is currently liquidating. The firm's…

A: When two or more entities come together and form a business, it is known as partnership firm. The…

Q: the partners plan to expand by opening a retail sales shop. They have decided to form the business…

A: Cash A/c PARTICULARS AMOUNT PARTICULARS AMOUNT Beg. Balance $0 (b) $100,000 (a) $188,000…

Q: The following are the capital balances and profit and loss ratios of the partners Mona, Nona, and…

A: Total Net Worth of the Partnership firm = Total of Partners' Capital Account Total of Partners'…

Q: CABLES Trading, a partnership formed by Carlo and Jamie, have the following data in its books: 1…

A: In this Question To calculate Jame Share in Net Income Firstly we need to calculate Interest on…

Q: Partners AIL and Charish capital is 480,000 and 520,000, respectively. They share profit or loss…

A: Admission of a new partner to the partnership firm: In the absence of an agreement to the contrary,…

Q: The partners of Blossom Company have decided to liquidate their business. Noncash assets were sold…

A: Partnership: This is the form of business entity that is formed by an agreement, owned and managed…

Q: Arshman, Aahil and Arad decided to form a partnership firm under the name of A Star Enterprises.…

A: A partnership firm is firm in which two or more than two partners combine to start business and…

Q: BUOT INIVS ABC, DEF and GHI decided to form a partnership contributing the following from each of…

A: Partnership: It is the agreement between the two or more person to carry the business with profit…

Q: A summary balance sheet for the Lemon, Mango, and Nobb partnership appears below. Lemon, Mango, and…

A: Introduction: Partnership: Its an agreement between two or more partners for forming a business and…

Q: Ahmed and Wahid are partners sharing profits and losses in the ratio of 3:1. Their Balance sheet as…

A: Revaluation of the account is mandatory when there is an admission of a new partner in the business.…

Q: Bedin, Ceyla and Deris have been in a partnership for a number of years, sharing profits in the…

A: Purpose of Preparation of Realization Account : Transferring all the assets except Cash or Bank…

Q: The accounts of Kelly, Loise, and Kyla, who share profits in a 5:3:2 ratio, are as follows on…

A: Partnership means where two or more person comes together to do some common business activity and…

Q: 1. Mary, Helga and Luz are partners who share profits and losses in the ratio of 4:2:2,…

A: Since there are multiple questions, we will solve first for you. To get the remaining questions…

Q: The following Information was obtained from the records of Alben Traders, a partnership business…

A: Here in this case, we are required to calculate net profit amount. We know that, partners share are…

Q: The Amos, Billings, and Cleaver partnership had two assets: (1) cash of $40,000 and (2) an…

A: A partnership is a kind of business structure in which two or more people agree to carry out…

Q: Alfa Company is liquidating. It has the following account balances: Cash $5,000, Non-cash assets…

A: Partnership means where two or more person comes together to do some common business activity and…

Q: Teoh, Meng and Chen are partners sharing profits and losses equally. The business performs has the…

A: In the context of the given question, we can prepare the ledger accounts to close the books of the…

Q: A, B and C were partners in a busines sharing profits equally, C retires on 1.1.2012, when the…

A: C is retiring partner. All the money payable to c is credited in his account and money payable by c…

Q: The assets and equities of the Queen, Reed, and Stac Partnership at the end of its fiscal year on…

A: Partnership liquidation A partnership is an agreement between two or more people who are willing to…

Q: Faith Busby and Jeremy Beatty started the B&B partnership on January 1, Year 1. The business…

A: The income statement shows the net income or net loss that is calculated by deducting the expenses…

Hi please help me with this it is about dissolution with liquidation - Theoretical Loss Approach.

Step by step

Solved in 2 steps

- Doy, Rey, May, and Fay are partners with capitals of P 22,000, P 20,600, P 27,400, and P 18,000 respectively. Doy has a loan balance of P 4,000. Profits and losses are shared 40%; 30%; 20%; 10% by Doy, Rey, May, and Fay respectively. Assuming assets were sold and liabilities paid and the balance of cash showed P 24,000. Prepare a schedule showing how the P 24,000 will be distributed to the partners.The capital balances of Donny and Belle remained at P500,000 and P250,000 throughout the entire year. Donny made regular drawings of P150,000 and Tiny P100,000. These are normal drawings made by the partners. Net income for the year was P400,000. They agree to divide profit equally. a. How much will be the capital balance of Donny at year end? b. How much will be the drawings' capital balance of Belle at year end?The balance sheet for Coney, Honey, and Money partnership shows the following information as of December 31, 2015;Cash P 40,000 Liabilities P 100,000Other assets 560,000 Coney, loan 50,000 Coney, capital 250,000 Honey, capital 140,000 Money, capital 60,000 P 600,000 P 600,000Profit and loss ratio is 3:2:1 for Coney, Honey, and Money, respectively. Other assets were realized as follows:Date Cash Received Book ValueJanuary 2016 P 120,000 P 180,000February 2016 70,000 154,000March 2016 250,000…

- King, Queen and Prince are partners sharing profit and loss in the ratio of 1:1:2 respectively. Their capital balances are P500,000, P300,000 and P200,000 respectively. Liabilities amounted to P200,000. There is also a loan payable to Prince, P20,000. _______ If the non-cash assets were sold at a gain of P150,000. How much is the cash proceeds? a.P1,100,000 c. P1,400,000 b.P800,000 d. P1,050,000The condensed balance sheet and profit – sharing ratio of the partnership of Wenda, Wendy, and Wilma are presented below: Cash P 22,500.00 Liabilities P52,500.00 Due from Wanda 7,500.00 Due to Wilma 10,000.00 Other assets 205,000.00 Wanda, cap’l (4) 75,000.00 Wendy, cap’l (3) 50,000.00 Wilma, cap’l (3) 47,500.00 Total assets P235,000.00 Total equities P235,000.00 21. The partners agreed to liquidate and they sold all the Other assets for P150,000.00. How much of the available cash should go to Wanda? a. P45,500.00 b. P75,000.00 c. P42,500.00 d. P53,000.00 22. Refer to No. 21 above, how much will be received by Wendy in the partnership liquidation a. P41,000.00 b. P74,000.00 c. P33,500.00 d. P66,600.00The balance sheet for Coney, Honey, and Money partnership shows the following information as of December 31, 2015;Cash P 40,000 Liabilities P 100,000Other assets 560,000 Coney, loan 50,000 Coney, capital 250,000 Honey, capital 140,000 Money, capital 60,000 P 600,000 P 600,000 Profit and loss ratio is 3:2:1 for Coney, Honey, and Money, respectively. Other assets were realized as follows:Date Cash Received Book ValueJanuary 2016 P 120,000 P 180,000February 2016 70,000 154,000March 2016 250,000…

- The balance sheet for Coney, Honey, and Money partnership shows the following information as of December 31, 2015;Cash P 40,000 Liabilities P 100,000Other assets 560,000 Coney, loan 50,000 Coney, capital 250,000 Honey, capital 140,000 Money, capital 60,000 P 600,000 P 600,000 Profit and loss ratio is 3:2:1 for Coney, Honey, and Money, respectively. Other assets were realized as follows:Date Cash Received Book ValueJanuary 2016 P 120,000 P 180,000February 2016 70,000 154,000March 2016 250,000…The balance sheet for Coney, Honey, and Money partnership shows the following information as of December 31, 2015;Cash P 40,000 Liabilities P 100,000Other assets 560,000 Coney, loan 50,000 Coney, capital 250,000 Honey, capital 140,000 Money, capital 60,000 P 600,000 P 600,000 Profit and loss ratio is 3:2:1 for Coney, Honey, and Money, respectively. Other assets were realized as follows:Date Cash Received Book ValueJanuary 2016 P 120,000 P 180,000February 2016 70,000 154,000March 2016 250,000…The balance sheet for Coney, Honey, and Money partnership shows the following information as of December 31, 2015; Cash ₱40,000 Liabilities ₱100,000 Other assets 560,000 Coney, Loan 50,000 Coney, Capital 250,000 Honey, Capital 140,000 Money, Capital 60,000 ₱600,000 ₱600,000 Profit and loss ratio is 3:2:1 for Coney, Honey, and Money, respectively. Other assets were realized as follows: DATE CASH RECEIVED BOOK VALUE January 2016 ₱120,000 ₱180,000 February 2016 70,000 154,000 March 2016 250,000 226,000 Cash is distributed as assets are realized. The total loss to Coney is: P60,000 b. P40,000 c. P20,000 d. None

- Jpea, Jic, and Jfenix formed a partnership and named it ESBIEYEY. At the end of the year, the partnership earned a profit of P 1,000,000. The capital balances are P250,000, P280,000, and P270,000 for Jpea, Jic, and Jfenix, respectively. The partners agreed to distribute the profit as follows: Interest to ending capital of 10% will be given Jpea and Jic will be given a salary amounting to P 150,000 each Jfenix will be given a bonus of 10% of net income after interest, salary and bonus Remaining profit is to be distributed equally How much is the bonus given to Jfenix? A. P 67,000 B. P 62,000 C. P 56,364 D. P 60,909 How much is Jpea’s share in net income? A. P 365,879 B. P 360,879 C. P 362,879 D. P 364,879 How much is Jic’s share in net income? A. P 360,879 B. P 362,879 C. P 364,879 D. P 365,879John and Peter are in partnership sharing profits and losses in the ratio 3/5: 2/5, respectively.The following is their trial balance as of 31 December 2007.Dr Cr$ $Buildings (cost $105,000) 80,000Fixtures at cost 4,100Provision for depreciation: Fixtures 2,100Debtors 30,700Creditors 13,295Cash at bank 3,065Stock at 01 January 2008 31,370Sales 181,555.50Purchases 105,000Carriage outwards 1,705Discounts allowed 310Loan interest: M. Money 1,950Office expenses 2,380Salaries and wages 28,904.50Bad debts 816Provision for doubtful debts 700Loan from M. Money 32,500Capitals: Shoes 50,000Socks 37,500Current accounts: Shoes 2,050Socks 600Drawings: Shoes 15900Book 14,100320,300.5 320,300.5i. Stock, 31 December 2008, $35,105ii. Expenses to be accrued: Office Expenses $107.50; Wages $360iii. Depreciate fixtures 15 percent on reducing balance basis, buildings $2,500iv. Reduce provision for doubtful debts to $625v. Partnership salary: $15,000 to Shoes. Not yet enteredvi. Interest on drawings:…A summary balance sheet for the Lemon, Mango, and Nobb partnership appears below. Lemon, Mango, and Nobb share profits and losses in a ratio of 2:3:5, respectively. Assets Cash $ 100,000 Marketable securities 200,000 Inventory 125,000 Land 100,000 Building-net 500,000 Total assets $1,025,000 Equities Lemon, capital $ 425,000 Mango, capital 400,000 Nobb, capital 200,000 Total equities $1,025,000 The partners agree to admit Oran for a one-fifth interest. The fair market value of partnership land is appraised at…