A company has common stock which paid a dividend of $2.75 per share last year. The company expects that earnings and dividends will grow by 15% for the next tw years before dropping to a constant 9% growth rate afterward. The required rate of return is 13%. 4 a) What is the current price per share of the stock? b) What is the expected market price of the share in one year? c) Calculate the expected dividend yield at the end of the first year d) Calculate the expected capital gains yield at the end of the first year

A company has common stock which paid a dividend of $2.75 per share last year. The company expects that earnings and dividends will grow by 15% for the next tw years before dropping to a constant 9% growth rate afterward. The required rate of return is 13%. 4 a) What is the current price per share of the stock? b) What is the expected market price of the share in one year? c) Calculate the expected dividend yield at the end of the first year d) Calculate the expected capital gains yield at the end of the first year

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter8: Basic Stock Valuation

Section: Chapter Questions

Problem 16MC

Related questions

Question

Give typing answer with explanation and conclusion

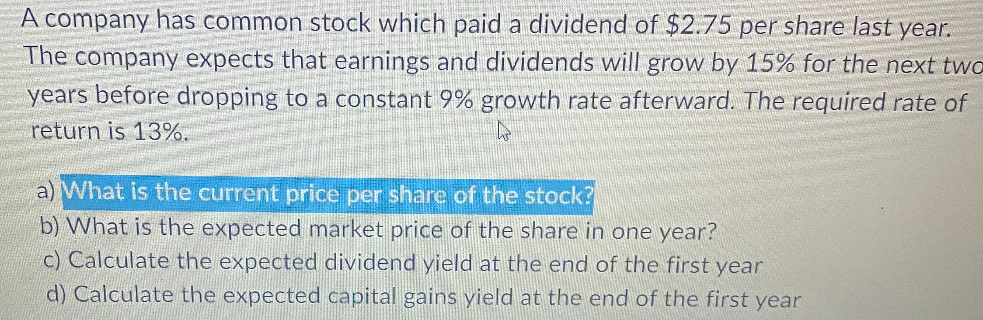

Transcribed Image Text:A company has common stock which paid a dividend of $2.75 per share last year.

The company expects that earnings and dividends will grow by 15% for the next two

years before dropping to a constant 9% growth rate afterward. The required rate of

return is 13%.

h

a) What is the current price per share of the stock?

b) What is the expected market price of the share in one year?

c) Calculate the expected dividend yield at the end of the first year

d) Calculate the expected capital gains yield at the end of the first year

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT