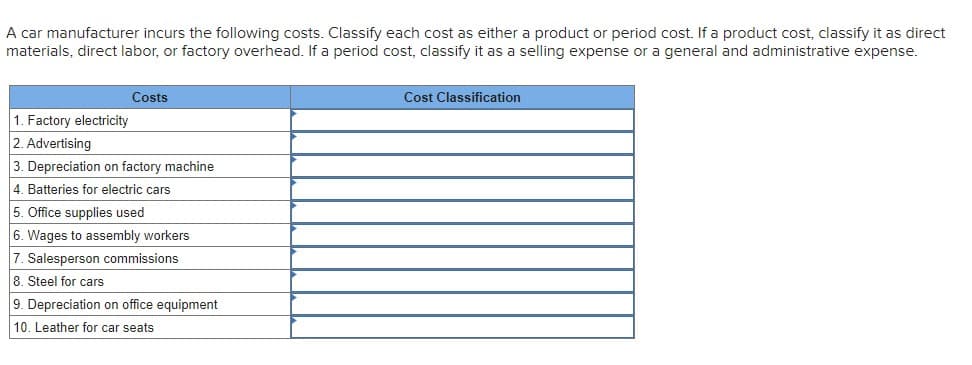

A car manufacturer incurs the following costs. Classify each cost as either a product or period cost. If a product cost, classify it as direct materials, direct labor, or factory overhead. If a period cost, classify it as a selling expense or a general and administrative expense. Costs Cost Classification 1. Factory electricity 2. Advertising 3. Depreciation on factory machine 4. Batteries for electric cars 5. Office supplies used 6. Wages to assembly workers 7. Salesperson commissions 8. Steel for cars 9. Depreciation on office equipment 10. Leather for car seats

A car manufacturer incurs the following costs. Classify each cost as either a product or period cost. If a product cost, classify it as direct materials, direct labor, or factory overhead. If a period cost, classify it as a selling expense or a general and administrative expense. Costs Cost Classification 1. Factory electricity 2. Advertising 3. Depreciation on factory machine 4. Batteries for electric cars 5. Office supplies used 6. Wages to assembly workers 7. Salesperson commissions 8. Steel for cars 9. Depreciation on office equipment 10. Leather for car seats

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter1: Introduction To Managerial Accounting

Section: Chapter Questions

Problem 4E: For apparel manufacturer Abercrombie Fitch, Inc. (ANF), classify each of the following costs as...

Related questions

Question

100%

Transcribed Image Text:A car manufacturer incurs the following costs. Classify each cost as either a product or period cost. If a product cost, classify it as direct

materials, direct labor, or factory overhead. If a period cost, classify it as a selling expense or a general and administrative expense.

Costs

Cost Classification

1. Factory electricity

2. Advertising

3. Depreciation on factory machine

4. Batteries for electric cars

5. Office supplies used

6. Wages to assembly workers

7. Salesperson commissions

8. Steel for cars

9. Depreciation on office equipment

10. Leather for car seats

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning