(a) Determine the annual and total depreciation recorded by each company during the 3 years. (b) Assuming that Kate Company also uses the straight-line method of depreciation instead of the declining-balance method as in (a), prepare comparative income data for the 3 years. (c) Which company should the investor Linda buy and Why?

(a) Determine the annual and total depreciation recorded by each company during the 3 years. (b) Assuming that Kate Company also uses the straight-line method of depreciation instead of the declining-balance method as in (a), prepare comparative income data for the 3 years. (c) Which company should the investor Linda buy and Why?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 11E: On January 1, 2014, Klinefelter Company purchased a building for 520,000. The building had an...

Related questions

Question

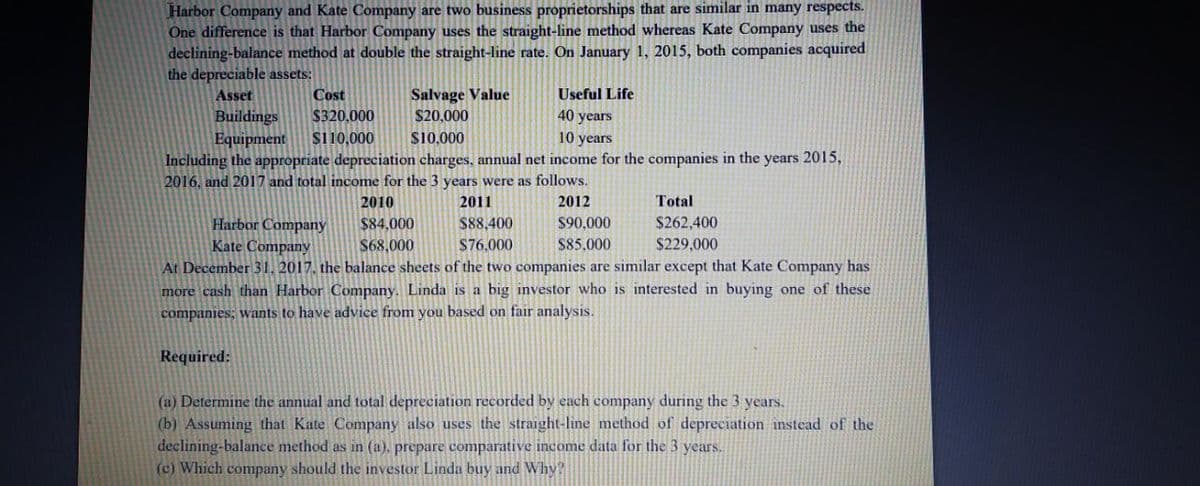

Transcribed Image Text:Harbor Company and Kate Company are two business proprietorships that are similar in many respects.

One difference is that Harbor Company uses the straight-line method whereas Kate Company uses the

declining-balance method at double the straight-line rate. On January 1, 2015, both companies acquired

the depreciable assets:

Asset

Cost

Salvage Value

Useful Life

40 years

Buildings

Equipment

Including the appropriate depreciation charges, annual net income for the companies in the years 2015,

$320.000

$20,000

$110,000

S10,000

10 years

2016, and 2017 and total income for the 3 years were as follows.

2010

2011

2012

Total

S88,400

$262,400

Harbor Company

Kate Company

$84,000

$90,000

$68,000

S76.000

S85,000

$229,000

At December 31, 2017. the balance sheets of the two companies are similar except that Kate Company has

more cash than Harbor Company. Linda is a big investor who is interested in buying one of these

companies; wants to have advice from you based on fair analysis.

Required:

(a) Determine the annual and total depreciation recorded by each company during the 3 years.

(b) Assuming that Kate Company also uses the straight-line method of depreciation instead of the

declining-balance method as in (a), prepare comparative income data for the 3 years.

(c) Which company should the investor Linda buy and Why?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning