A corporation's shareholders are not legally entitled to share in dividends unless its board of directors has declared these dividends. If dividends are not declared in a particular year, a holder of noncumulative preferred stock will never be paid the dividend for that year. Most preferred stock is cumulative preferred stock. If a corporation fails to declare a dividend on cumulative preferred stock at the stated rate on the usual dividend date, the amount becomes dividends in arrears. Dividends in arrears accumulate from period to period. A corporation cannot pay common shareholders any dividends until it has paid the preferred dividends in arrears. c. Preferred stock is fully participating and cumulative. Preferred dividends are 1 year in arrears at the beginning of the year. Andrews Company Schedule of dividends to be paid Preferred Common Dividends in arrears 20,000 Current preferred dividends 20,000 Common proportional share 20,000 Remainder shared Total 2. For 1(a), compute the dividend yield on the preferred stock and the common stock. If required, round your answers to one decimal place. Dividend yield Preferred stock Common stock % Record the adjustment for the allowance for uncollectible accounts: Preferred Common Particulars Stock Stock (Amount S)(Amount $) Dividend in arrears (1x2,000x 10% x$100) Current Preferred dividend (2,000 x10% x$100) Common proportional share (20,000x10% x$ 10) Remainder shared (S95,000-$60,000) $20,000 $20,000 $20,000 $17,500 $17,500 $57,500 Total $37,500 Working Notes: Remainder shared to preferred stock Number of shares x Par Value Preferred Stock Extra dividend x- (Number of shares x Par Value+ Number of shares outstanding x Par Value 2,000 x$100 $35,000x 2,000 x$100+20,000 x $10 $17,500 Remainder shared to common stock Common Stock = Extra dividend - Preferred Stock $35,000-$17,500 $17,500

A corporation's shareholders are not legally entitled to share in dividends unless its board of directors has declared these dividends. If dividends are not declared in a particular year, a holder of noncumulative preferred stock will never be paid the dividend for that year. Most preferred stock is cumulative preferred stock. If a corporation fails to declare a dividend on cumulative preferred stock at the stated rate on the usual dividend date, the amount becomes dividends in arrears. Dividends in arrears accumulate from period to period. A corporation cannot pay common shareholders any dividends until it has paid the preferred dividends in arrears. c. Preferred stock is fully participating and cumulative. Preferred dividends are 1 year in arrears at the beginning of the year. Andrews Company Schedule of dividends to be paid Preferred Common Dividends in arrears 20,000 Current preferred dividends 20,000 Common proportional share 20,000 Remainder shared Total 2. For 1(a), compute the dividend yield on the preferred stock and the common stock. If required, round your answers to one decimal place. Dividend yield Preferred stock Common stock % Record the adjustment for the allowance for uncollectible accounts: Preferred Common Particulars Stock Stock (Amount S)(Amount $) Dividend in arrears (1x2,000x 10% x$100) Current Preferred dividend (2,000 x10% x$100) Common proportional share (20,000x10% x$ 10) Remainder shared (S95,000-$60,000) $20,000 $20,000 $20,000 $17,500 $17,500 $57,500 Total $37,500 Working Notes: Remainder shared to preferred stock Number of shares x Par Value Preferred Stock Extra dividend x- (Number of shares x Par Value+ Number of shares outstanding x Par Value 2,000 x$100 $35,000x 2,000 x$100+20,000 x $10 $17,500 Remainder shared to common stock Common Stock = Extra dividend - Preferred Stock $35,000-$17,500 $17,500

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter13: Corporations: Earning & Profits And Distributions

Section: Chapter Questions

Problem 29P

Related questions

Question

Andrews Company has $95,000 available to pay dividends. It has 2,000 shares of 10%, $100 par,

Required

Compute the dividend yield on the preferred stock and the common stock. If required, round your answers to one decimal place.

| Dividend yield | |

| Preferred stock | % |

| Common stock | % |

Transcribed Image Text:A corporation's shareholders are not legally entitled to share in dividends unless its board of directors has declared these dividends. If

dividends are not declared in a particular year, a holder of noncumulative preferred stock will never be paid the dividend for that year. Most

preferred stock is cumulative preferred stock. If a corporation fails to declare a dividend on cumulative preferred stock at the stated rate on

the usual dividend date, the amount becomes dividends in arrears. Dividends in arrears accumulate from period to period. A corporation

cannot pay common shareholders any dividends until it has paid the preferred dividends in arrears.

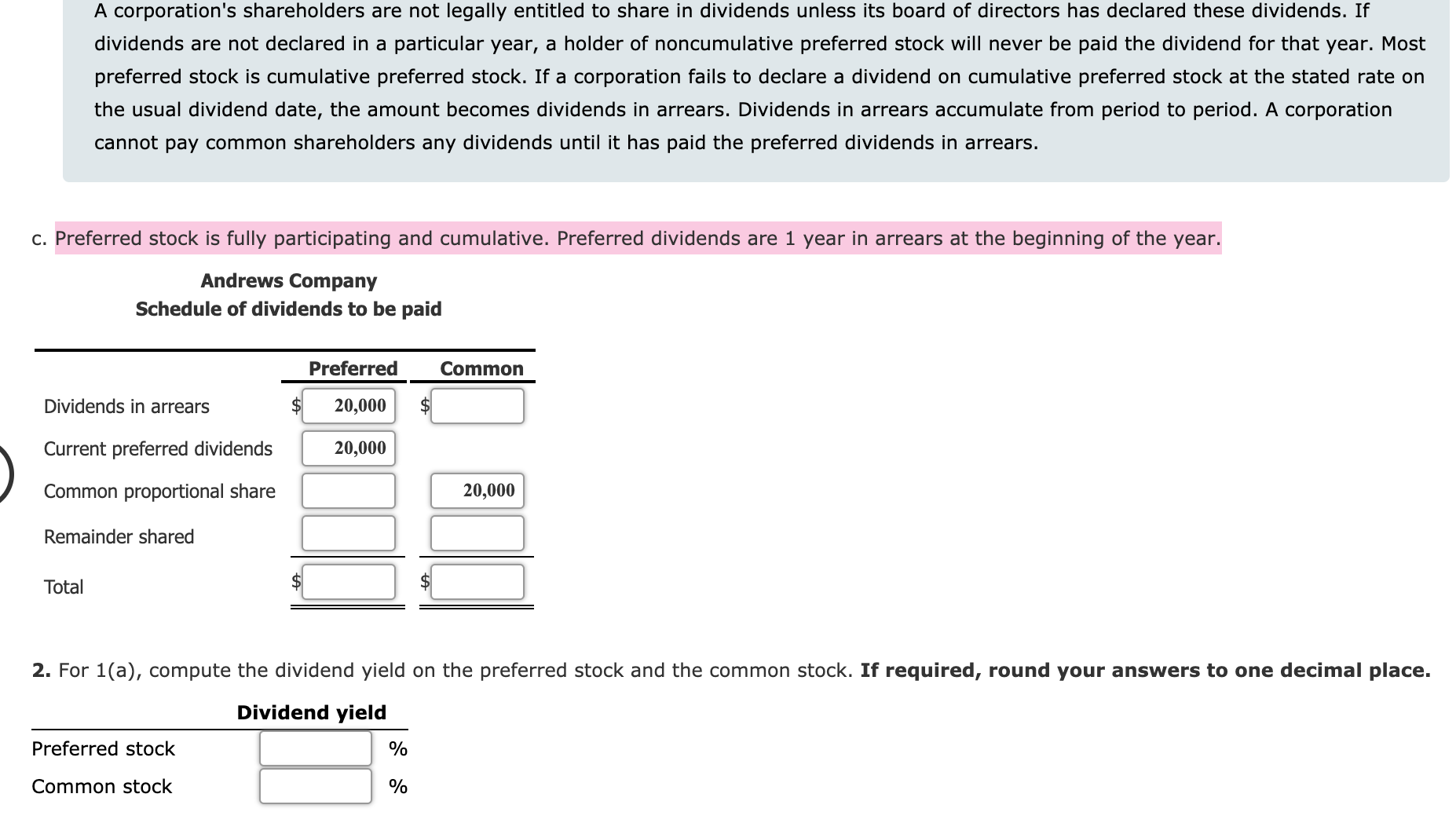

c. Preferred stock is fully participating and cumulative. Preferred dividends are 1 year in arrears at the beginning of the year.

Andrews Company

Schedule of dividends to be paid

Preferred

Common

Dividends in arrears

20,000

Current preferred dividends

20,000

Common proportional share

20,000

Remainder shared

Total

2. For 1(a), compute the dividend yield on the preferred stock and the common stock. If required, round your answers to one decimal place.

Dividend yield

Preferred stock

Common stock

%

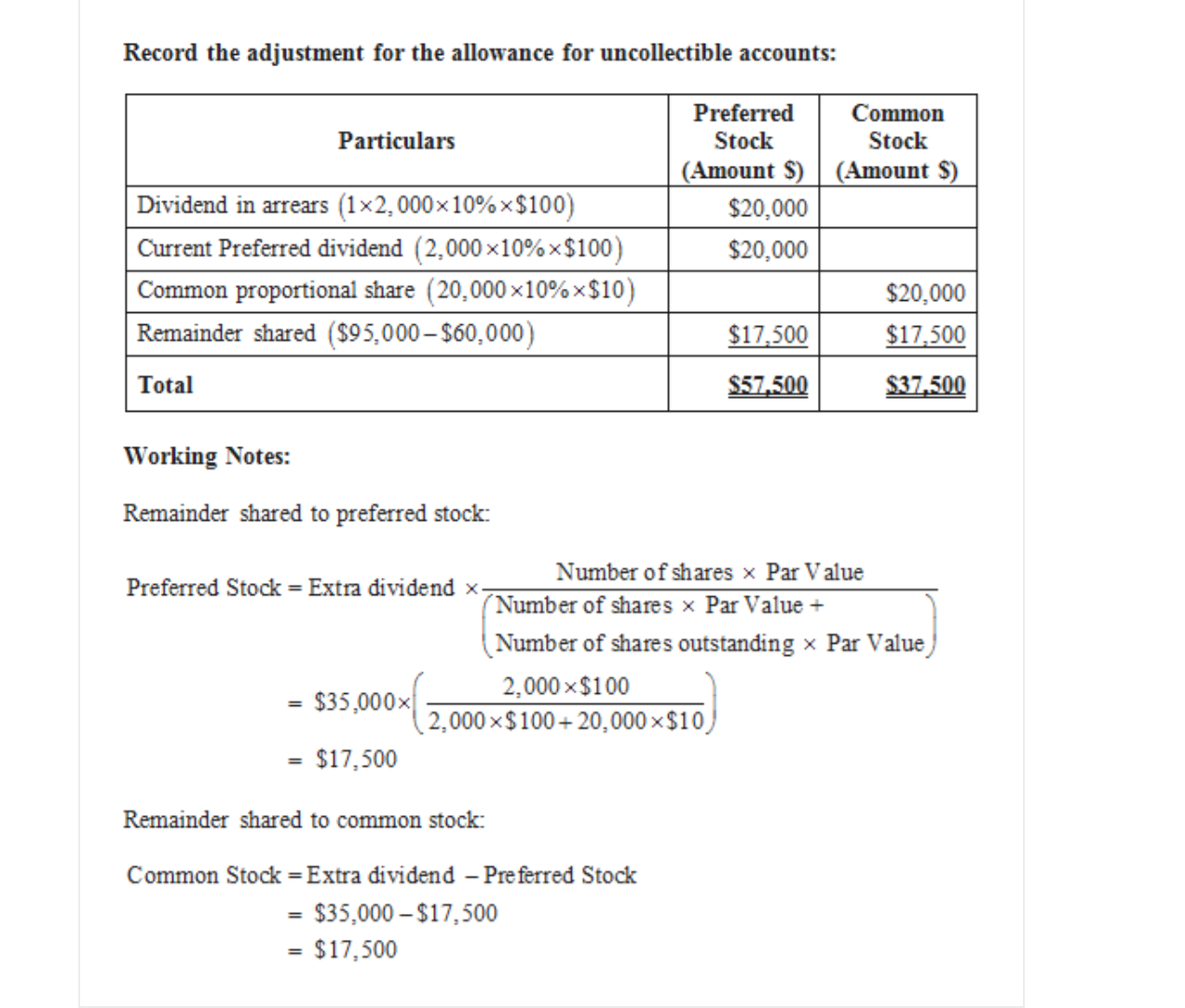

Transcribed Image Text:Record the adjustment for the allowance for uncollectible accounts:

Preferred

Common

Particulars

Stock

Stock

(Amount S)(Amount $)

Dividend in arrears (1x2,000x 10% x$100)

Current Preferred dividend (2,000 x10% x$100)

Common proportional share (20,000x10% x$ 10)

Remainder shared (S95,000-$60,000)

$20,000

$20,000

$20,000

$17,500

$17,500

$57,500

Total

$37,500

Working Notes:

Remainder shared to preferred stock

Number of shares x Par Value

Preferred Stock Extra dividend x-

(Number of shares x Par Value+

Number of shares outstanding x Par Value

2,000 x$100

$35,000x

2,000 x$100+20,000 x $10

$17,500

Remainder shared to common stock

Common Stock = Extra dividend - Preferred Stock

$35,000-$17,500

$17,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning