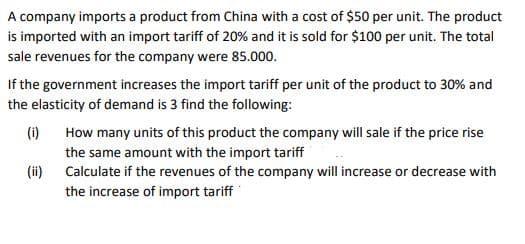

A company imports a product from China with a cost of $50 per unit. The product is imported with an import tariff of 20% and it is sold for $100 per unit. The total sale revenues for the company were 85.000. If the government increases the import tariff per unit of the product to 30% and the elasticity of demand is 3 find the following: (i) (ii) How many units of this product the company will sale if the price rise the same amount with the import tariff Calculate if the revenues of the company will increase or decrease with the increase of import tariff

A company imports a product from China with a cost of $50 per unit. The product is imported with an import tariff of 20% and it is sold for $100 per unit. The total sale revenues for the company were 85.000. If the government increases the import tariff per unit of the product to 30% and the elasticity of demand is 3 find the following: (i) (ii) How many units of this product the company will sale if the price rise the same amount with the import tariff Calculate if the revenues of the company will increase or decrease with the increase of import tariff

Microeconomics: Principles & Policy

14th Edition

ISBN:9781337794992

Author:William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:William J. Baumol, Alan S. Blinder, John L. Solow

Chapter16: Externalities, The Environment, And Natural Resources

Section: Chapter Questions

Problem 4DQ

Related questions

Question

Transcribed Image Text:A company imports a product from China with a cost of $50 per unit. The product

is imported with an import tariff of 20% and it is sold for $100 per unit. The total

sale revenues for the company were 85.000.

If the government increases the import tariff per unit of the product to 30% and

the elasticity of demand is 3 find the following:

(i)

(ii)

How many units of this product the company will sale if the price rise

the same amount with the import tariff

Calculate if the revenues of the company will increase or decrease with

the increase of import tariff

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Microeconomics: Principles & Policy

Economics

ISBN:

9781337794992

Author:

William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Microeconomics: Principles & Policy

Economics

ISBN:

9781337794992

Author:

William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax