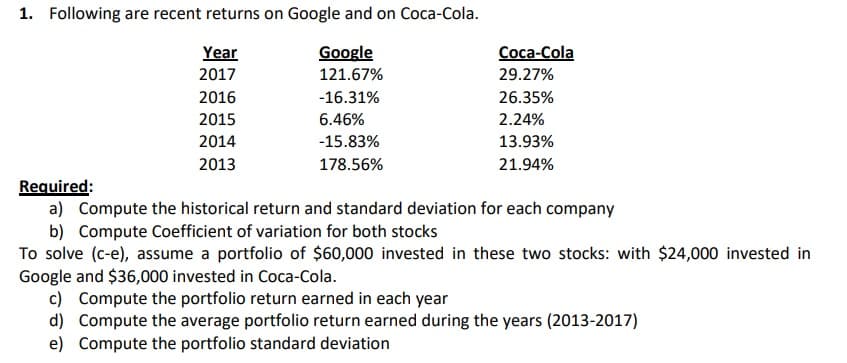

a) Compute the historical return and standard deviation for each company b) Compute Coefficient of variation for both stocks To solve (c-e), assume a portfolio of $60,000 invested in these two stocks: with $24,000 invested i Google and $36,000 invested in Coca-Cola. c) Compute the portfolio return earned in each year d) Compute the average portfolio return earned during the years (2013-2017) e) Compute the portfolio standard deviation

a) Compute the historical return and standard deviation for each company b) Compute Coefficient of variation for both stocks To solve (c-e), assume a portfolio of $60,000 invested in these two stocks: with $24,000 invested i Google and $36,000 invested in Coca-Cola. c) Compute the portfolio return earned in each year d) Compute the average portfolio return earned during the years (2013-2017) e) Compute the portfolio standard deviation

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter3: Analysis Of Financial Statements

Section: Chapter Questions

Problem 8MC: Use the extended DuPont equation to provide a breakdown of Computrons projected return on equity....

Related questions

Question

100%

answered only a,d,e

Transcribed Image Text:a) Compute the historical return and standard deviation for each company

b) Compute Coefficient of variation for both stocks

To solve (c-e), assume a portfolio of $60,000 invested in these two stocks: with $24,000 invested i

Google and $36,000 invested in Coca-Cola.

c) Compute the portfolio return earned in each year

d) Compute the average portfolio return earned during the years (2013-2017)

e) Compute the portfolio standard deviation

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning