a b) Create a replicate portfolio using bonds A, B, and C to replicate cashflows from bond D. Is there opportunity for arbitrage? Why or why not? Find an arbitrage strategy, replicating the cash flows from Bond D. How many of each bond will you trade? Which bonds would you buy or sell? For reference, fill out the following table: Buy or Sell Buy or Sell Buy or Sell Buy or Sell Number of bonds: Number of bonds: Number of bonds: Number of bonds: Of Bond A Of Bond B Of Bond C Of Bond D

a b) Create a replicate portfolio using bonds A, B, and C to replicate cashflows from bond D. Is there opportunity for arbitrage? Why or why not? Find an arbitrage strategy, replicating the cash flows from Bond D. How many of each bond will you trade? Which bonds would you buy or sell? For reference, fill out the following table: Buy or Sell Buy or Sell Buy or Sell Buy or Sell Number of bonds: Number of bonds: Number of bonds: Number of bonds: Of Bond A Of Bond B Of Bond C Of Bond D

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter10: Long-term Liabilities

Section: Chapter Questions

Problem 10.2E

Related questions

Question

do ? correct will be upvote

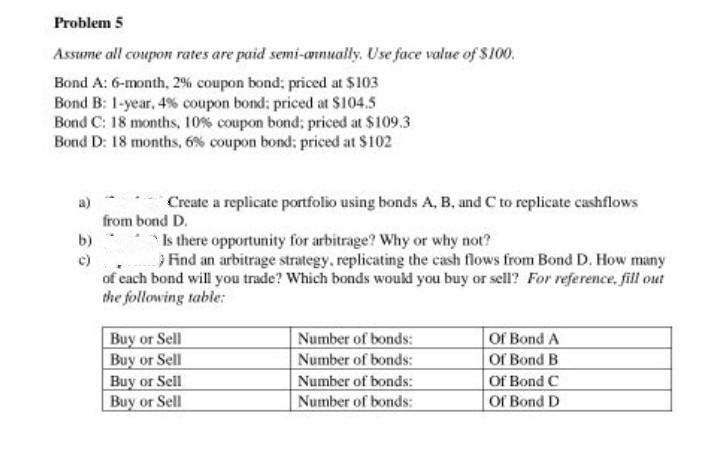

Transcribed Image Text:Problem 5

Assume all coupon rates are paid semi-annually. Use face value of $100.

Bond A: 6-month, 2% coupon bond; priced at $103

Bond B: 1-year, 4 % coupon bond: priced at $104.5

Bond C: 18 months, 10% coupon bond; priced at $109.3

Bond D: 18 months, 6% coupon bond; priced at $102

b)

c)

Create a replicate portfolio using bonds A, B, and C to replicate cashflows

from bond D.

Is there opportunity for arbitrage? Why or why not?

Find an arbitrage strategy, replicating the cash flows from Bond D. How many

of each bond will you trade? Which bonds would you buy or sell? For reference, fill out

the following table:

Buy or Sell

Buy or Sell

Buy or Sell

Buy or Sell

Number of bonds:

Number of bonds:

Number of bonds:

Number of bonds:

Of Bond A

Of Bond B

Of Bond C

Of Bond D

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning