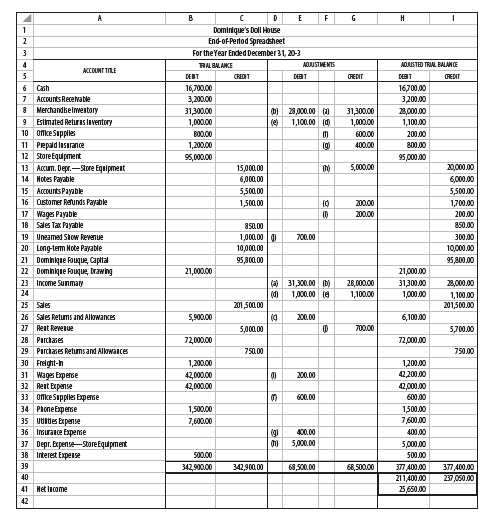

A B E H Dominique's Doll House End-of Pertod Spreadsheet 2 For the Year Ended December 31, 20-3 RALBALANKE ADJUSTMEMTS ADJUSTED TRAAL BALANCE ACCOUNT IILE 5 DEBT CREDIT DEBT OREDNT REDIT 6 Cash 16,700.00 16700.00 7 Accounts Recelvable Merchandbelmwentory Estimated Returaslaventory 10 ofke Sapplies 3,200.00 3200.00 31300.00 D 28,0.00 0 31,300.00 28,000.00 1,000.00 (e) 1,100.00 (d 1,000.00 1,100.00 B00.00 600.00 200.00 11 Pepadlasırance 12 Store Equipment 13 Accum. Depr.-Store Equipment 1,200.00 400.00 800.00 95,000.00 95,000.00 15,000.00 5,000.00 20,000.00 14 Hotes Payable 6,000.00 6,000.00 15 Accounts Payable 5,500.00 5,500.00 16 Ostomer Refunds Payable 1,500.00 200.00 1,700.00 17 Wages Payable 200.00 200.00 18 Sales Tax Payable 850.00 850.00 1,000.00 0 10,000.00 19 Uneamed Show Revenue 700.00 300.00 20 Long-tem Note Payatle 21 Domnkque Fouque, Capital 22 Domnique fouque, brawing 23 Income Sunmaty 10,000.00 95,800.00 95,800.00 21,000.00 21,000.00 (a) 31,300.00 (b) 28,000.00 31300.00 28,000.00 24 1,000.00 (e 1,100.00 1,000.00 1,100.00 201,500.00 25 Sales 201,500.00 26 Sales Retums and Alowances 5,900.00 (0 200.00 6,100.00 27 Rent Revenue 5,000.00 700.00 5,700.00 28 Parchases 72,000.00 72,000.00 29 Pırchases Retumsand Alowances 750.00 750.00 1,200.00 42,000.00 30 Freight-h 1200.00 31 Wages Expese 200.00 42,200.00 32 Rent Expense 33 omke Sapples Expense 34 PhoneExperse 35 uoites Erpense 36 Isurance Experse 37 Depr. Expense-Store Equipment 38 Interest Expense 42,000.00 42,00.00 600.00 600.00 1,500.00 7,600.00 1500.00 7,600.00 400.00 400.00 5,000.00 5,000.00 500.00 500.00 39 342,900.00 342,900.00 68,500.00 68,500.00 377 400.00 377 400.00 40 211,400.00 237,050.00 41 Het lncome 25,650.00 42

Dominique Fouque owns and operates Dominique’s Doll House. She has a small shop in which she sells new and antique dolls. She is particularly well known for her collection of antique Ken and Barbie dolls. A completed spreadsheet for 20-3 is shown on page 610. Fouque made no additional investments during the year and the long-term note payable is due in 20-9. No portion of the long-term note is due within the next year. Net credit sales for 20-3 were $38,000, and receivables on January 1 were $3,000.

Required

1. Prepare a multiple-step income statement.

2. Prepare a statement of owner’s equity.

3. Prepare a balance sheet.

4. Compute the following measures of performance and financial condition for 20-3:

(a)

(b) Quick ratio

(c)

(d) Return on owner’s equity

(e) Accounts receivable turnover and average number of days required to

collect receivables

(f) Inventory turnover and the average number of days required to sell inventory 5. Prepare

6. Open an Income Summary account. Post adjusting and closing entries

(prepared in 7) to this account.

7. Prepare closing entries.

8. Prepare reversing entries for the adjustments where appropriate.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

What would the general journals (adjusting/closing/revising) look like?

What about the general ledger?