A Calculator E Print Item Fortuna Company is authorized to issue 1,000,000 shares of $1 par value common stock. In its first year, the company has the following transactions: Jan. 31 Issued 38,000 shares at $9 share. Jun. 10 Issued 120,000 shares in exchange for land with a dearly determined value of $820,000. Aug. 3 Purchased 11,000 shares of treasury stock at $8 per share.

A Calculator E Print Item Fortuna Company is authorized to issue 1,000,000 shares of $1 par value common stock. In its first year, the company has the following transactions: Jan. 31 Issued 38,000 shares at $9 share. Jun. 10 Issued 120,000 shares in exchange for land with a dearly determined value of $820,000. Aug. 3 Purchased 11,000 shares of treasury stock at $8 per share.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter10: Stockholder's Equity

Section: Chapter Questions

Problem 57E: Outstanding Stock Lars Corporation shows the following information in the stockholders equity...

Related questions

Question

Transcribed Image Text:geNOWv2 |Online teachin X

eAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false

Calculator

E Print Item

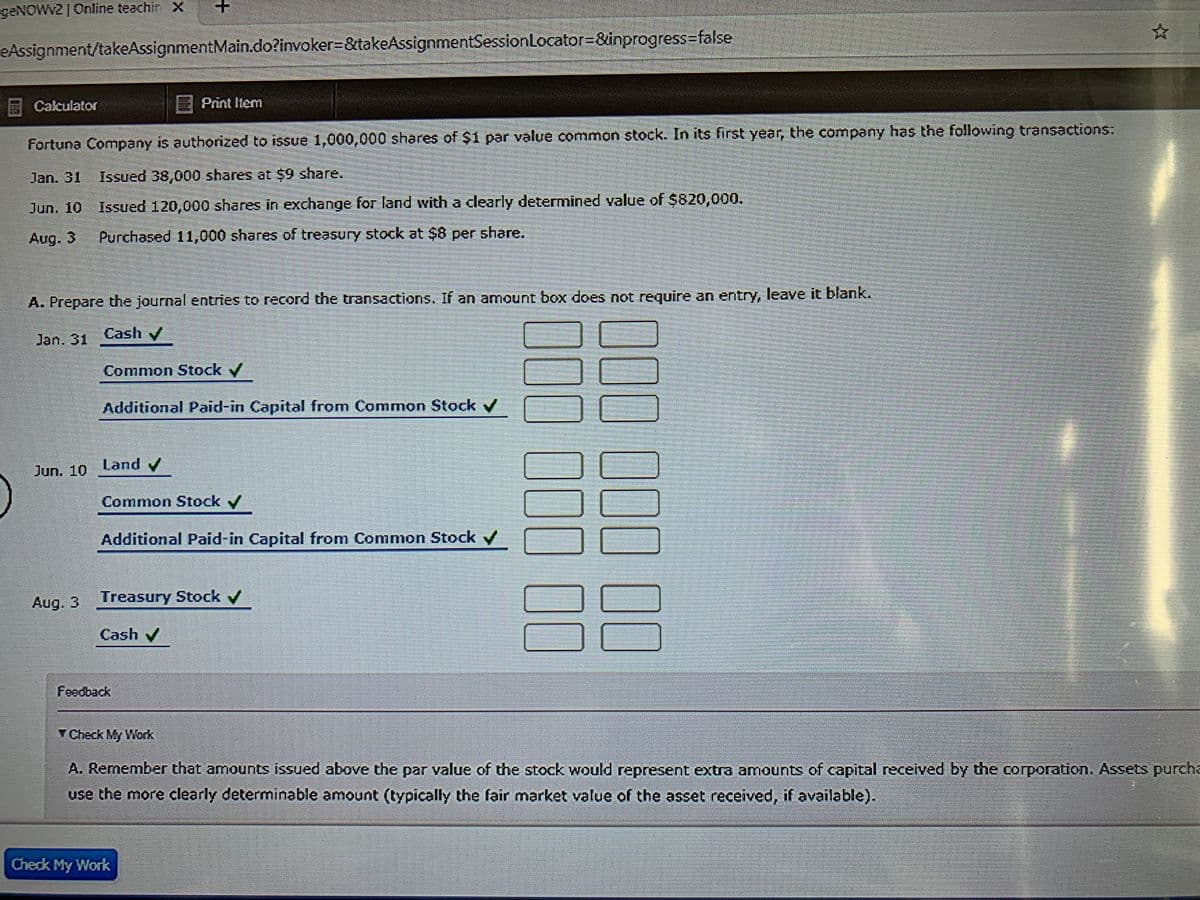

Fortuna Company is authorized to issue 1,000,000 shares of $1 par value common stock. In its first year, the company has the following transactions:

Jan. 31

Issued 38,000 shares at $9 share.

Jun. 10 Issued 120,000 shares in exchange for land with a clearly determined value of $820,000.

Aug. 3

Purchased 11,000 shares of treasury stock at $8 per share.

A. Prepare the journal entries to record the transactions. If an amount box does not require an entry, leave it blank.

Jan. 31

Cash

Common Stock

Additional Paid-in Capital from Common StockV

பபா. 10

Land y

Common Stock

Additional Paid-in Capital from Common Stock

Aug. 3

Treasury Stock /

Cash

Faedback

TCheck My Work

A. Remember that amounts issued above the par value of the stock would represent extra amounts of capital received by the corporation. Assets purcha

use the more clearly determinable amount (typically the fair market value of the asset received, if available).

Check My Work

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning