A certain college graduate borrows 8658 dollars to buy a car. The lender charges interest at an annual rate of 17%. Assuming that interest is compounded continuously and that the borrower makes payments continuously at a constant annual rate k dollars per year, determine the payment rate that is required to pay off the loan in 2 years. Also determine how much interest is paid during the 2-year period. Round your answers to two decimal places. Payment rate =| dollars per year Interest paid = dollars

A certain college graduate borrows 8658 dollars to buy a car. The lender charges interest at an annual rate of 17%. Assuming that interest is compounded continuously and that the borrower makes payments continuously at a constant annual rate k dollars per year, determine the payment rate that is required to pay off the loan in 2 years. Also determine how much interest is paid during the 2-year period. Round your answers to two decimal places. Payment rate =| dollars per year Interest paid = dollars

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 85E: ExerciseInstallment Notes ABC bank loans $250,000 to Yossarian to purchase a new home. Yossarian...

Related questions

Concept explainers

Question

Transcribed Image Text:its

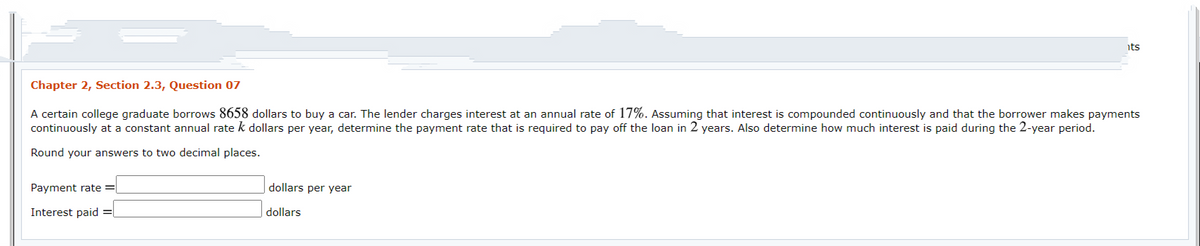

Chapter 2, Section 2.3, Question 07

A certain college graduate borrows 8658 dollars to buy a car. The lender charges interest at an annual rate of 17%. Assuming that interest is compounded continuously and that the borrower makes payments

continuously at a constant annual rate k dollars per year, determine the payment rate that is required to pay off the loan in 2 years. Also determine how much interest is paid during the 2-year period.

Round your answers to two decimal places.

Payment rate =

dollars per year

Interest paid =[

dollars

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning